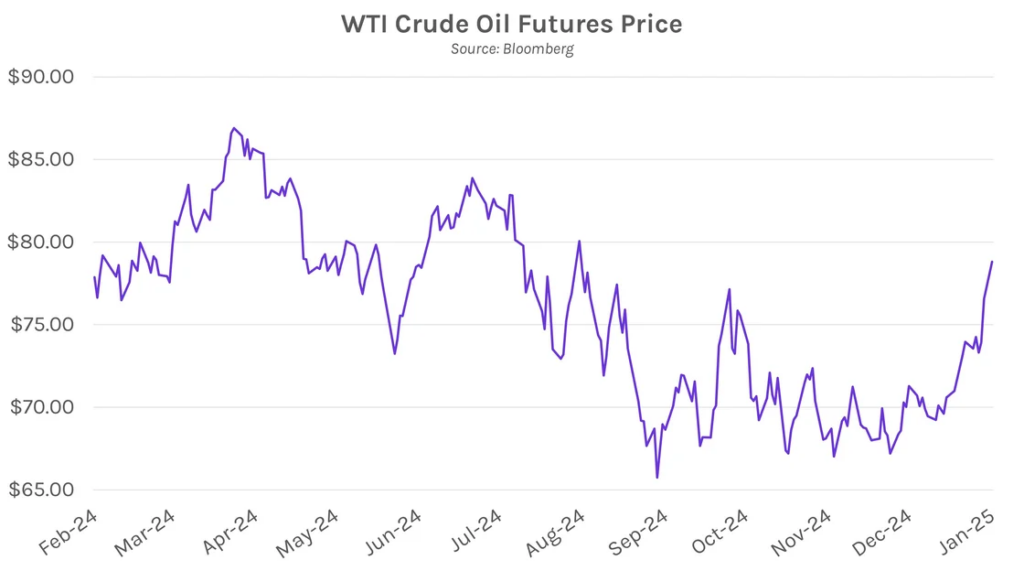

Yields rise slightly while oil continues to surge. Markets were relatively quiet today with most attention being paid toward tomorrow’s PPI and Wednesday’s CPI prints. Yields closed 1-2 bps higher across the curve after trading within a 4bp range today. Meanwhile, renewed US sanctions against Russia’s oil industry, a potential disruption to the global supply chain, drove another rally in oil prices today. WTI and Brent crude are currently trading at $78.82 (+2.94%) and $80.97 (+1.52%) per barrel, respectively.

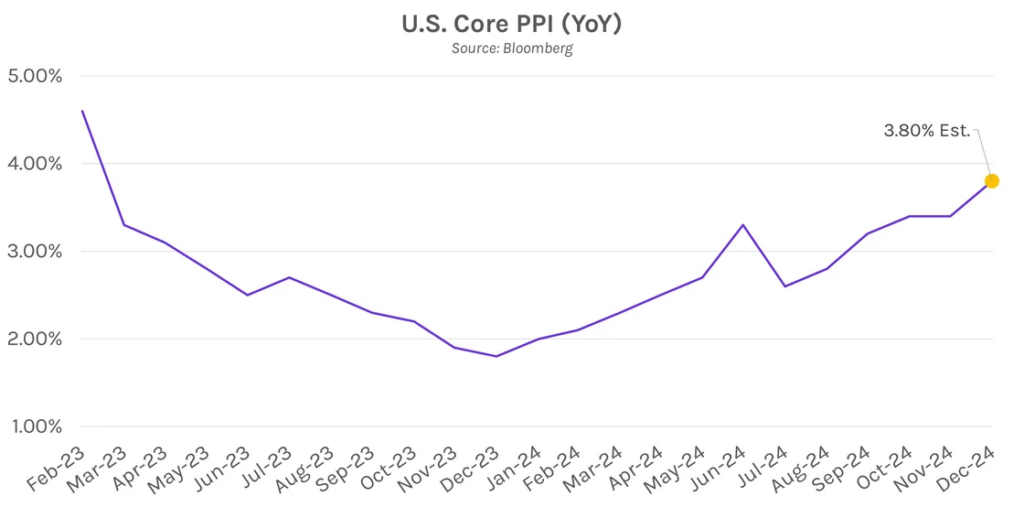

Tomorrow’s PPI has a bigger spotlight than usual. PPI is expected to climb across most measurements tomorrow, driven by higher financial-services costs and energy prices. Core PPI is expected to land at 3.8%, the highest level since February 2023. The data will be closely watched as it’s the first major inflation release following the Fed’s pivotal December meeting. Amidst renewed inflationary risks, the effects of above-forecast PPI could be magnified, especially considering it will be published before CPI. On the other hand, below-forecast PPI is unlikely to impact the January FOMC meeting outlook, where markets overwhelmingly expect the Fed to pause rate cuts.

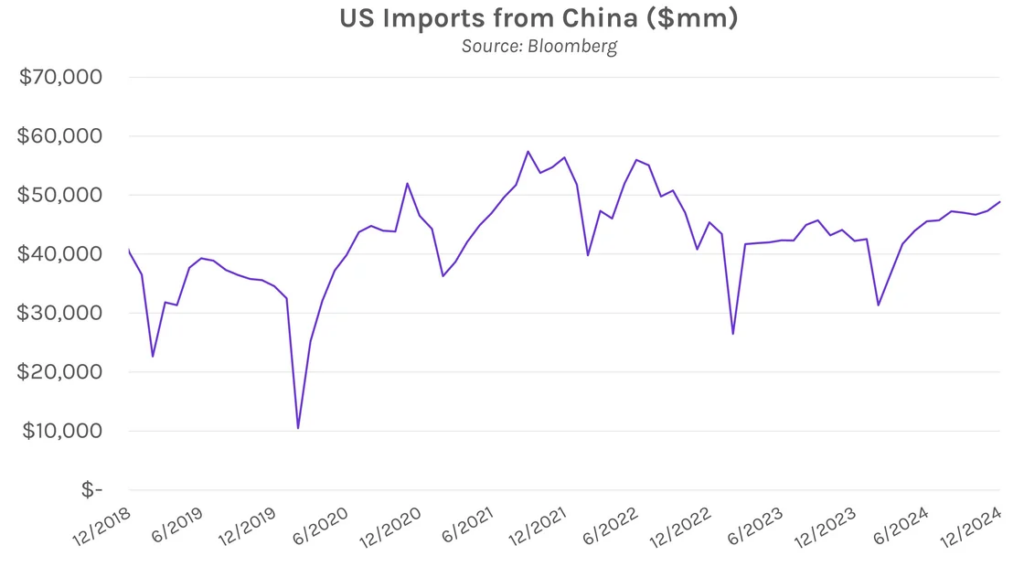

China trade surplus hits an all-time high. With the threat of Trump’s tariffs against Chinese exports looming, China’s trade surplus soared to a record $992B in 2024. Exports were largely buoyed by US companies that are rushing to import goods before Trump’s tariffs are enacted. Exports to the US rose to the highest level in more than 2 years in December, reaching $49B and $525B on the year. Trump is set to take office on January 20th, and he has been vocal about his intentions to impose the tariffs on day one of his second term.