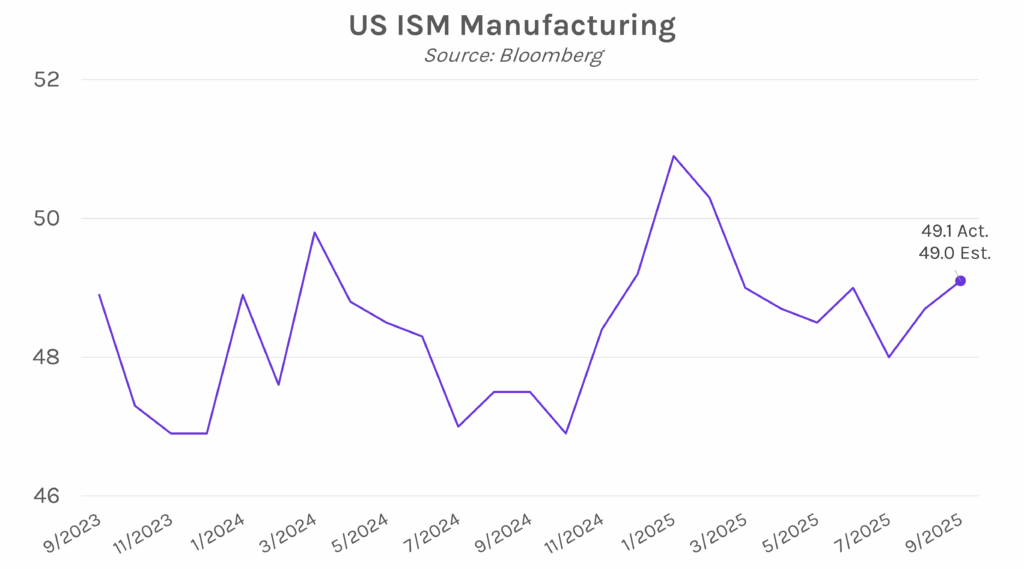

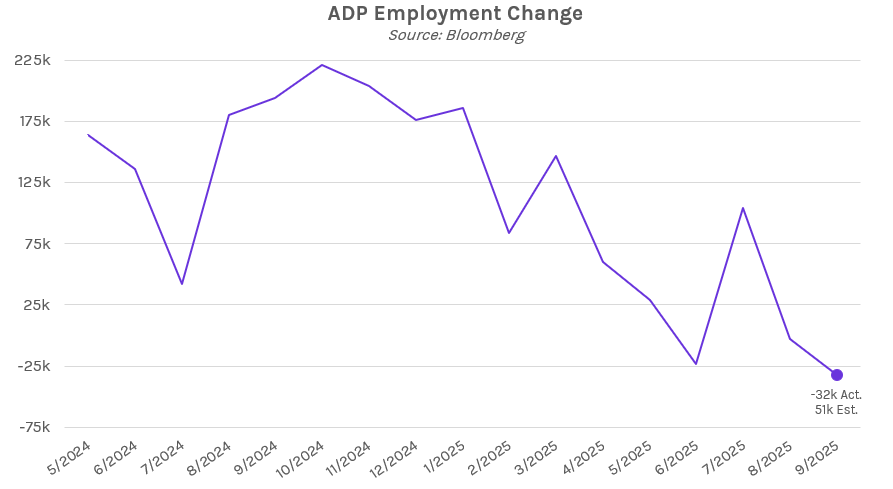

Yields plummet on weak labor data. UST yields fell ~6 bps in the aftermath of ADP employment data that highlighted a sharp decline in private-sector payrolls, increasing the likelihood of a Fed rate cut at the end of this month. ISM manufacturing data was released shortly after and fell in line with expectations (49.1 actual vs. 49.0 estimated), resulting in minimal rate movement. Rates also appeared to be generally unaffected by the US government shutdown today, largely because the shutdown was highly anticipated in days prior. The 2-year yield ultimately closed 7 bps lower at 3.53%, while the 10-year yield fell 5 bps to 4.10%. Meanwhile, equities rose today on strength in healthcare and technology names, with the S&P 500 and NASDAQ up 0.34% and 0.42%, respectively.

Private payrolls revised down by 43k jobs. ADP employment data for the month of September showed that private-sector payrolls decreased by 32k jobs, well below initial estimates of 11k added jobs and down from August, which saw a 3k job decrease. The data highlighted slowing job creation in small and mid-sized firms, while larger companies added employees. It is of note that many economists find ADP’s figures to be less reliable than so-called ‘gold-standard’ US government data. However, today’s ADP data is likely to face greater scrutiny because it remains unclear whether the BLS will release their monthly jobs report on Friday, amid the government shutdown.

Fed Governor Cook to remain on the FOMC board until at least January. The US Supreme Court unanimously denied President Donald Trump’s attempt to immediately remove Fed Governor Lisa Cook from the Fed as her mortgage fraud case continues to play out in court. The order, issued today, means that Cook’s position is secure until at least January, when the justices are set to hear arguments. Following the decision, White House spokesperson Kush Desai released a statement which read, “President Trump lawfully removed Lisa Cook for cause from the Federal Reserve Board of Governors. We look forward to ultimate victory after presenting our oral arguments before the Supreme Court in January.”