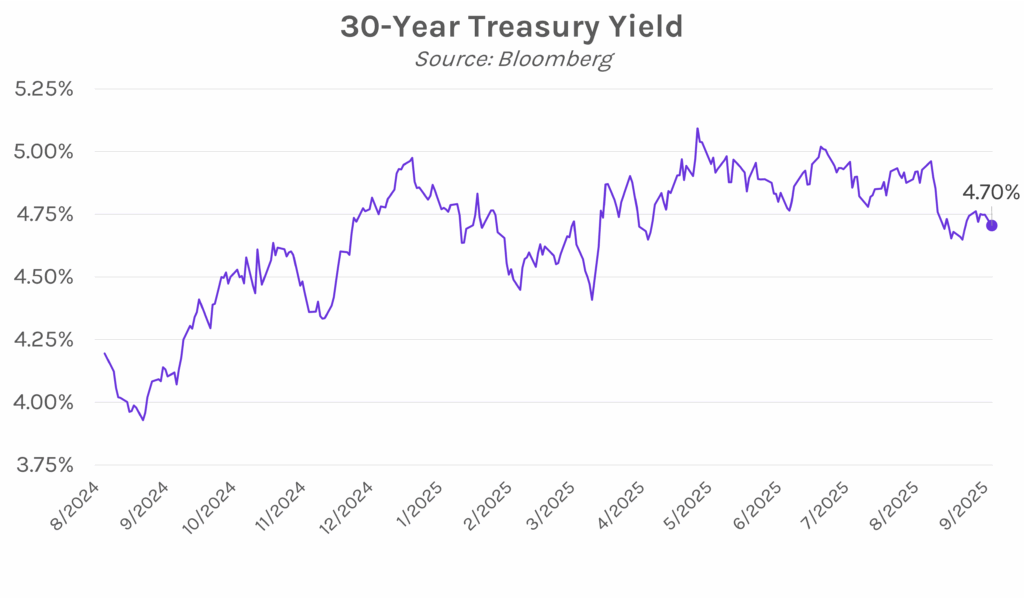

Yields end lower amid worries about a US government shutdown. UST yields were lower across the curve today as concerns increased over a possible government shutdown delaying key nonfarm payrolls and unemployment data to be released on Friday. In the meantime, markets look ahead to tomorrow’s JOLTS job openings data, which is expected to show 7170k jobs added in August versus 7181k in July. The 2-year yield ended 2 bps lower at 3.62%, while the 10-year and 30-year yield fell 4-5 bps to 4.14% and 4.70%, respectively. Meanwhile, equities rose today as Nvidia rebounded 2.07%, helping push the NASDAQ which closed up 0.48%.

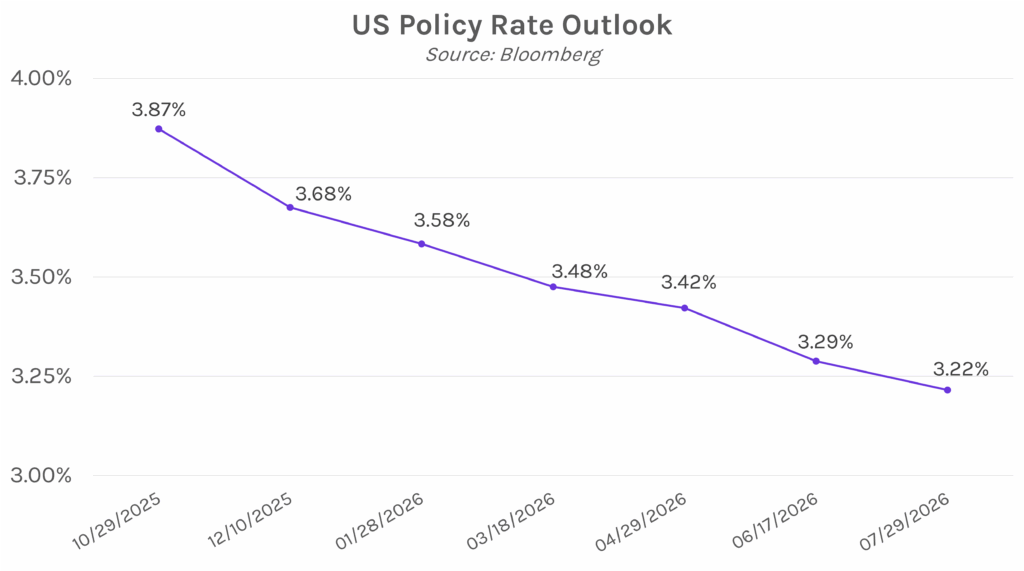

Looming government shutdown would impact the BLS, delay data releases. The US government will shutdown if a new funding bill is not passed tomorrow, the end of the current government fiscal year. One of many implications would be the suspension of data collection and release by the Bureau of Labor Statistics, causing potential delays of upcoming data. Initial jobless claims, expected to come out on Thursday, would be the first prominent release impacted, followed by the monthly jobs report on Friday. Depending on the length of a shutdown, trade balance data (10/7), CPI (10/15), retail sales (10/15) and PPI (10/16) could all be pushed back as well. Delayed government data is likely to have implications on the Fed’s policy decision at next month’s FOMC meeting. Stephen Stanley, chief US economist at Santander US Capital Markets, believes that, without updated figures to paint a full picture of the current economy, a second rate cut could be harder to justify. Other experts point to a shutdown dampening economic activity due to increased uncertainty. The last time a government shutdown delayed BLS data was in 2013, when jobs data and CPI were pushed as a result of the 16 day shutdown.

New York Fed President Williams sees inflation risks fading. In a question-and-answer session today, New York Fed President and FOMC voter John Williams expressed his view that downside employment risks have worsened, while inflation risk is dwindling. Williams acknowledged that tariffs caused a “relatively modest or moderate effect” on import good prices, but that “the tariff effects have been smaller than most people thought, and there doesn’t seem to be any signs of inflationary pressures building.” He also shared that he currently views the policy stance as restrictive, although he did not explicitly indicate whether he would support a rate cut at the October FOMC meeting.