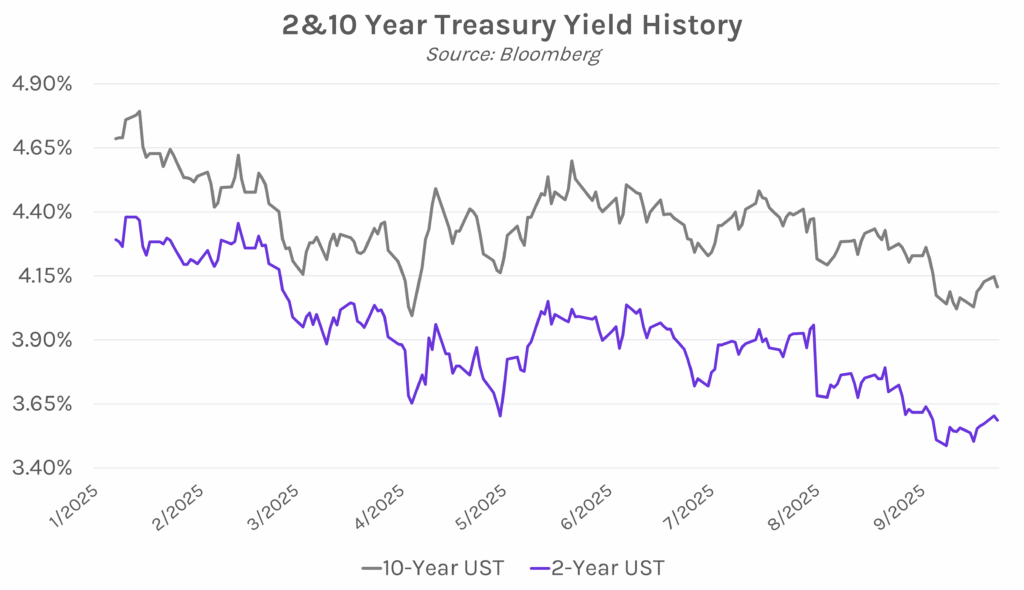

Yields slightly lower as Powell’s rate outlook remains uncertain. Rate volatility was limited again today as UST yields traded in a 1-3 bp range for a bulk of the session. Flash PMI data released this morning came in only slightly lower than expected, barely moving the front-end of the curve while the long-end of the curve rose 2 bps in the aftermath. Meanwhile, Chair Powell spoke in the afternoon but did not make any comments on his policy outlook, and yields fell gradually over the remainder of the session. The 2-year yield ended 2 bps lower at 3.59%, while the 10-year yield fell 4 bps to 4.10%. Meanwhile, equities fell from record levels on a slide in big tech names, with the NASDAQ down 0.95% to 22,573.

Powell says there is no risk-free path. In a speech today, Fed Chair Powell maintained his position that “there is no risk-free path” forward. Keeping largely in-line with his tone at last week’s FOMC press conference, Powell said that “Near-term risks to inflation are tilted to the upside and risks to employment to the downside – a challenging situation.” Powell expressed concern over declining labor supply and demand, while pointing to tariffs as a cause of price increases, though he still believes they will cause a one-time price increase. The Chairman did not give any hints about whether he will support a rate cut next month but did address the recent politicization of the central bank, denying a political agenda and saying the Fed is “looking at what’s the best thing for the people that we serve,” and that accusations to the contrary were “a cheap shot.” An October policy decision remains uncertain as the dot plot shows a board divided, with governors supporting rate cuts of anywhere from 25 to 200 bps by the end of the year.

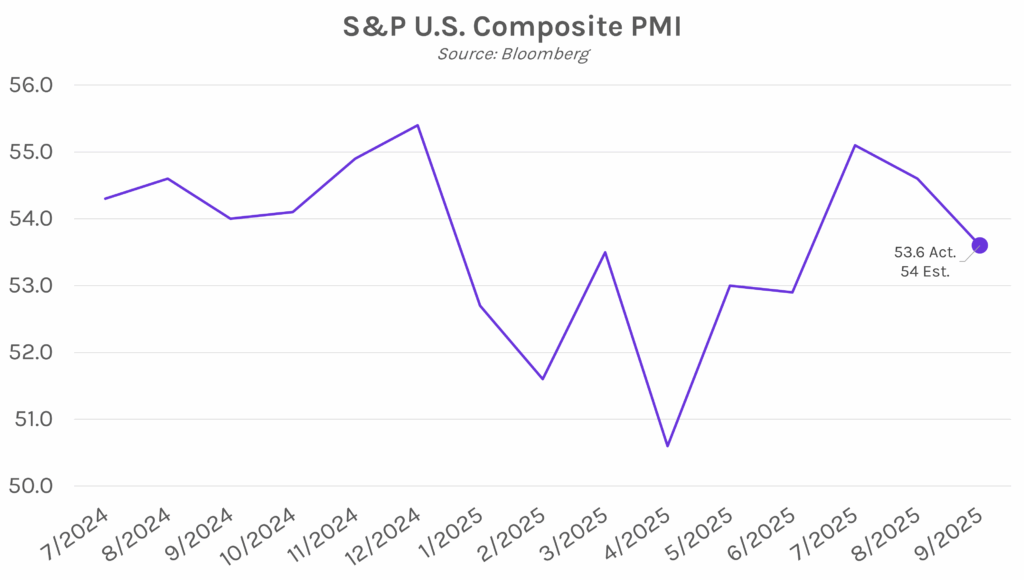

September flash PMI data slows, roughly in line with expectations. Flash composite PMI data released today came in at 53.6, below expectations of 54 and 54.6 the month prior, marking the slowest growth in three months. Manufacturing PMI came in at 52 and services PMI at 53.9, both near estimates of 52.2 and 54, respectively, but noticeably down from August’s numbers. Slowing manufacturing and services sectors are a result of cooling demand, which has left companies unable to increase prices to offset higher tariffs. The data supports this trend, with prices paid hitting a four-month high while prices received recorded its lowest level since April. Additionally, new orders and backlogs data had the slowest growth in three months, emphasizing declining demand.