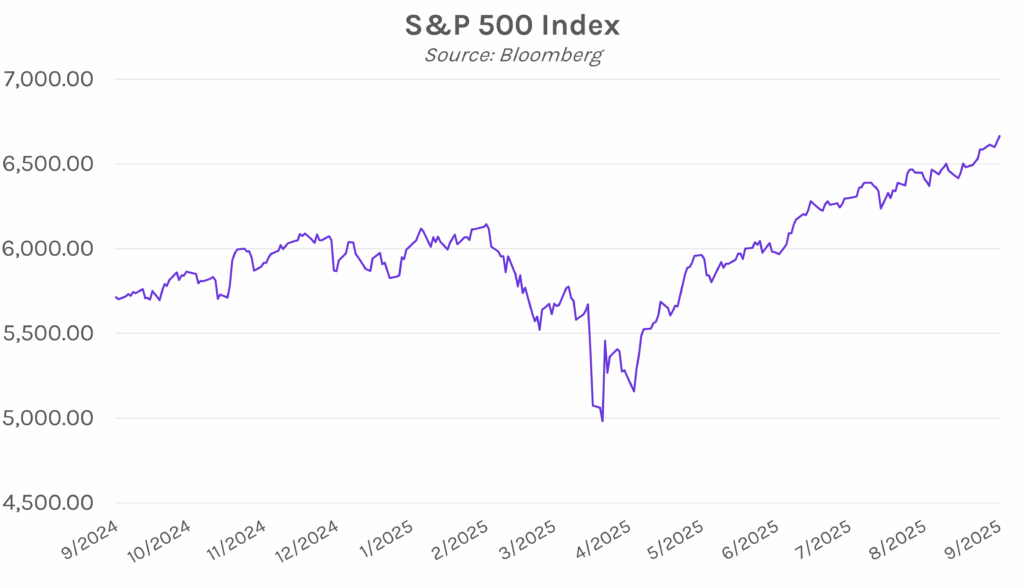

Yields close slightly higher to end FOMC meeting week. UST yields inched higher today as markets continued to digest this week’s FOMC decision and Powell’s hawkish-leaning “meeting by meeting” approach. Rate movement was ultimately muted as yields traded in a tight 3 bp range throughout the session, and the 2-year yield closed 1bp higher at 3.57%, 2 bps higher on the week, while the 10-year yield climbed 2 bps to close 6 bps higher on the week at 4.13%. Meanwhile, the S&P 500 rallied to close at a new all-time high, largely driven by tech stocks, with today being the third-busiest trading day on US exchanges by volume since 2008.

Miran, Kashkari weigh in after the September FOMC meeting. New Fed Governor Stephen Miran said that he did not promise President Trump that he would vote a certain way on policy rates, and that his decision to vote for a 50 bp cut comes as he doesn’t “see any material inflation from tariffs.” Miran was the only FOMC member to vote in favor of a 50 bp rate cut, and had the outlier forecast of 150 bps of cuts for the remainder of the year. Meanwhile, Fed Governor Neel Kashkari published an essay today about his outlook for two more cuts this year, in line with the Fed’s median forecast. Kashkari wrote, “I believe the risk of a sharp increase in unemployment warrants the committee taking some action to support the labor market,” while adding that the Fed should not have a “preset course for a series of rate cuts.”

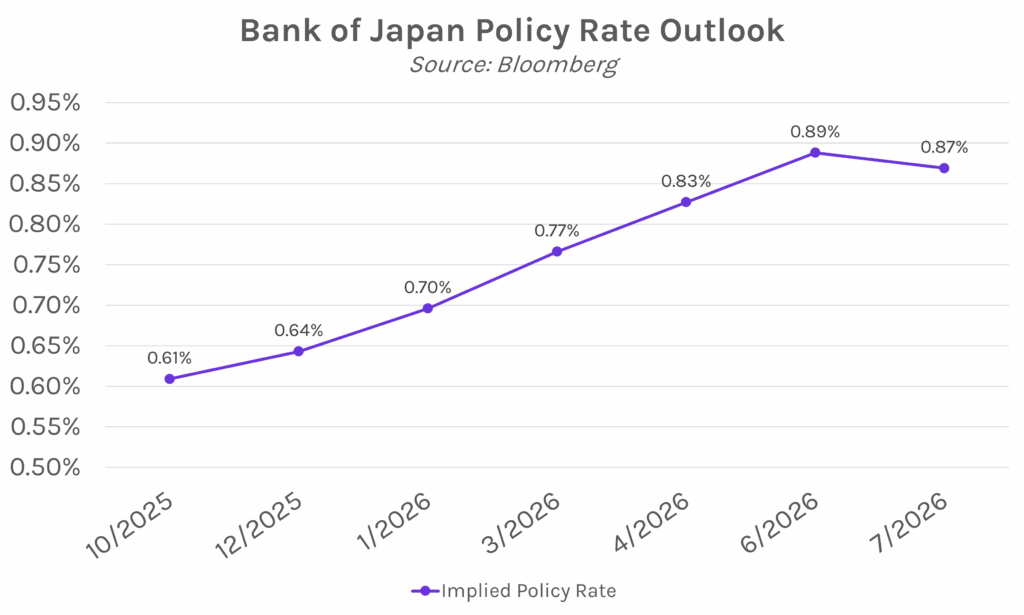

Bank of Japan votes to hold rates. The BOJ voted 7-2 to hold its policy rate at 0.5%, with two dissenters favoring a hike. Despite holding rates, the BOJ continued policy normalization by announcing it will start offloading it’s $508bn ETF holdings within the next 12 months, at a rate of ~$4.2bn per year. The BOJ also kept up to two rate hikes on the table by year end, and markets see a hike as 50% likely next month. Even though the full inflationary impact of U.S. tariffs remains uncertain, per the released policy statement, the BOJ projects inflation will be in-line with target levels during the back half of its 3-year projection period. Governor Ueda said, “We don’t necessarily have to see all of the data through to the end…we probably have no choice but to move based on what we forecast based on data that keep coming in.”