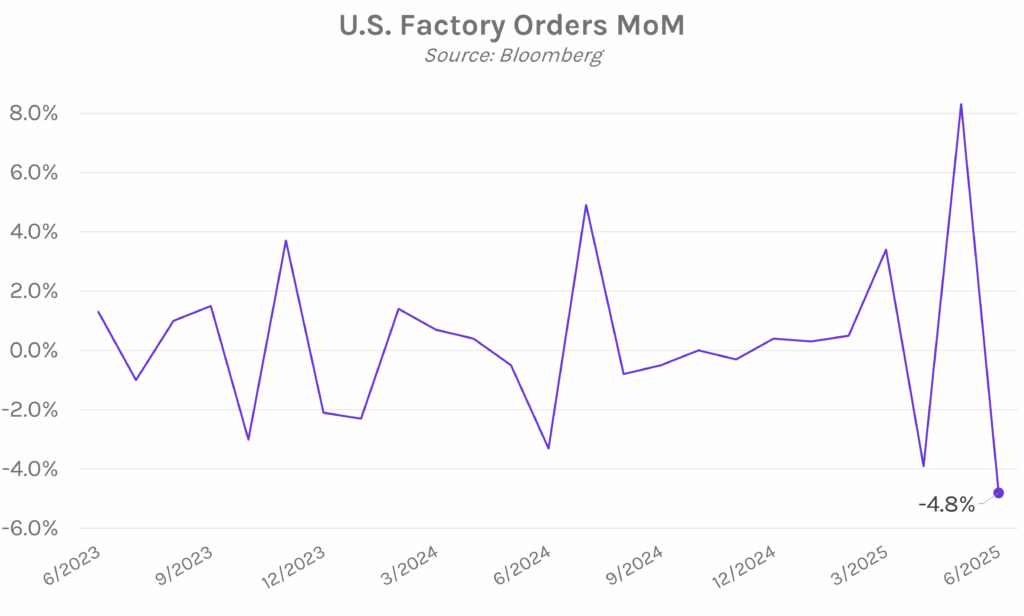

Today’s data have little impact on yields. UST Yields were roughly unchanged to end the day, with the 2-year ending ~1bp lower at ~3.68% and the 10-year down ~2 bps to ~4.19%, after factory orders and durable goods orders data landed in-line with expectations and were largely overlooked. Instead, markets continued to digest last Friday’s labor data release and are now looking ahead to the 10- and 30-year UST auctions scheduled for this week. On the other hand, major indices surged ~1.34% – 1.95% today, fueled by elevated expectations for Fed rate cuts this year. Futures markets currently see a ~97% chance the Fed will cut 25 bps in September, up from ~87% on Friday and ~40% on Thursday.

Personnel upheaval at Fed, Bureau of Labor Statistics. On Friday, Fed Governor Adriana Kugler announced her resignation from the Fed effective at the end of this week. Kugler’s term ends next January, and speculation around her departure has mounted given she hasn’t provided an explanation for her decision. Last night, President Trump said, “I think she left because she agreed with me on interest rates,” referring to his position that the Fed should cut rates. On the other hand, Kugler said in a July speech at a D.C. housing forum that she believed it was “appropriate to hold our policy rate at the current level for some time,” consistent with Chair Powell’s sentiment at the latest FOMC meeting. Kugler’s departure opens the door for the President to appoint a new FOMC member, and some believe the President could use the opportunity to appoint his preferred successor to Chair Powell.

Separately, President Trump’s dismissal of Bureau of Labor Statistics (BLS) chief Erika McEntarfer following Friday’s jobs report has left observers concerned about U.S. economic data integrity. The President called the report “rigged,” and said on social media yesterday afternoon that McEntarfer was also responsible for inflating the numbers prior to the recent presidential election, implying a political motive. McEntarfer’s predecessor Bill Beach came to her defense, saying, “I don’t know that there’s any grounds at all for this firing,” and that, “There’s no way for that [data manipulation] to happen.” He added that the President’s firing of McEntarfer “undermined credibility” in the federal statistical system.

Looking ahead, President Trump said today that he will be announcing nominees for a new Fed governor and a new BLS head in the coming days.

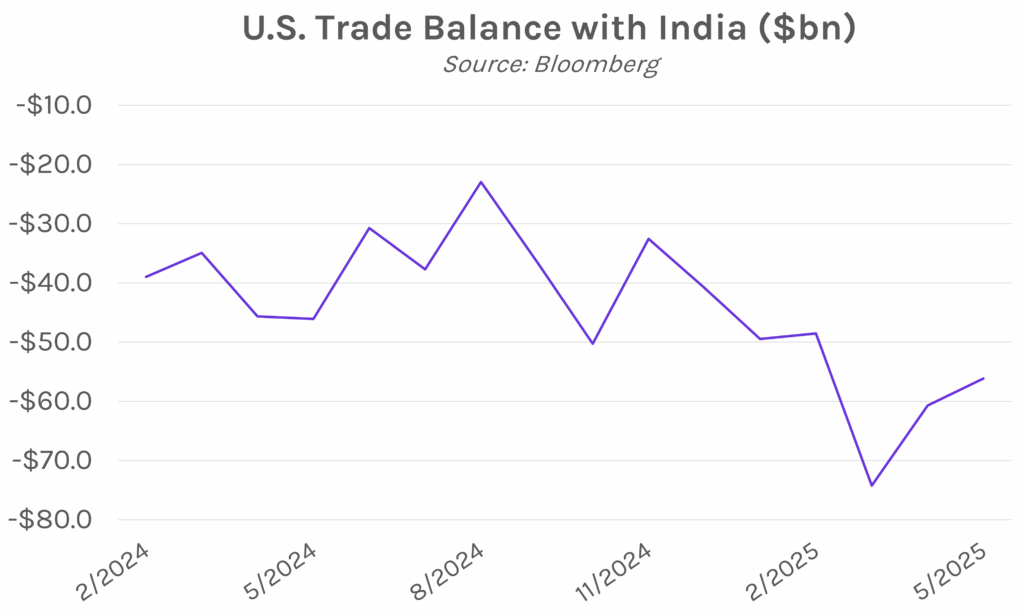

India faces higher tariffs due to Russian oil imports. President Trump today threatened to impose “substantially” higher tariffs on India in response to their continued purchases of Russian oil. Currently, the nation faces a 25% export tariff by the U.S., and it is unclear how high that rate could rise at Trump’s discretion. Previously, the U.S. supported India importing Russian oil after the 2022 invasion of Ukraine, subject to a price cap to squeeze Russian oil revenues, as a means to stabilize the global oil market, and some view the U.S. policy reversal as an attempt to pressure India into a bilateral trade agreement. China and Turkey also continue to import Russian oil, but have not faced U.S. repercussions, and in response to Trump’s threats, India’s Ministry of External Affairs said, “the targeting of India is unjustified and unreasonable.”