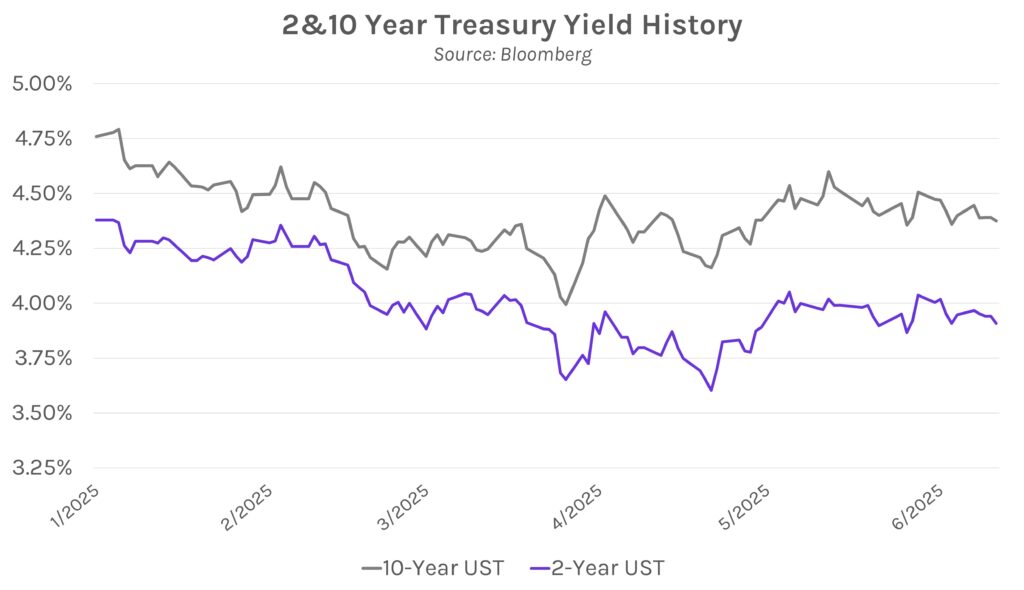

Trade war fears, Fed commentary fuel Treasury yield decline. The Wall Street Journal reported today that the US may revoke waivers that allow global semiconductor manufacturers to ship American chip-making equipment to facilities in China without obtaining licenses. The report rekindled trade war concerns and risk-off sentiment, pushing the 2-year yield 3 bps lower to 3.91% and the 10-year to 4.38% after a 2 bp decline. Dovish Fed commentary from Fed Governor Waller also contributed to the yield decline, as he is in favor of earlier rate cuts. Meanwhile, equities dropped amid the risk-off sentiment, with the NASDAQ and S&P 500 down 0.51% and 0.22%, respectively.

