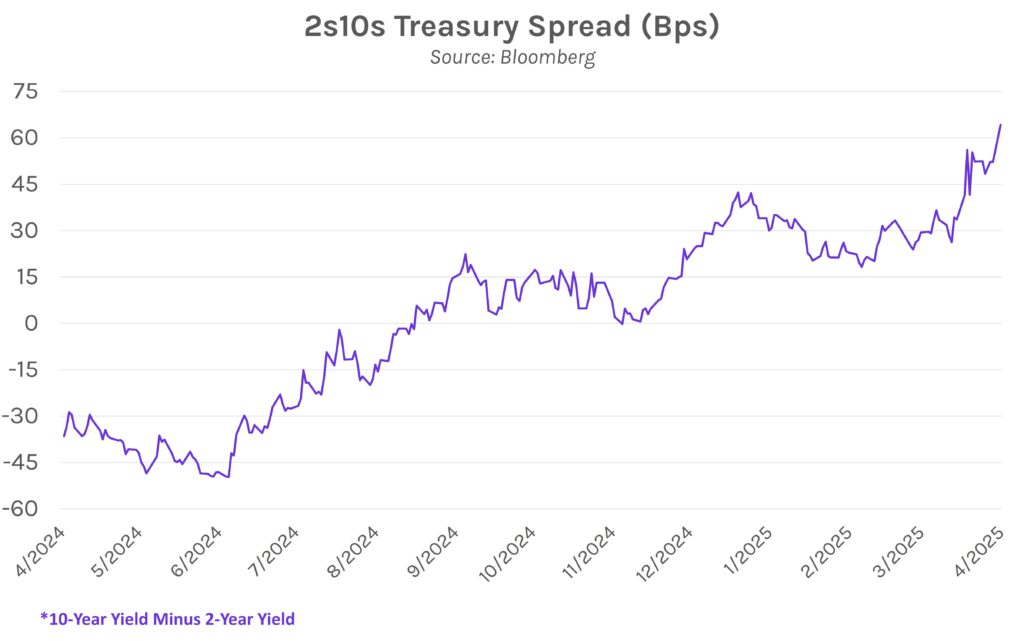

Yield curve steepens again. President Trump’s condemnation of Chair Powell and calls for near-term rate cuts have largely driven a US asset sell-off amid rising uncertainty. The long end of the yield curve rose 9-11 bps today, cementing a 11-28 bp rise over the past month whereas shorter-term yields have declined as many as 22 bps over the same timeframe. The spread between 2-year (3.76%) and 10-year (4.41%) yields closed above +64 bps, the steepest closing level since Q1 2022. Meanwhile, equities were hammered, with each of the S&P 500, DJIA, and NASDAQ down 2.36%-2.55%.

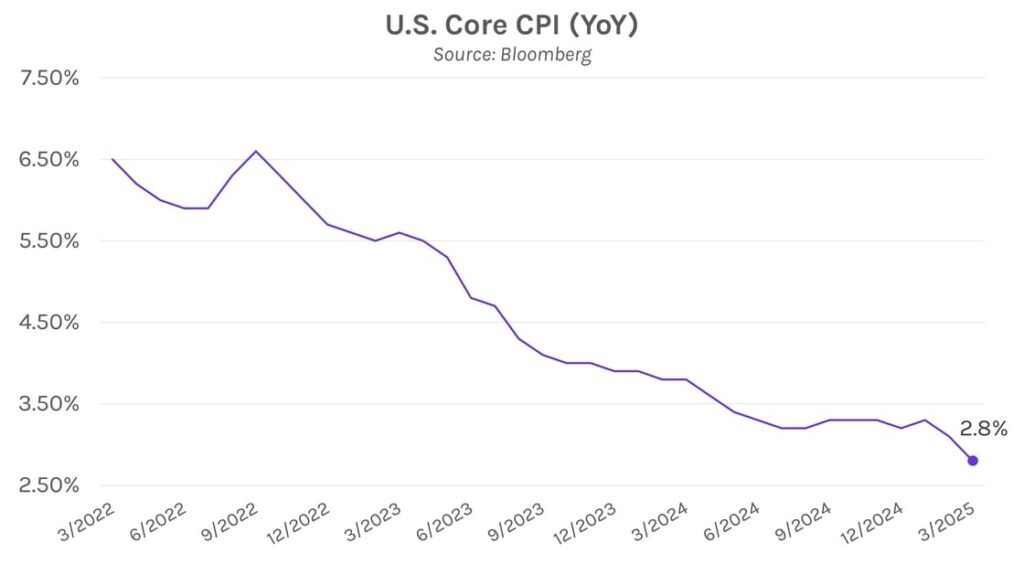

President Trump reiterates Chair Powell criticism. President Trump posted on Truth Social today that the Fed should opt for “preemptive cuts” due to lower price pressures. The president argued that there is “virtually no inflation… but there can be a slowing of the economy” if the Fed does not reduce policy rates now. Trump’s criticism has cast doubt over the Fed’s long-standing independence and credibility. National Economic Council Director, Kevin Hassett, said on Friday that Trump is studying whether he’s able to fire Powell, and Chair Powell has previously stated that his removal would not be “permitted under the law.”

China issues a tariff warning. China’s Ministry of Commerce released a statement today that warned other nations about agreeing to trade deals with the US that would hurt China. The statement said that Beijing “opposes any party reaching a deal at the expense of China’s interests… China is willing to strengthen solidarity and coordination with all parties, jointly respond and resist unilateral bullying acts.” China also warned that it would “resolutely take reciprocal countermeasures” if any punitive deals are agreed upon with the US. The statement comes amid speculation that President Trump will push other nations to curb their trade with China as part of ongoing tariff negotiations.