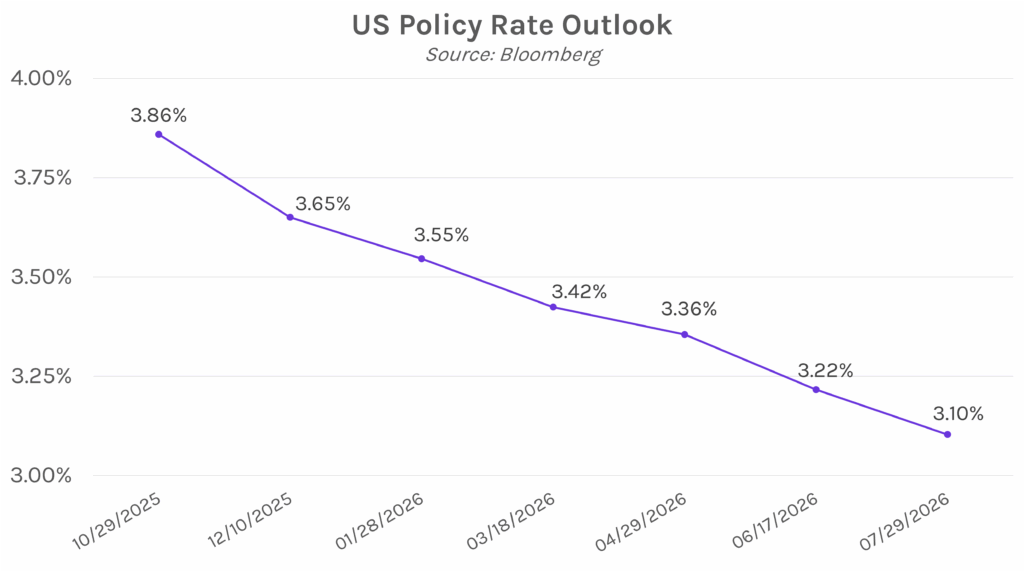

Yields rise on hawkish Fed commentary. Rate movement was limited this morning as markets looked ahead to three Treasury auctions happening later this week and key inflation data on Friday. UST yields broke out of the tight 2-3 bp trading range in the early afternoon when hawkish Fed members began to speak out on their policy rate views for the remainder of the year, leaving markets wary of fully pricing in 50 bps of cuts through the end of the year. 2-year yields closed 3 bps higher on the day at 3.60%, while 10-year yields ended up 2 bps at 4.15%. Meanwhile, equities rose today, with the S&P 500 hitting a new record high once again, led by Nvidia rallying 4% after committing to invest up to $100 billion in OpenAI.

Musalem, Bostic, and Hammack see limited scope for more rate cuts, while Miran supports aggressive easing. Today, Fed Governor Alberto Musalem described his recent vote for a 25 bp cut as a “precautionary move” against the weakening labor market but warned that elevated inflation leaves “limited room for easing further without policy becoming overly accommodative.” Musalem would, however, support additional rate cuts if the labor market deteriorates further. Atlanta Fed President Raphael Bostic also backed last week’s cut but sees little reason for additional easing given persistent inflation. Cleveland Fed President Beth Hammack had a similar focus on inflation, but sees the labor market as “robust,” despite recent disappointing labor data, leading her to cautiously support future rate cuts. By contrast, Fed Governor Stephen Miran, who dissented in favor of a 50 bp cut last week, called current policy rates “restrictive” and that they risk higher unemployment, endorsing 125 bps of cuts by the end of the year.

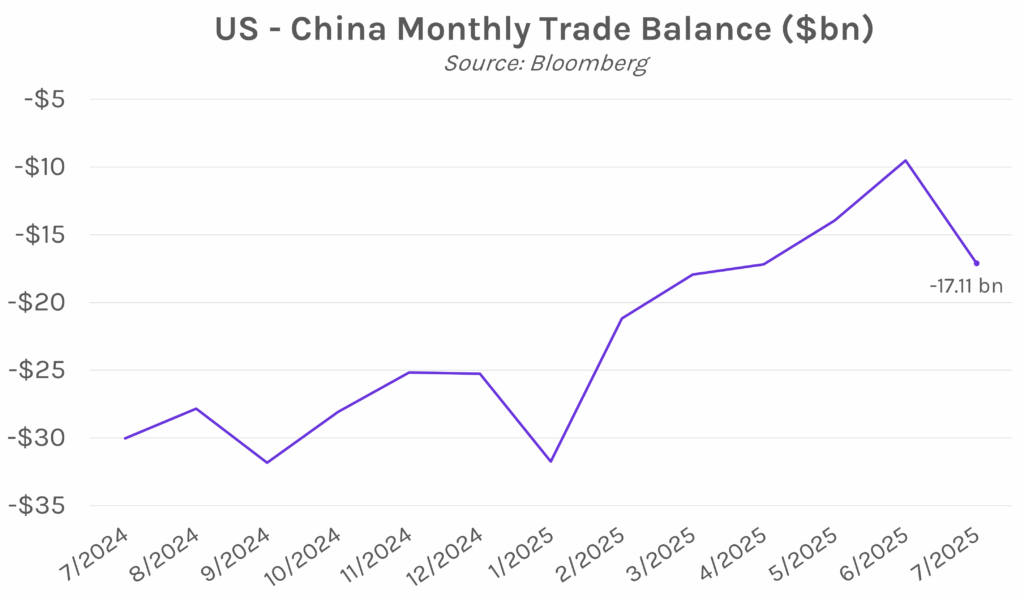

US lawmakers make rare China visit. A bipartisan delegation from the US House of Representatives met with Chinese Vice Premier He Lifeng, the first official visit to China by House members in six years. The parties discussed military defense as well as trade, the latter of which focused on China allowing the flow of critical minerals used in advanced computer chips, while the US continues to push the effort to curb fentanyl trafficking. Representative Adam Smith, the delegation lead, said “We simply want a fair trading relationship and there are a variety of issues on both sides.” The rare visit by US lawmakers could be a sign of thawing relations between the two nations, setting the foundation for possible talks between the countries’ leaders. President Trump and President Xi may meet on the side of the Asia-Pacific Economic Cooperation summit in South Korea at the end of next month, which would come just ahead of the mid-November expiration date of the current US-China tariff truce.