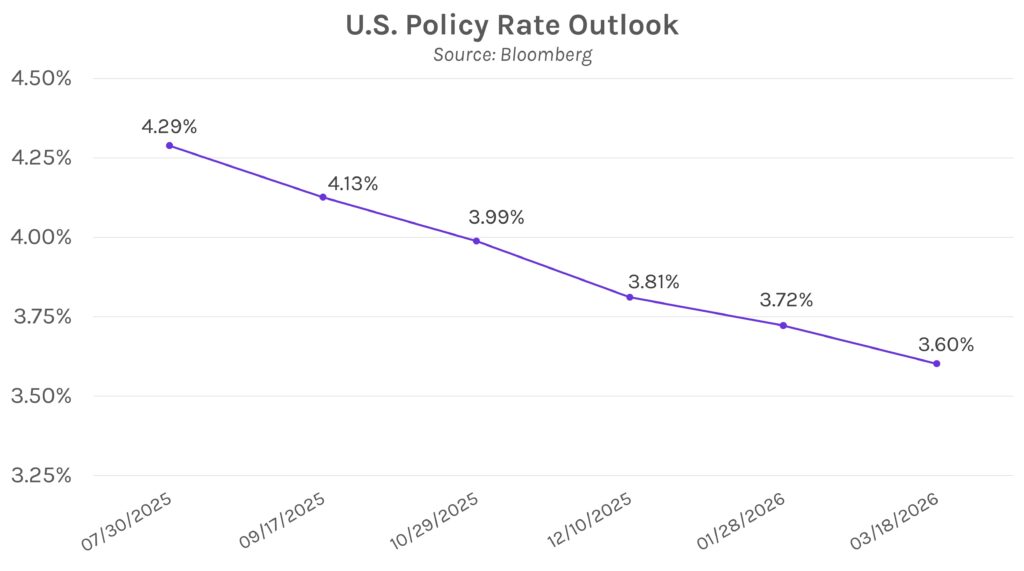

Fed’s Waller says rate cuts could resume in July. Fed Governor Christopher Waller continues to be more concerned about the labor market than inflation. He stated in an interview on CNBC today that tariffs should have “a one-off level effect and not cause persistent inflation,” a stark contrast to Chair Powell, who remains concerned that tariff-driven price pressures will “take some time” to be realized. Meanwhile, Waller argued that the Fed should ease monetary policy before the labor market crashes; he said, “If you’re starting to worry about the downside risk [to the] labor market, move now, don’t wait.” Waller also emphasized that he would like to reduce policy rates gradually, on par with comments from his Fed peers.

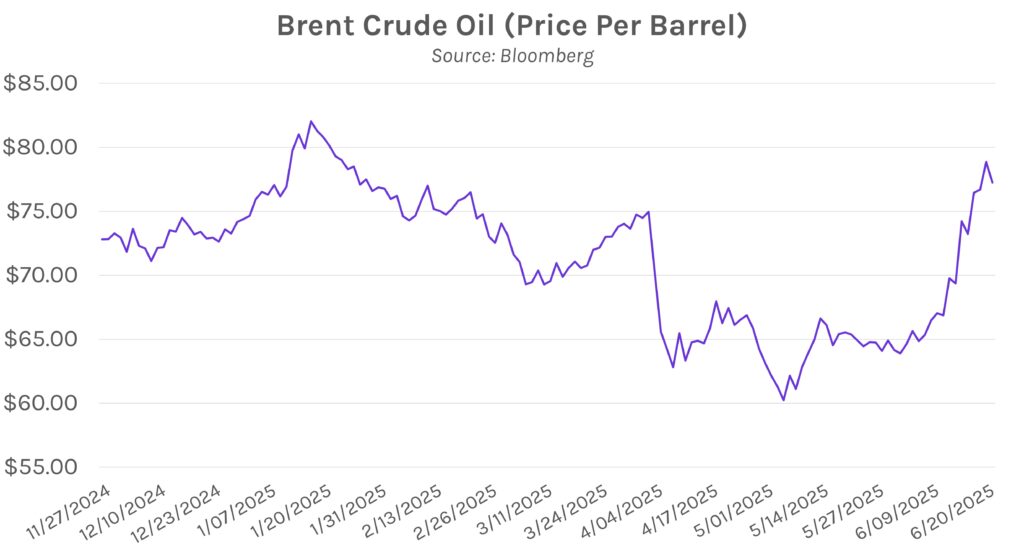

Oil prices decline after President Trump announces 2-week negotiation period with Iran. Amid growing speculation that the US may directly join Israel’s attacks on Iran to dismantle their nuclear program, President Trump prepared a statement saying, “Based on the fact that there’s a substantial chance of negotiations that may or not take place with Iran in the near future, I will make my decision whether or not to go within the next two weeks.” Optimism that negotiations will be successful led to a decline in oil prices, with Brent crude falling below $76 per barrel intraday after opening near $79 per barrel. However, optimism cooled slightly after Iran stated that they would only meet with US officials if Israel agreed to stop attacks, which Trump said would be “very hard to do.” Brent closed above $77 per barrel, a ~2% decline, while WTI closed 0.28% lower at just under $75 per barrel.