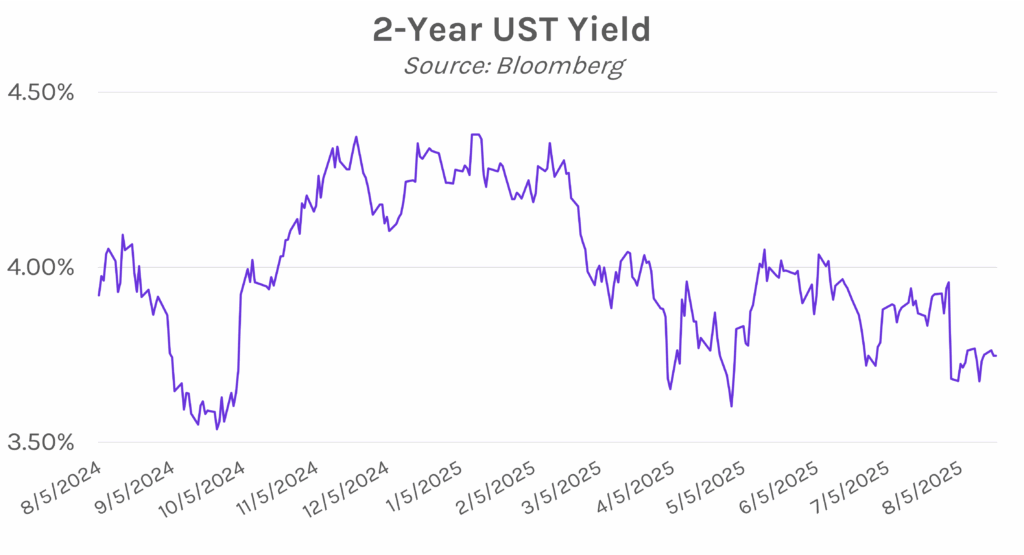

Yield movement limited as Fed remains concerned about inflation. UST yields gradually declined this morning after President Trump called for Fed Governor Lisa Cook to resign. The 2-year yield fell below 3.72% for the first time this week, but the move reversed course after FOMC meeting minutes underscored that policymakers viewed inflation risk as a greater concern than employment risk. The 2-year yield closed nearly flat at 3.75% and the 10-year yield dropped 2 bps to 4.29%. Meanwhile, the slide in tech stocks continued, with the NASDAQ and S&P 500 down 0.67% and 0.24%, respectively.

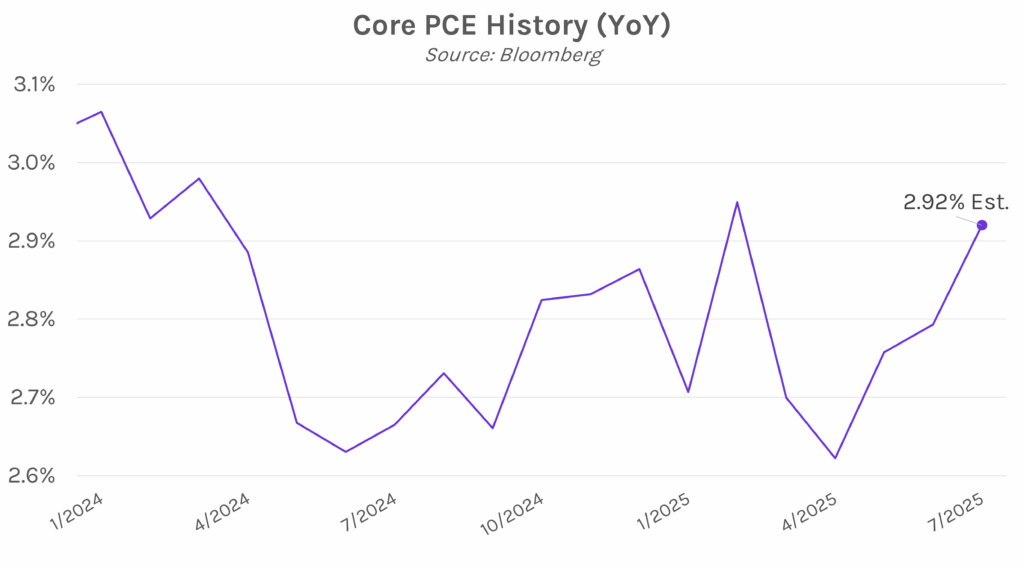

FOMC minutes emphasize inflation concerns over labor market woes. July FOMC meeting minutes released today showed that a majority of committee members “judged the upside risk to inflation” as a greater concern than dwindling labor market strength. Participants noted that inflation has stayed above the Fed’s 2% target for an extended period of time, which “increased the risk of longer-term inflation expectations becoming unanchored in the event of drawn-out effects of higher tariffs on inflation.” Last week’s inflation prints are unlikely to have eased the concerns, as core CPI hit multi-month highs and PPI was well above expectations. However, the Fed is largely expected to cut rates in September after nonfarm payrolls data released on August 1st was well below forecasts.

Trump considers firing Fed Governor Cook. President Trump is considering an attempt to fire Fed Governor Lisa Cook, having already urged her to resign following allegations of mortgage fraud. While the accusation has not been formally investigated by the Department of Justice, the director of the Federal Housing Finance Agency, Bill Pulte, says it appears Cook falsified bank documents to obtain better loan terms. Cook, whose term expires in 2038, has been a reliable ally of Fed Chair Powell. If her seat opens, President Trump will have another opportunity to appoint a new member who aligns with his own policy preferences of lower rates. The Trump Administration is already in the process of filling Adriana Kugler’s seat, who resigned late last month, with nominee Stephen Miran, an advocate for lower rates.