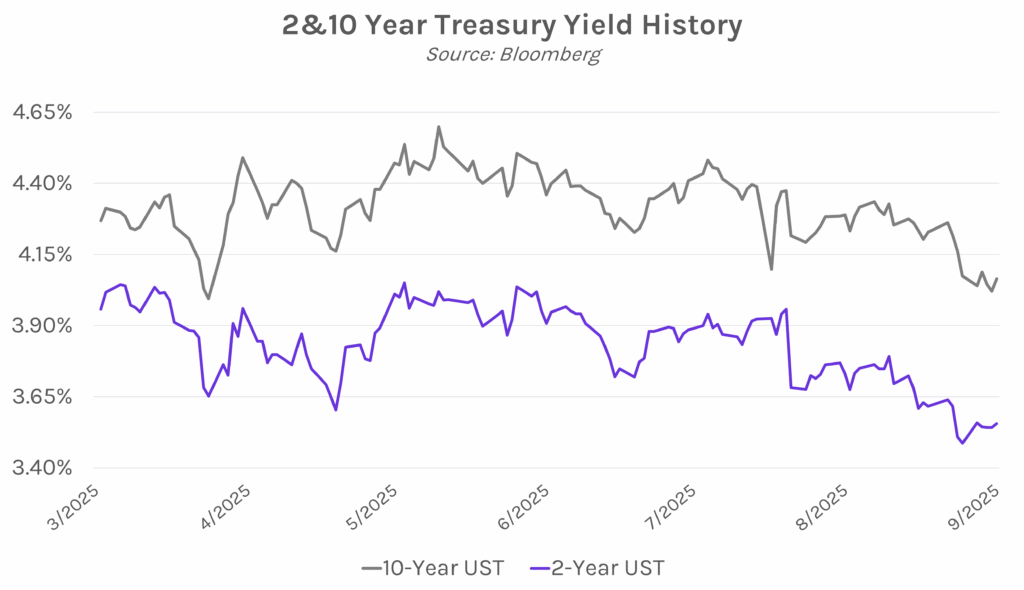

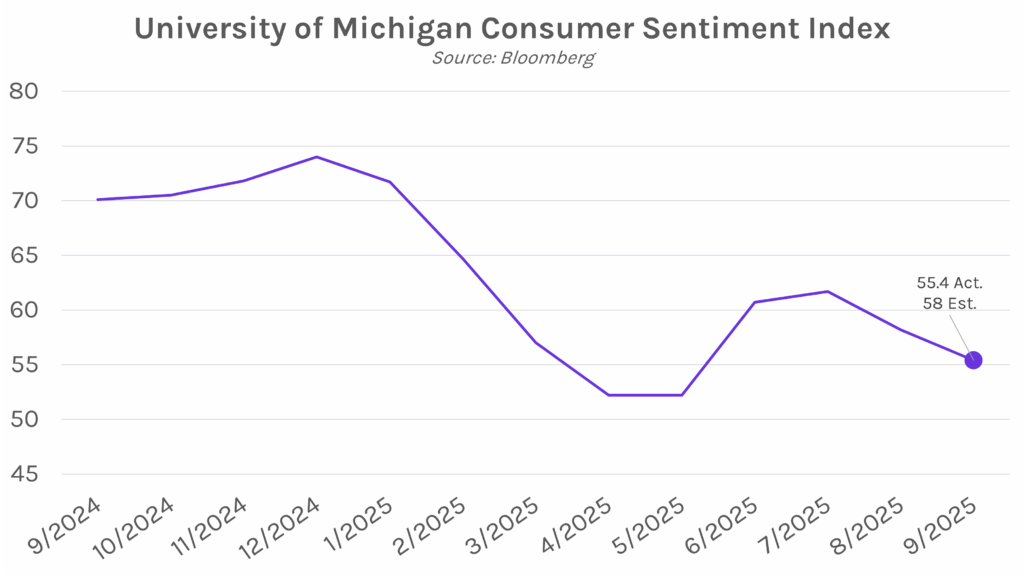

Yields rise on weak consumer sentiment, higher inflation expectations. Rate movement was relatively muted today as yields traded in a 3-5 bp range for the entirety of the session. UST yields gradually crept higher overall, with weaker-than-expected consumer sentiment data combined with increased UMich long-term inflation expectations helping to keep yields elevated. The 2-year yield climbed 1bp today to end 5 bps higher on the week at 3.56%, while the 10-year yield climbed 4 bps today to close 1bp lower on the week at 4.06%. Meanwhile, equities hovered near all-time highs following a busy week of IPOs which raised over $4 billion.

Consumer sentiment hits four-month low. University of Michigan consumer sentiment landed at 55.4 in September, the lowest level since May and below expectations of 58 and the prior month’s 58.2. Long-term inflation expectations rose for the second consecutive month to 3.9%, up from 3.5% in August, while short-term expectations held steady at 4.8% on a one-year outlook. On the whole, the data points to concern about the labor market and rising prices beginning to weigh on consumer