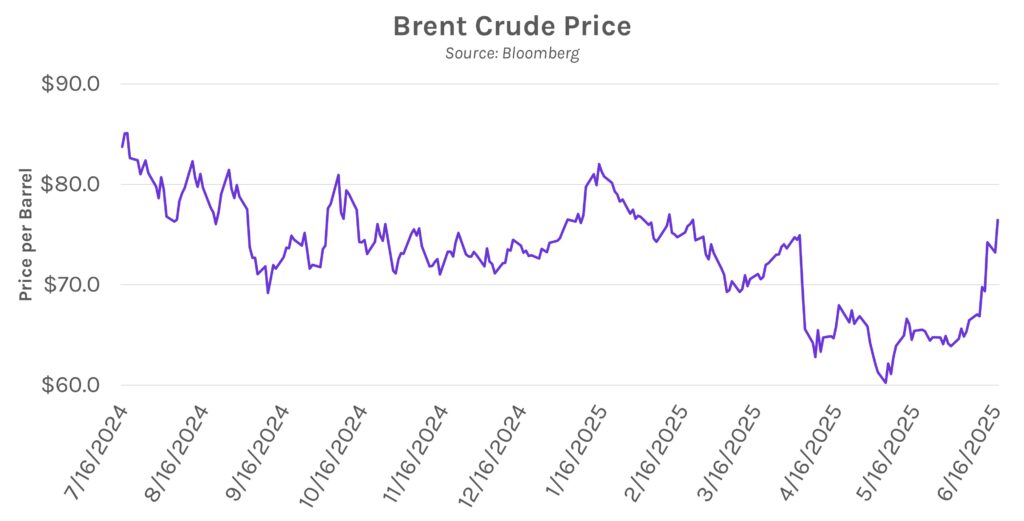

Treasurys rise after Iran-Israel concerns reemerge. Markets were risk-on yesterday following reports that Iran was seeking to de-escalate the conflict with Israel, but price action reversed course today amid growing fears about a prolonged war. Demand for safe haven assets rose, with Treasury yields down 2-6 bps across a flattening curve. The 2-year yield closed at 3.95% while the 10-year closed at 4.39%. Meanwhile, the NASDAQ and S&P 500 closed 0.91% and 0.84% lower, respectively, while Brent ($77 per barrel) and WTI ($75 per barrel) crude surged over 4% today.

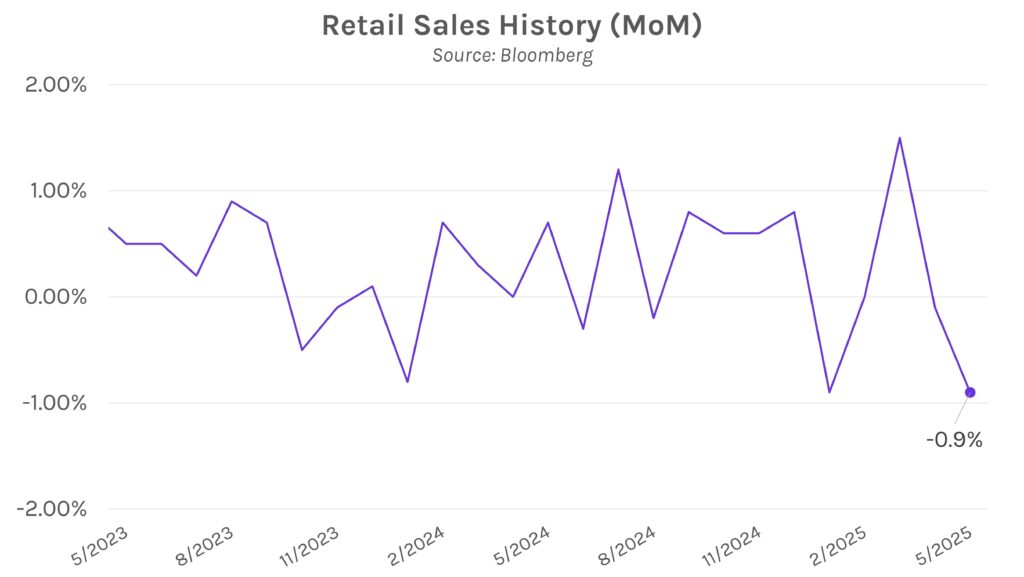

Retail sales fall amid tariff concerns. Ahead of tomorrow’s FOMC meeting decision, the Fed was left with another datapoint showing that tariffs could be hurting economic growth. Retail sales declined by 0.9% MoM in May, the largest decrease in four months. The print was also lower than the -0.6% estimate, while April’s reading was revised lower from +0.1% to -0.1%. While the Fed is unlikely to cut policy rates tomorrow, slowed consumer spending and confidence could push the Fed to act earlier than expected. Fed Funds futures have a 25 bp rate cut fully priced in by the end of October’s meeting while September remains a realistic timeline.

Possibility of direct U.S. involvement in Iran grows. President Trump met with his national security team today to discuss the Israel-Iran conflict, and the President’s early departure from a meeting of G7 leaders in Canada prompted further speculation that the U.S. is weighing direct involvement. The President has called for Iran’s “Unconditional Surrender” and even said on social media that the U.S. considers Iran’s “Supreme Leader” Ayatollah Khamenei to be an “easy target” but that it will not “take him out (kill!), at least not for now.” German Chancellor Friedrich Merz offered a somewhat direct opinion, telling German state media that a U.S. decision on whether to join the war would come “in the course of the day” and that the “complete destruction” of Iran’s nuclear program could be a possibility if it doesn’t come back to the negotiating table.