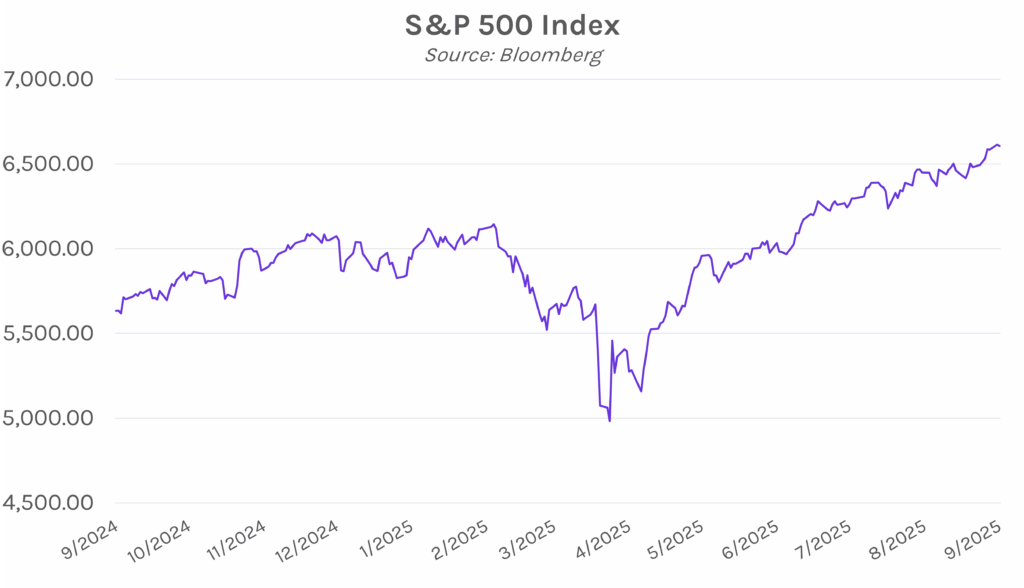

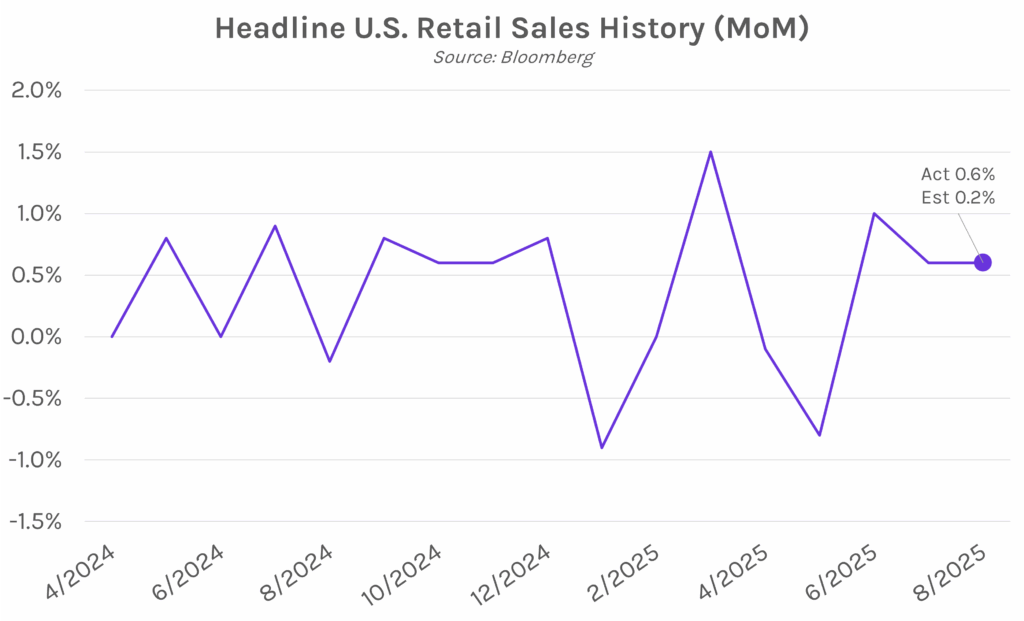

Yields decline as Fed policy outlook overshadows strong retail sales data. A surprise surge in August retail sales fueled a 1-2 bp rise in rates this morning before the move reversed course with markets largely looking ahead to tomorrow’s likely rate cut. Yields quickly fell 4 bps from intraday highs before trading within a tight 3 bp range for the remainder of the session. The 2-year yield ultimately closed 3 bps lower at 3.51% and the 10-year yield 1bp lower at 4.03%. Meanwhile, equities fell slightly but remain near all-time highs, ahead of tomorrow’s FOMC decision.

Retail sales increases for the third consecutive month. US retail sales data released today came in at 0.6%, three times higher than the 0.2% forecast. The strength was further reflected in sales excluding cars (0.7%) and sales excluding cars and gas (0.7%). The growth was driven by online retailers, clothing stores, and sporting goods, potentially reflective of back-to-school seasonality. Overall, retail sales increased in nine of 13 total categories, including motor vehicle sales, which was expected to be a drag on the data. The print reflects resilient consumer behavior despite increased costs from tariffs and a weakening job market. Heather Long, chief economist at Navy Federal Credit Union says, “The big question is how long this can continue if layoffs pick up.”

Appeals court blocks Trump’s removal of Cook. In a 2-1 ruling, a federal appeals court blocked the White House’s second attempt to oust Fed governor Cook, allowing her to remain on the board and participate in the FOMC meeting that started today. The majority decision stated that Cook’s removal “would itself introduce the possibility of ‘the disruptive effect of the repeated removal and reinstatement’ of Cook during this litigation.” In her defense, Cook’s attorneys stated that her firing would call into question the independence of the central bank, with potential to cause significant volatility in the financial markets. Reports say the White House plans to appeal again, which would take the case to the Supreme Court.