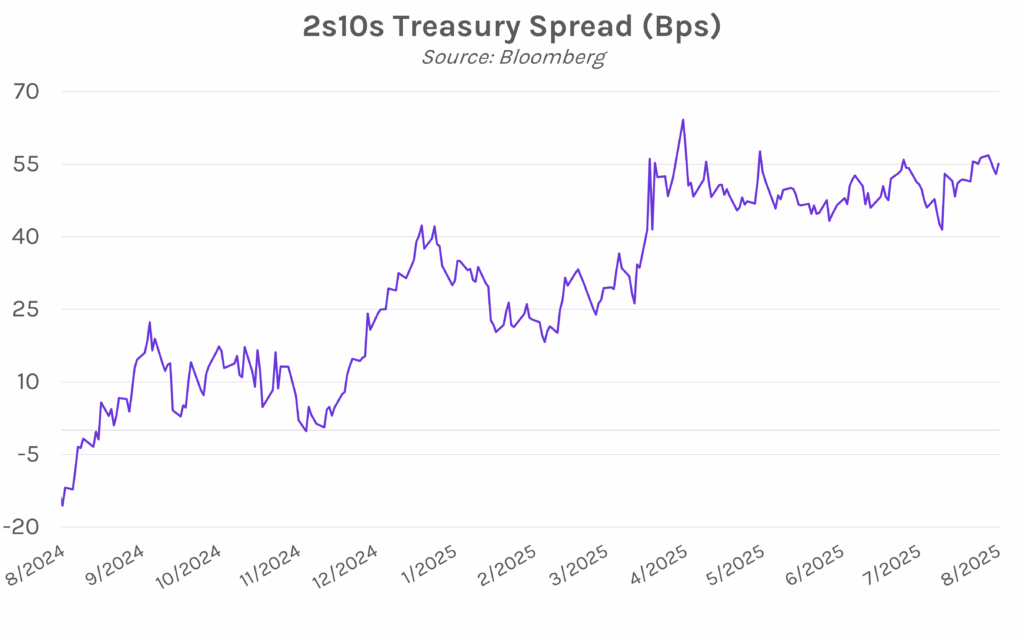

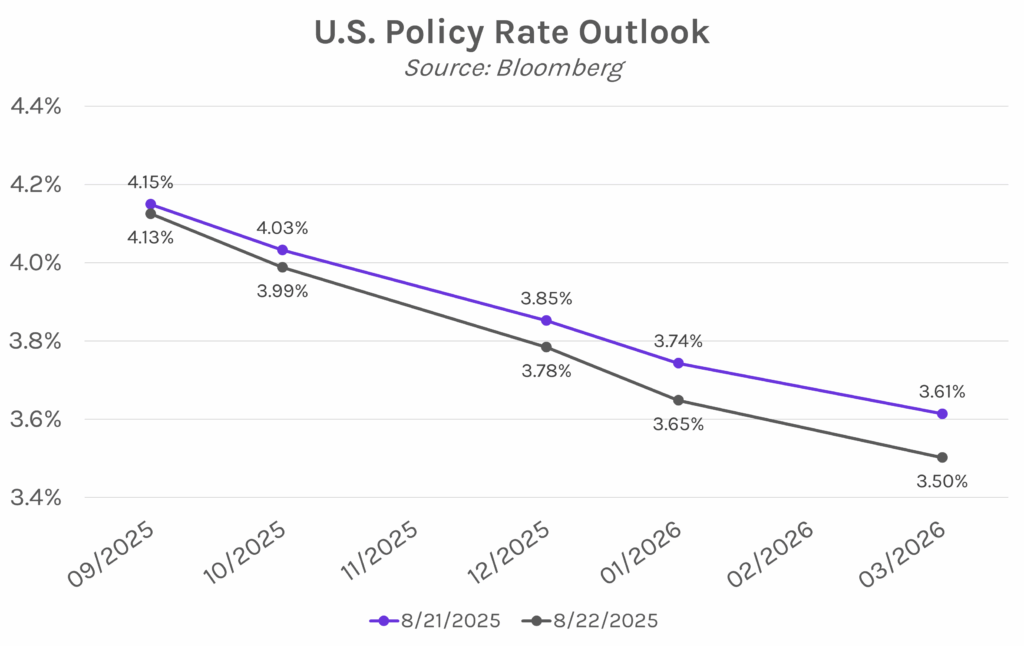

Yields tumble on Powell’s dovish tone. Chair Powell emphasized downside labor market risks at today’s Jackson Hole symposium, which solidified expectations for a September rate cut and fueled an immediate 6-10 bp decline in yields. The yield curve steepened as rising September rate cut odds pushed the front-end of the curve down more sharply than the long end, with the spread between 2-year (3.70%) and 10-year (4.25%) yields now ~55 bps. The bond rally was further boosted by Trump’s announcement that he would fire Fed Governor Cook, a hawkish policy voter. Meanwhile, equities saw strong gains, with the S&P 500 and the NASDAQ closing 1.52% and 1.88% higher, respectively.

Powell indicates policy shift. Fed Chair Powell’s remarks at the Jackson Hole Economic Symposium today signaled the Fed is moving towards cutting rates. Powell emphasized growing concerns about labor market vulnerabilities, stating that “the shifting balance of risks may warrant adjusting our policy stance,” and urging caution as employment remains in a “curious kind of balance.” Powell also