outlook. Tariffs also remain top of mind for many, with 60% of survey respondents mentioning the levies without being explicitly asked. After last month’s data illustrated an unprecedented division in outlooks along political-party lines, September saw the gap narrowing, with Republican and Independent outlooks falling to a four-month low, while sentiment among Democrats rose slightly.

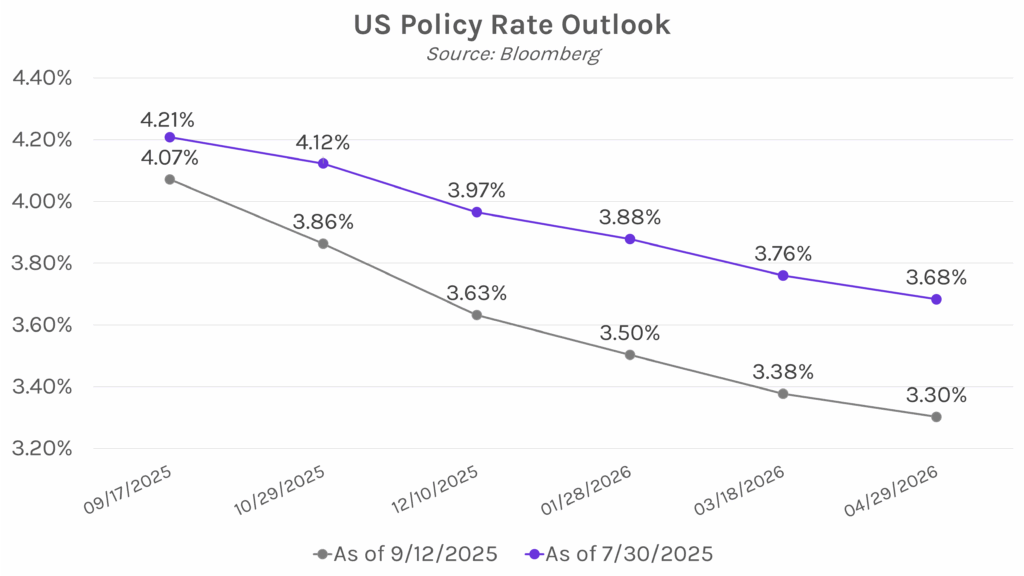

Rate cut fully priced in for next week’s FOMC meeting. The September FOMC meeting kicks off on Tuesday, with futures markets fully pricing in a 25 bp cut. Since the committee last met in July, data has shown signs of a cooling labor market, with two nonfarm payroll misses and the largest ever downward revision to 12-month nonfarm payrolls. On the inflation front, August PPI data came in lower than expected while CPI landed mostly in-line with estimates. As the data has come out in recent weeks, Chair Powell’s tone on the dual mandate has changed, saying “the shifting balance of risks may warrant adjusting our policy stance.” Another focus of next week’s meeting will be the updated dot plot, as the June rendition showed a median expectation of two cuts for the remainder of 2025.