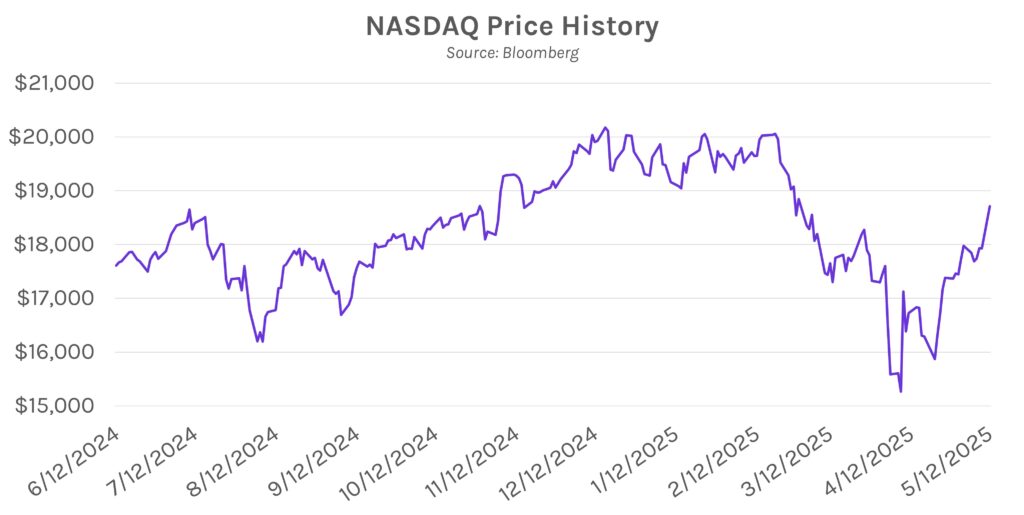

Rates soar as trade war appears to thaw. U.S. Treasury yields rose ~7-13 bps across the long end of the curve, with the 2-year ending ~12 bps higher at ~4.01% and the 10-year rising ~9 bps to end at ~4.47%, after the U.S. and China announced sharp tariff reductions following positive trade discussions in Switzerland over the weekend. The 10-year yield is now ~30 bps below YTD highs in early January, and ~50 bps above lows set in early April. Equities surged on the news, with major indices ending ~2.80% – 4.35% higher on the day, and the NASDAQ 100 re-entered a bull market. The heightened positivity drove traders to re-evaluate their expectations of Fed cuts in 2025, with futures implying just two 25bp rate cuts this year vs. three last week.

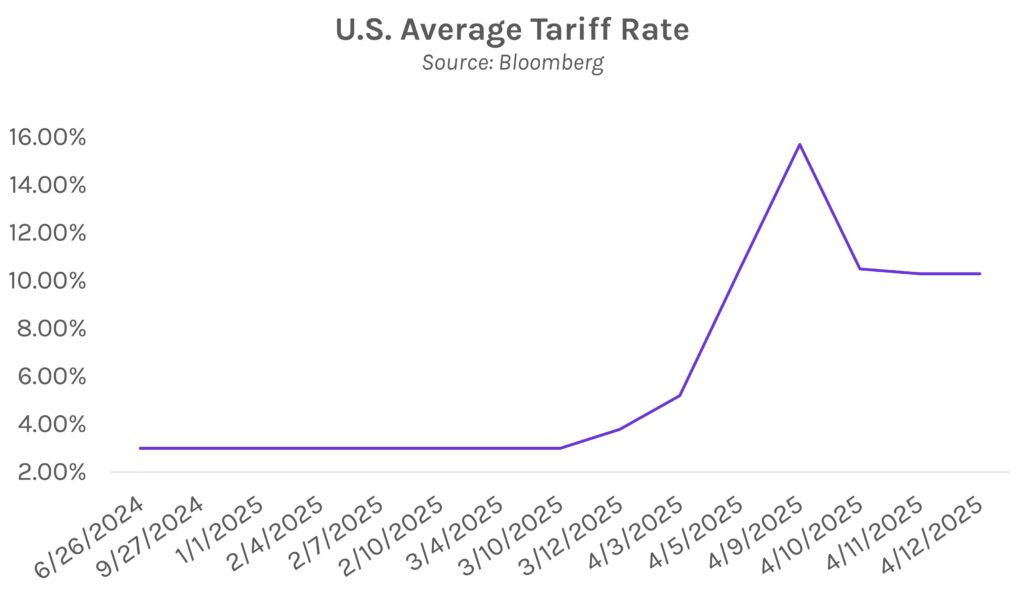

U.S. and China slash tariffs after positive talks. To the surprise of many, the trade talks held this weekend in Switzerland between China and the U.S. were positive, with both sides making significant public concessions. Most encouragingly, an agreement was reached lowering U.S. tariffs on Chinese imports from 145% to 30%, while China will reduce its duties on the U.S. from 125% to 10%. President Trump said today, “China will also suspend and remove all of its non-monetary barriers. They’ve agreed to do that,” a key U.S. demand that would involve the rollback of barriers including regulations that make it difficult for the U.S. to invest and market its products in the country. Much remains to be seen; the tariff rollback is only a temporary measure intended to give both sides more time to iron out the finer details of a trade agreement, but the tone was positive. Secretary Bessent said, “Just like with all our other trading partners, as long as there is good faith effort, engagement and constructive dialogue, then we will keep moving forward.

Governor Kugler still expects significant tariff impact. The past week has offered many positive trade developments, including a trade framework announced with the U.K. and today’s announcement of tariff rollbacks after discussions with China. Still, Fed Governor Kugler believes that current tariff policies will weigh heavily on the economy. Kugler said trade policies are evolving, but “…they appear likely to generate significant economic effects even if tariffs stay close to the currently announced levels.” Chicago Fed President Goolsbee seemed to agree, saying today that the current tariff environment still poses risks of higher prices and more sluggish economic growth.