acknowledged tariff-driven inflation risk, but pushed back on the idea of persistent price-level hikes, predicting a one-time increase. Though, he clarified that a “‘one-time’ [price hike] does not mean ‘all at once.’” The labor-focused remarks came as a bit of a surprise after the Fed held rates in July and as hawkish officials continue to highlight inflation risks. Currently, the market sees a 81.3% likelihood of a September rate cut.

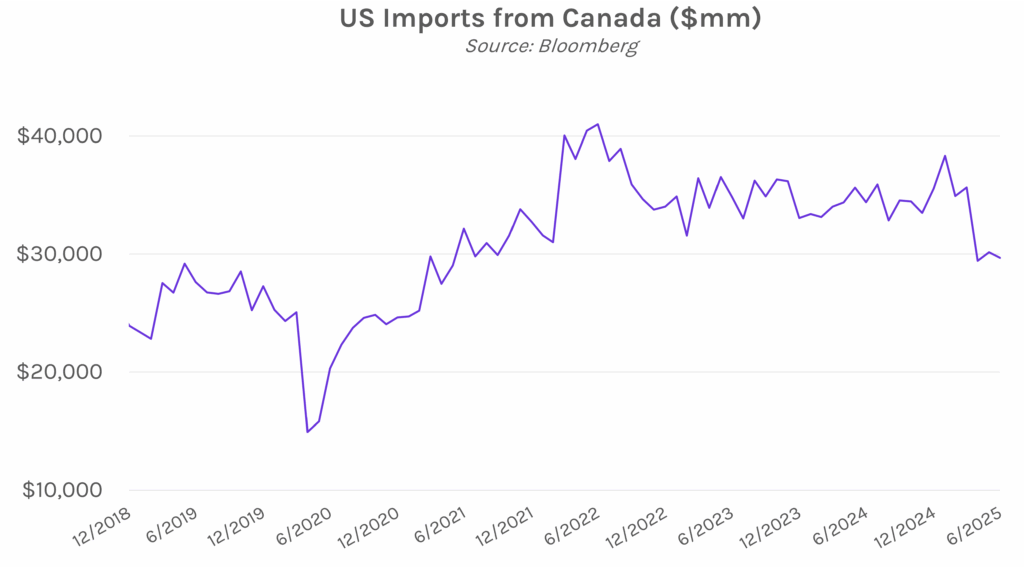

Canada to remove retaliatory tariffs on many US products. Prime Minister Mark Carney announced that Canada will be removing 25% tariffs from a wide range of American-made consumer products that are shipped in compliance with the US-Mexico-Canada Agreement. However, 25% tariffs on US steel, aluminum, and automobiles will remain in place as the US maintains tariffs on Canada in those three sectors. This decision is a notable shift from Canada’s previous approach where they proactively retaliated against US tariffs. Carney’s announcement today comes one day after he spoke with President Trump over the phone, and several months ahead of USMCA’s scheduled review in 2026.