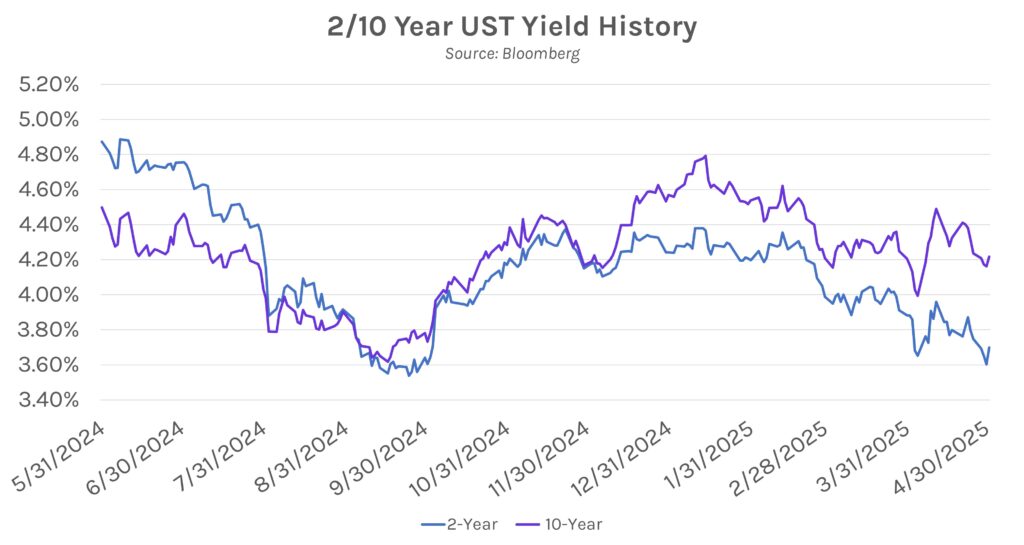

Markets risk-on ahead of labor data. Optimism from yesterday’s news that the U.S. reached out to China for tariff negotiations combined with today’s stronger-than-expected U.S. manufacturing data to fuel risk-on sentiment. Treasury yields surged as a result, with the policy-sensitive 2-year yield (3.70%) up 10 bps and the long-end of the curve up 4-5 bps. Stocks rallied alongside the surge in yields, with tech stocks having a particularly strong day after Microsoft and Meta reported strong earnings. The NASDAQ rose 1.52% on the day while the S&P 500 climbed 0.63%. Markets are now looking ahead to tomorrow’s labor data, where the U.S. is expected to have added 138k jobs in April while the unemployment rate is forecast to remain flat at 4.2%.

