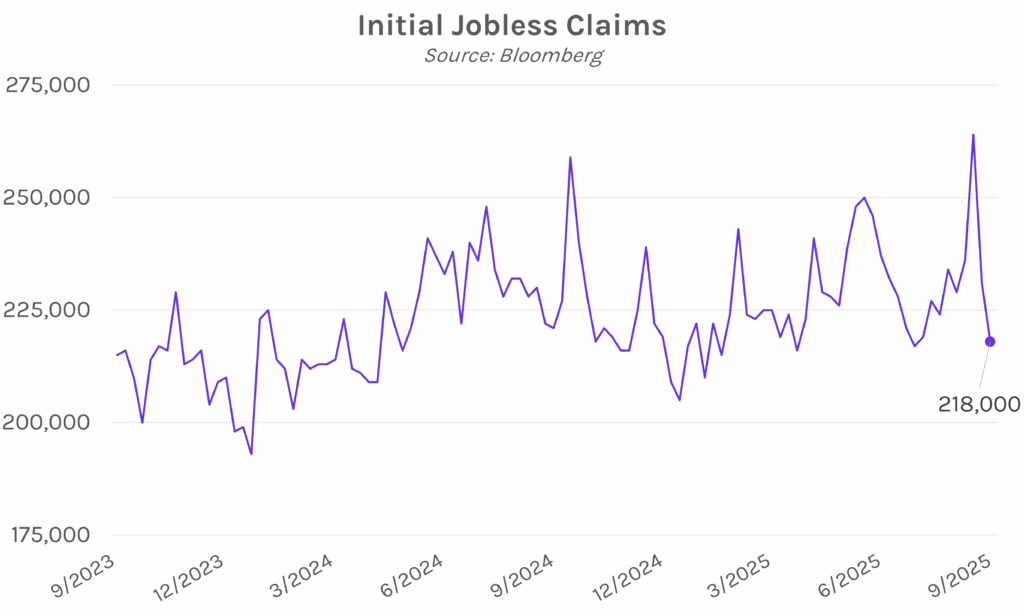

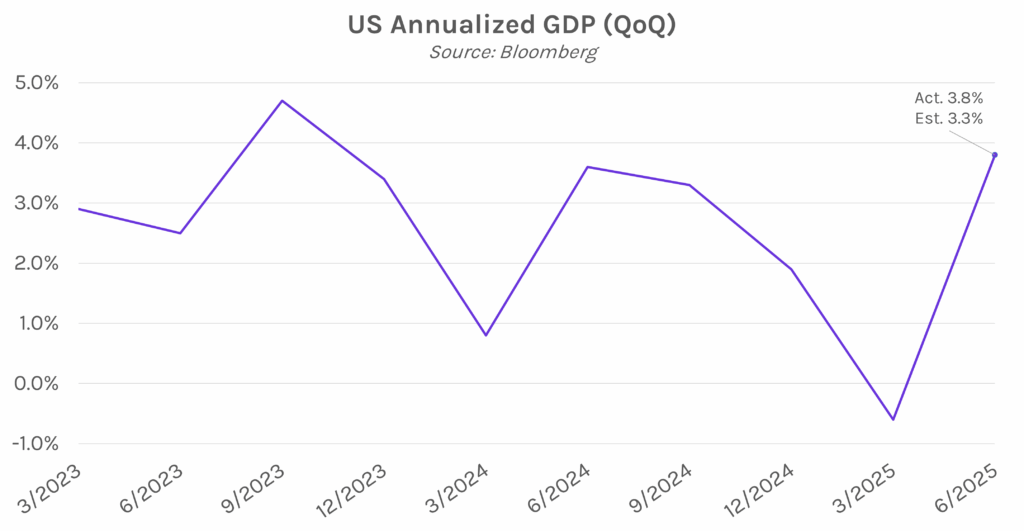

Yields higher after strong U.S. economic data. UST yields climbed 5-6 bps after a slew of data which showed the fastest GDP growth (+3.8%) in two years, the lowest initial jobless claims (218k) since July, and durable goods orders growth (+2.9%) far above expectations (-0.3%). Taken together, the data pointed to a resilient U.S. economy. Markets are now preparing for tomorrow’s key PCE inflation report, which may offer another clue into the Fed’s next policy move. Meanwhile, major equities fell for a third consecutive day as valuation concerns persisted. The S&P 500 and NASDAQ both ended the day 0.50% lower.

US GDP sees fastest growth in almost two years. US GDP grew 3.8% in the second quarter on an annualized basis, above expectations of 3.3% and marking the fastest growth in almost two years. Today’s figure was an upward revision from initial estimates of 3.0% in July and marked a notable rebound after Q1’s 0.5% contraction due to a tariff-related import surge. Digging deeper, the results were largely driven by higher consumer spending and business investment, which were up 2.5% YoY and 7.3% YoY, respectively. Despite recent labor market concerns, the Atlanta Fed expects robust economic output to continue through the third quarter, estimating growth for the period from July to September at 3.3% on an annual basis. The BEA will release initial Q3 GDP estimates on October 30th, the day after the next FOMC meeting.

Fed Governor Miran continues his push for aggressive rate cuts. Today Fed Governor Stephen Miran, who dissented at last week’s FOMC meeting in favor of a 50 bp cut, spoke again about why he favors a series of large cuts to support the economy. Despite believing that the economy and labor market is not about to “fall off a cliff,” Miran voiced his preference to “act proactively and lower rates…ahead of time, rather than wait for some giant catastrophe to occur.” Miran views the current policy rate as highly “restrictive” and believes that by not undertaking large rate cuts in the upcoming months, the Fed risks damaging the economy. Miran’s aggressive view is an outlier among the Fed and in glaring opposition to recent remarks by Fed members Musalem, Bostic, and Hammack, and Powell who have indicated a more cautious, meeting-by-meeting approach to their policy view.