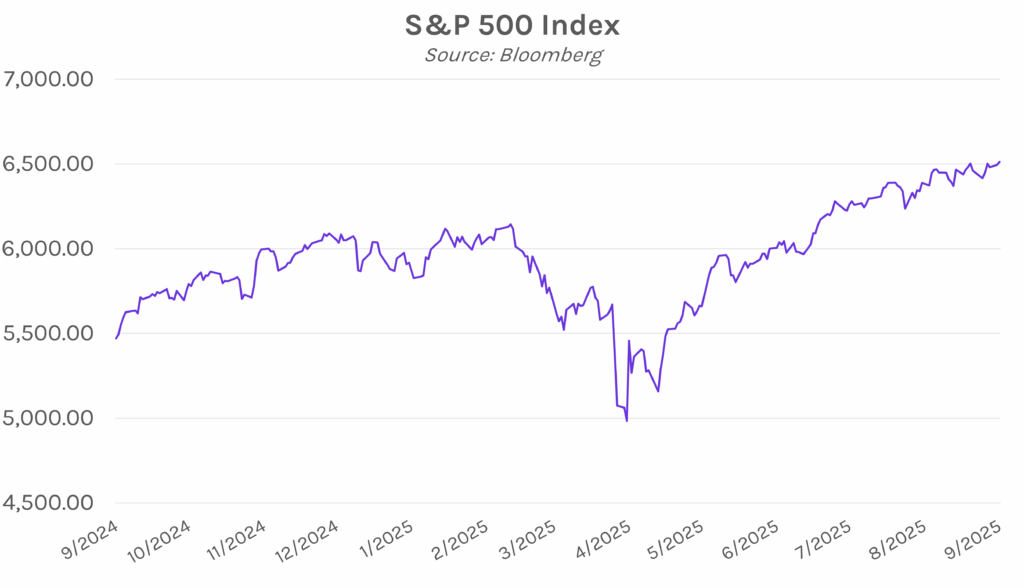

Yields higher as markets await tomorrow’s inflation prints. UST yields were little changed this morning ahead of payrolls data, which saw the worst-ever downward revision to nonfarm payrolls on record. Rates rose in the immediate aftermath of the revision and throughout the afternoon despite the troubling print, with markets largely turning focus to tomorrow’s inflation data. The 2-year yield closed 7 bps higher at 3.56% and the 10-year yield rose 5 bps to 4.09%. Meanwhile, the S&P 500, DJIA, and NASDAQ closed at record highs of 6,512.61, 45,711.34, and 21,879.49, respectively.

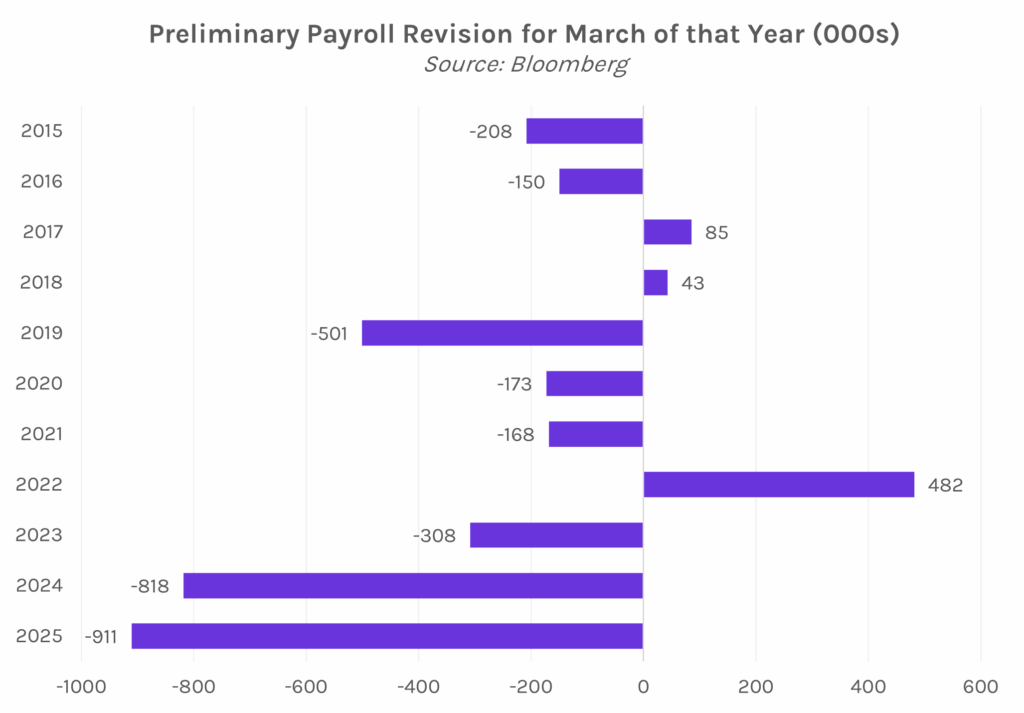

Record jobs data revision lands down 911k. The BLS payroll revision for the twelve-month period ending March 2025 showed 911k fewer jobs added than initially reported. The 0.6% downward revision is the largest on record, though it fell roughly in line with estimates predicting between ~700k and ~1mm fewer jobs. Today’s revision shows job growth at nearly half of initial numbers, with an average ~73k jobs added each month compared to 149k. The downward shift appeared across industries including wholesale, hospitality, professional services, and manufacturing. White House Press Secretary Karoline Leavitt said the revision proved “…that President Trump was right; Biden’s economy was a disaster and the BLS is broken.” Other voices have highlighted that these annual revisions are a normal occurrence, and that 911k jobs is relatively small in an economy with 166 million employees.

BOJ officials still see rate hike despite political turmoil. Bank of Japan officials believe it will still be possible to hike rates again this year, even as the nation faces political instability following Prime Minister Shigeru Ishiba’s resignation earlier this week. According to people familiar with the matter, the finalized US – Japan trade deal removed significant uncertainty from Japan’s economic forecast, opening the door to a rate hike. The BOJ is unlikely to hike at its upcoming September 19 meeting, but some officials see a possible move as soon as October. Japan’s economy has expanded for five consecutive quarters as corporate profits hit record levels, and the labor market remains steady, outweighing concerns about political turmoil.