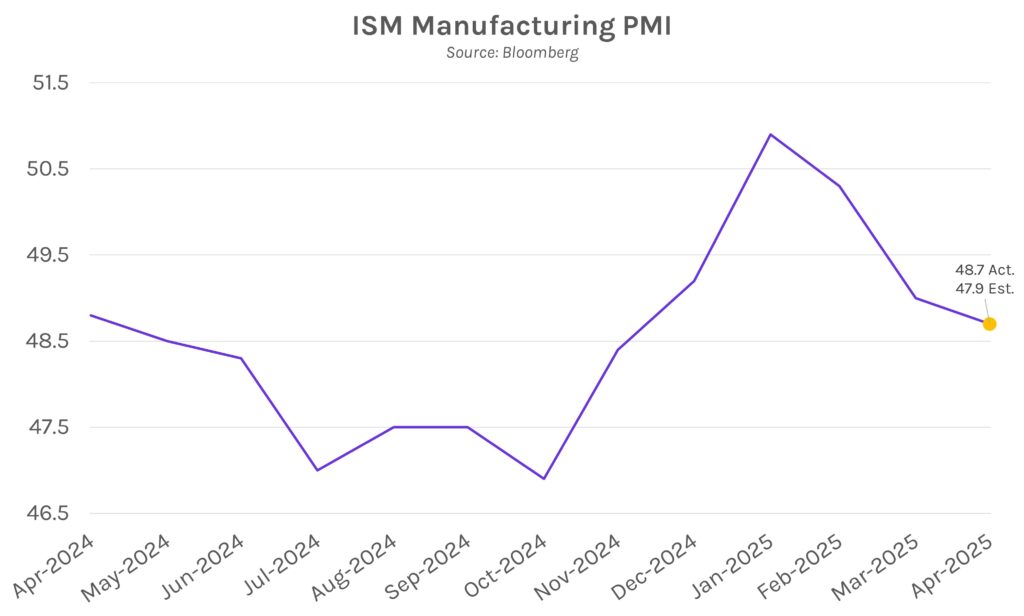

Manufacturing activity contracts in April. Per ISM data released today, manufacturing activity contracted in April for a second consecutive month. The overall manufacturing activity index landed at 48.7, above expectations of a more pronounced fall to 47.9, and slightly lower than March’s 49 print. Despite activity contracting slightly less than expected, the data indicated the fastest contraction since last November and was largely driven by elevated tariff-related uncertainty. ISM Manufacturing Business Survey Committee chair Timothy Fiore said, “Demand and production retreated and de-staffing continued, as panelists’ companies responded to an unknown economic environment.”

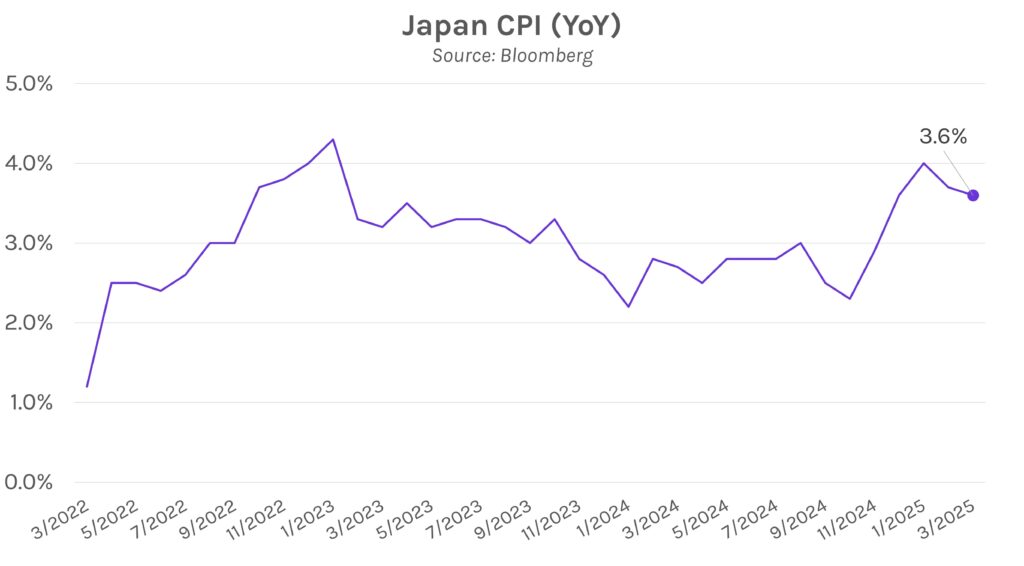

Bank of Japan unanimously holds rates steady. The BOJ kept policy rates at 0.5% for the second straight meeting amid concerns that global trade tensions could hurt economic growth and prevent 2% sustained inflation. The central bank noted “extremely high” uncertainties and cut this fiscal year’s growth forecast to 0.5%. However, the BOJ appears committed to continuing rate hikes so long as economic forecasts are realized. BOJ Governor Ueda stated, “It’s true that the timing for when prices will reach 2% is now slightly delayed, but that doesn’t necessarily mean the timing of the rate hike will also be delayed.” The yen depreciated against the dollar in the aftermath, now weaker than ~145.6 per dollar versus ~143 per dollar as of yesterday’s market close.