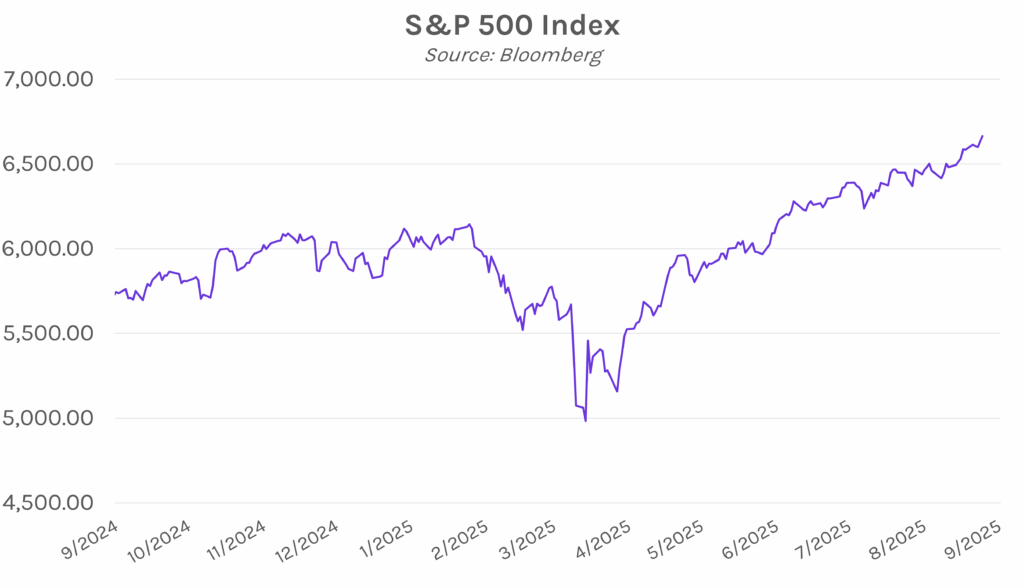

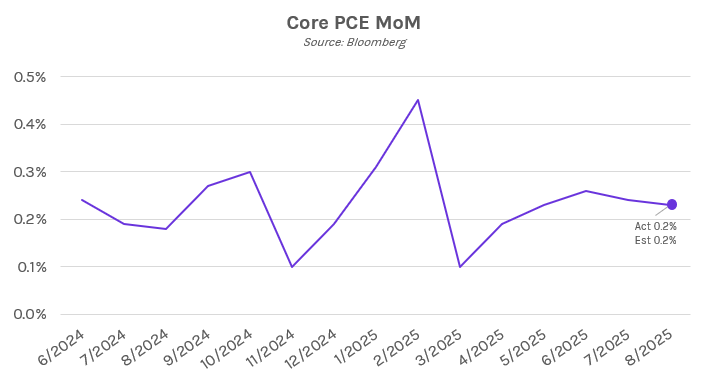

Yields end the day mixed. UST yields were little changed following today’s data releases which included core PCE, the Fed’s preferred inflation gauge, as well as consumer spending data. Core PCE fell in line with expectations and, by avoiding a blowout, kept two more Fed rate cuts on the table through the end of the year. The 2-year yield ended the day ~1bp lower at 3.64%, up 7 bps on the week, and the 10-year yield closed less than 1bp higher at 4.18%, up 5 bps on the week. Meanwhile, the three-day slide in equities ended, with the S&P 500 and NASDAQ climbing 0.59% and 0.44%, respectively.

Personal spending rises for third straight month despite elevated inflation. Inflation-adjusted personal spending rose by 0.4% in August, compared to estimates of 0.2% and 0.3% the prior month. Meanwhile, core PCE rose 0.2% MoM, slightly cooler than July’s 0.3% gain, while the YoY metric held steady at 2.9%, stubbornly above the Fed’s 2% target. Together, the data suggest consumers continue to spend despite higher prices, reinforcing the image of a solid U.S. economy, especially after yesterday’s robust GDP print. Still, many economists caution that this trend may not hold, as further deterioration in the labor market is expected to put downward pressure on household spending. Another concern is the impact of Trump’s tariffs, as firms may begin to pass price increases on to consumers, though for now many are absorbing tariff driven costs.

Fed’s Barkin sees limited risk to unemployment and inflation. Richmond Fed President Tom Barkin said on television today that inflation and unemployment “have ticked in the wrong direction – but on the other hand, the downside is limited.” Barkin agreed that while both sides of the dual mandate have moved away from the Fed’s goals, he thinks it is unlikely either front will deteriorate much further. Barkin has spoken out in support of last week’s rate cut, indicating that he believes the Fed is moving toward a target rate that will balance the need to support the softening labor market alongside persistent inflation, thereby “keeping the economy on path to that more stable horizon.”