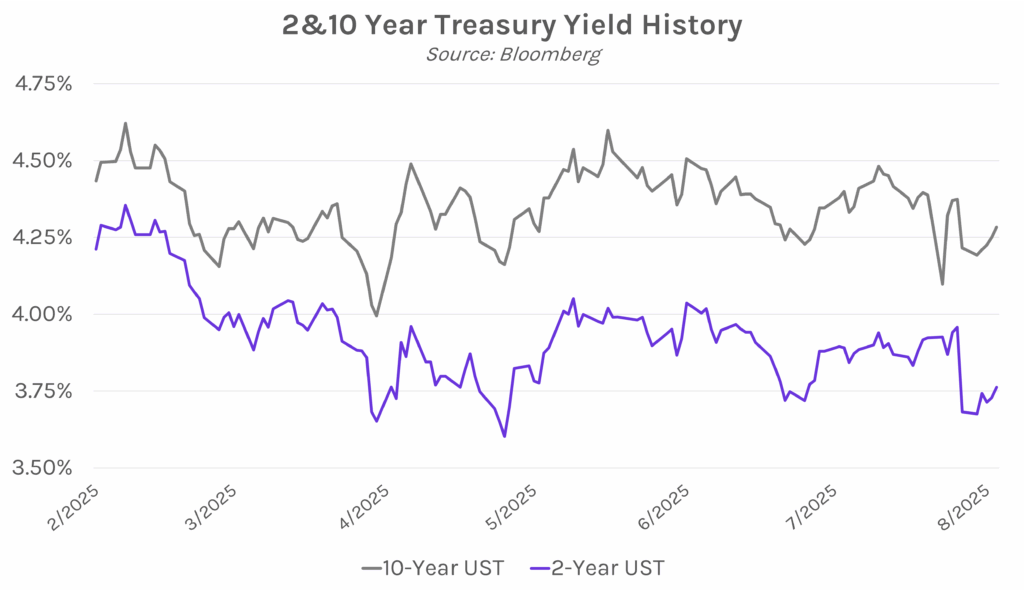

Yields rise with markets risk-on. UST yields climbed gradually today and closed higher across the curve, with the majority of the move occurring before noon EST. Yields closed 3 bps higher, with the 2-year yield at 3.76% and the 10-year yield at 4.28%. All eyes are now on next week’s inflation data, where core CPI is expected to accelerate by 0.1% MoM and YoY. Meanwhile, the stock market had its best week in over a month, with big tech pushing the NASDAQ to all-time highs (21,450) and Apple seeing its best week since 2020.

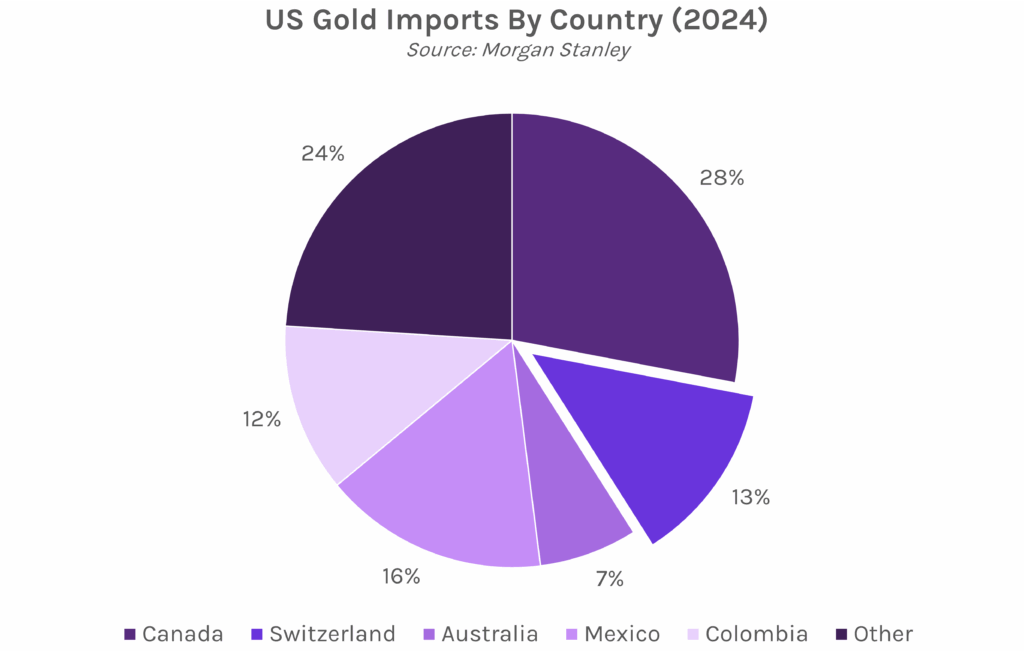

Import tariff on gold causes widespread confusion. The US Customs and Border Protection fueled market volatility yesterday after ruling that one-kilogram and 100-ounce gold bars were impacted by reciprocal tariffs. This unexpected notice sent US gold futures soaring to an all-time high of $3,514.50 as traders had previously assumed that gold was exempt. At the time, no official statement was released by the White House, leaving many questions unanswered and speculation that the ruling was an error. In response, several refineries in Asia and Switzerland said they paused shipments to the US. This afternoon, the White House announced that it will issue an executive order to exempt gold bars from tariffs.

Trump Administration hoping to take Fannie Mae and Freddie Mac public. The Wall Street Journal reported today that the White House is moving towards a possible IPO of the government-controlled mortgage giants Fannie Mae and Freddie Mac later this year. The offering is said to involve selling between 5% and 15% of the companies’ stock, raising an estimated $30 billion. One Trump official stated that government conservatorship, which began after the 2008 financial crisis, would remain in place throughout the IPO process. Meanwhile, there are doubts around the purported 2025 kickoff timeline given the complexity of the deal, and it remains unclear whether Fannie and Freddy would IPO separately or together.