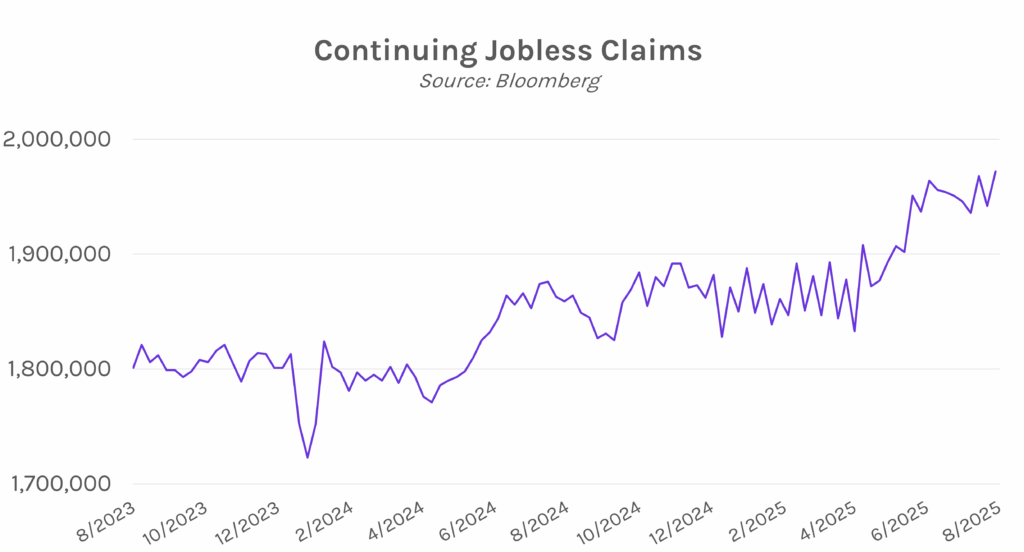

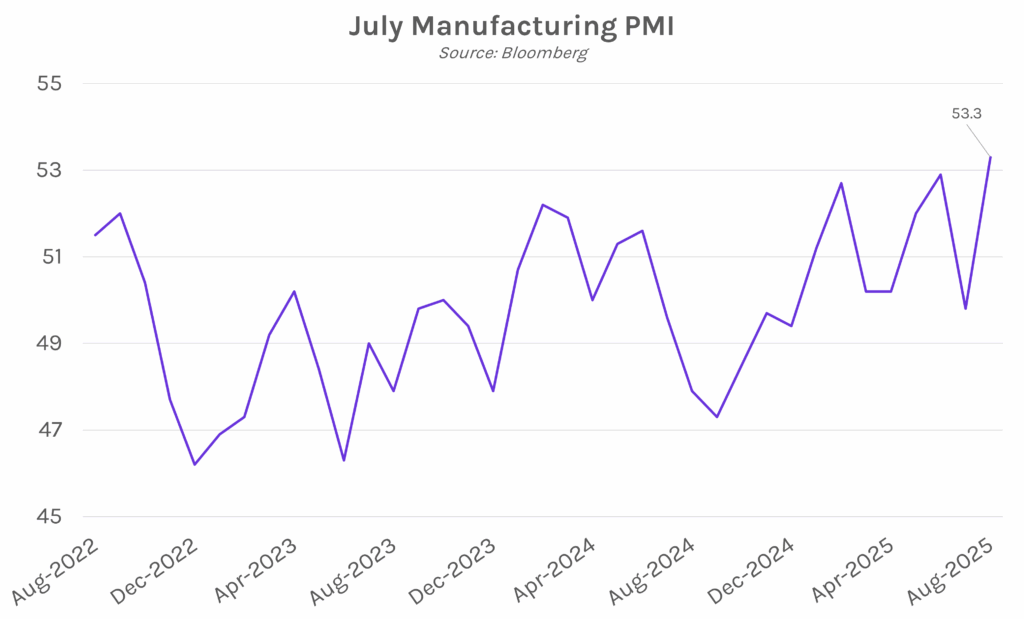

Yields rise on strong economic data, hawkish Fed commentary. UST yields initially fell following jobless claims data, which reinforced the picture of a deteriorating labor market as continuing claims hit its highest level since November 2021. Shortly after, hot PMI data, which highlighted positive economic signals from the services and manufacturing sectors, dampened rate-cut expectations and sent yields climbing 2-3 bps. These gains were further supported by hawkish commentary from three Fed officials. Ultimately, yields ended 4 bps higher with the 2-year yield at 3.79% and the 10-year yield at 4.33%.

Manufacturing PMI comes in hot. US manufacturing PMI came in at 53.3 today, above the growth threshold of 50 and the highest level since May 2022. Alongside services PMI (55.4), the data drove composite PMI to a year-to-date high. The print highlights strong manufacturing demand, though, in turn, companies have been given pricing power that allows them to pass along tariff-related costs to consumers. As such, today’s release underscores lingering inflation concerns, a main focus of the Fed, as markets look to Chair Powell’s speech in Jackson Hole tomorrow morning for any clues on policy sentiment.

Fed officials Bostic, Schmid, and Hammack (non-voters) strike a hawkish tone. Today, Atlanta Fed President Raphael Bostic shared that he only sees one rate cut for 2025, citing concerns about uneven inflation progress while acknowledging the “potentially troubling” labor market. Echoing Bostic’s view, Kansas City Fed President Jeffrey Schmid and Cleveland Fed President Beth Hammack expressed a priority to control inflation risk over weakening employment, in line with the FOMC minutes released yesterday. Hammack explained, “We have inflation that’s too high and has been trending upwards over the past year… if the meeting was tomorrow, I would not see a case for reducing interest rates.” The comments follow last week’s CPI and PPI reports, which both showed signs of rising inflationary pressures.