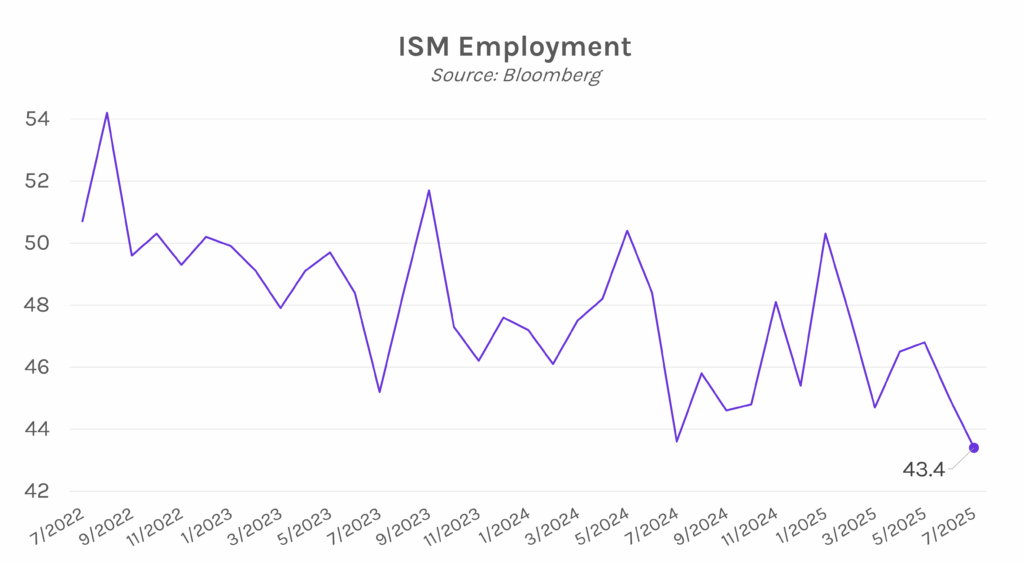

Yields fall as economic figures point to a slowdown. In the aftermath of weaker than expected labor data, UST yields dropped by 13-17bps as the numbers pointed to a slow in hiring. Further amplifying the downward pressure was consumer sentiment and ISM manufacturing data, which also fell short of expectations, and pushed yields down another 2-4 bps. ISM manufacturing index landed at 48, its fastest pace of contraction in nine months, with the employment gauge hitting its lowest level since June 2020. None of the six key manufacturing sectors expanded employment in July, with most firms placing an emphasis on reducing head counts. Today’s data paints a concerning picture of a weakening labor market. Ultimately, the 2-year yield closed 28 bps lower at 3.68%, while the 10-year yield closed 16 bps lower at 4.22%. Meanwhile, the S&P 500 and NASDAQ fell by 1.60% and 2.24%, respectively.

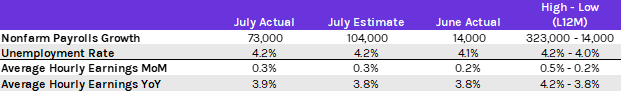

Large miss in nonfarm payrolls drags down yields. July’s nonfarm payrolls delivered a substantial disappointment, growing by only 73k against an estimated 104k. Adding to the concern, June’s initial robust print of 147k was revised down to 14k, bringing the three-month average payroll gain to 35k, the lowest level since 2020. The lag in payrolls reflects struggles in manufacturing, government, and professional and business services. Private payrolls improved from May, largely driven by healthcare and social assistance sectors. The good news is that the unemployment rate remained steady at 4.2% and average hourly earnings grew by 0.3%, both as expected. Nevertheless, job growth is cooling. These numbers support Governor Waller’s recent FOMC dissent statement where he wrote, “while the labor market looks fine on the surface, once we account for expected data revisions, private-sector payroll growth is near stall speed.” Traders are now pricing in an 87% chance of a rate cut in September, up from 40% yesterday.

Trump’s August 1st tariff deadline is here. In the hours leading up to midnight on Thursday, The Trump administration unveiled a global 10% minimum tariff. Countries having major trade surpluses with the U.S. were hit with even higher rates. Canada will face a 35% rate, while Switzerland and Taiwan face a 39% and 20% tariff, respectively. Uncertainty remains as some nations will continue to negotiate for better deals. Canadian Prime Minister Mark Carney previously said he did not expect to reach an agreement by August 1st, and while noting his disappointment today, said he will continue to negotiate. Taiwan is following a similar tone, with President Lai Ching-te saying that this 20% tariff is not final. For others, the trade outcomes were better than anticipated. Malaysia, for example, was previously threatened with a 25% tariff, but now faces only a 19% duty.