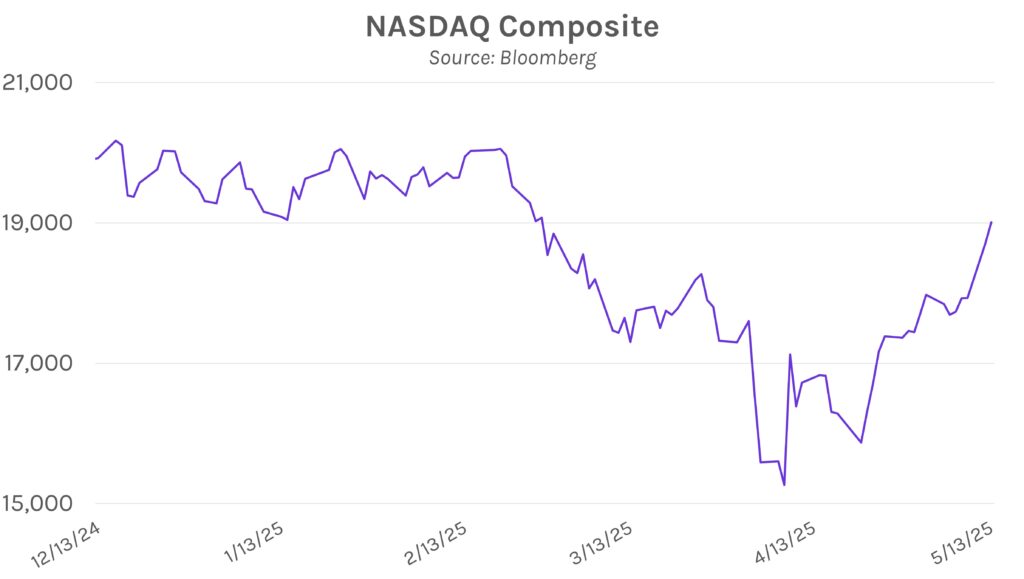

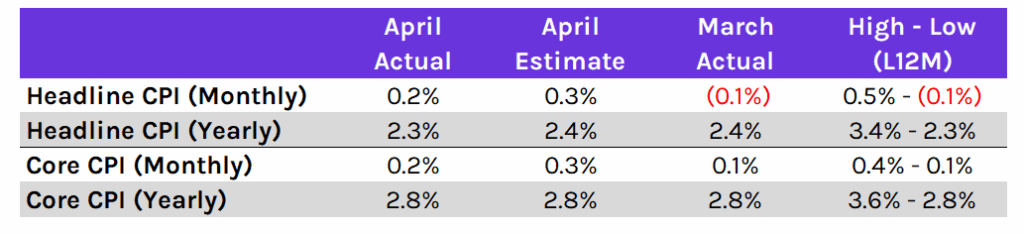

Rates little changed after Trump optimism overshadows inflation data. The policy-sensitive 2-year Treasury yield declined ~3 bps in the immediate aftermath of today’s CPI data, which was generally lower than expected. The relatively soft inflation print momentarily boosted odds for earlier rate cuts, which are now expected to resume in September. However, Treasurys sold-off later in the session after President Trump spoke optimistically about the stock market, spurring a risk-on move. Most of the yield curve closed just 1-2 bps lower on the session while the move in equities was more pronounced; the NASDAQ climbed 1.61% while the S&P 500 rose 0.72%.

April CPI suggests tariff-driven price pressures may be more muted than expected. CPI was 0.1% lower than forecasts for MoM headline, YoY headline, and core MoM prints while core YoY CPI was flat at a 4-year low of 2.8%. Prices for groceries, cars, airfares, and clothing declined, with the latter a surprise given steep tariffs on China’s imports. However, there were some signs of tariff effects, including a ~9% jump in audio equipment prices and a 2.2% increase in photographic equipment prices from March to April. While many of the tariff-driven impacts may be more evident in later months, the recent 90-day deal between the US and China has spurred optimism that the inflationary pressures will be short-lived.

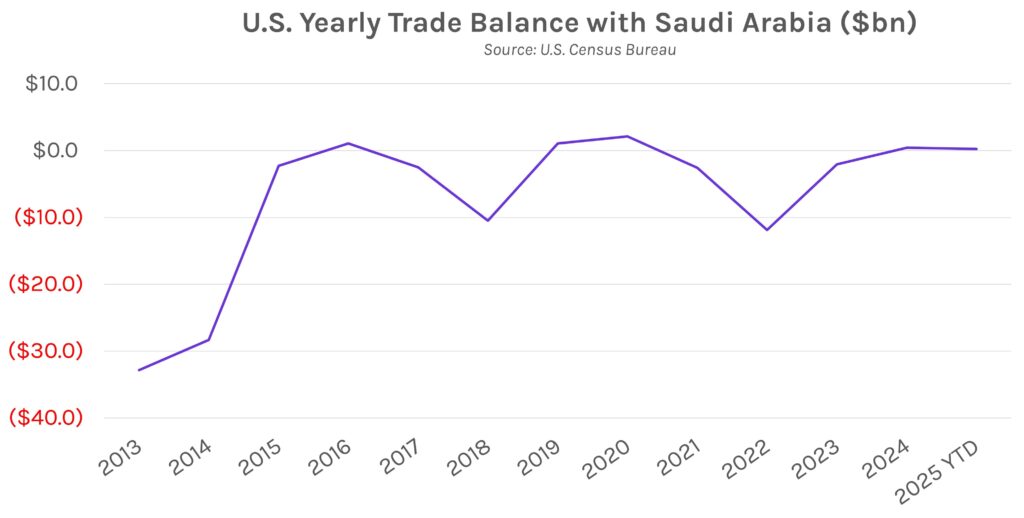

U.S. and Saudi Arabia announce historic investment partnership. President Trump kicked off the first international trip of his term by announcing a ~$600 billion of investment package with Saudi Arabia. A White House statement released today listed several U.S. and Saudi companies participating in the partnership and outlined a ~$142 billion weapons deal. Though finer details remain unclear, the commitment brings President Trump closer to his goal of achieving $1 trillion in total investments from the Gulf region, and the announcement comes ahead of stops in Qatar and the UAE later this week. Together, those two nations’ sovereign wealth funds manage upwards of ~$1.5 trillion, representing a sizeable opportunity for the President to ink additional trade and investment partnerships during his visit.