September and Early October 2025 Highlights

3 Things to Know:

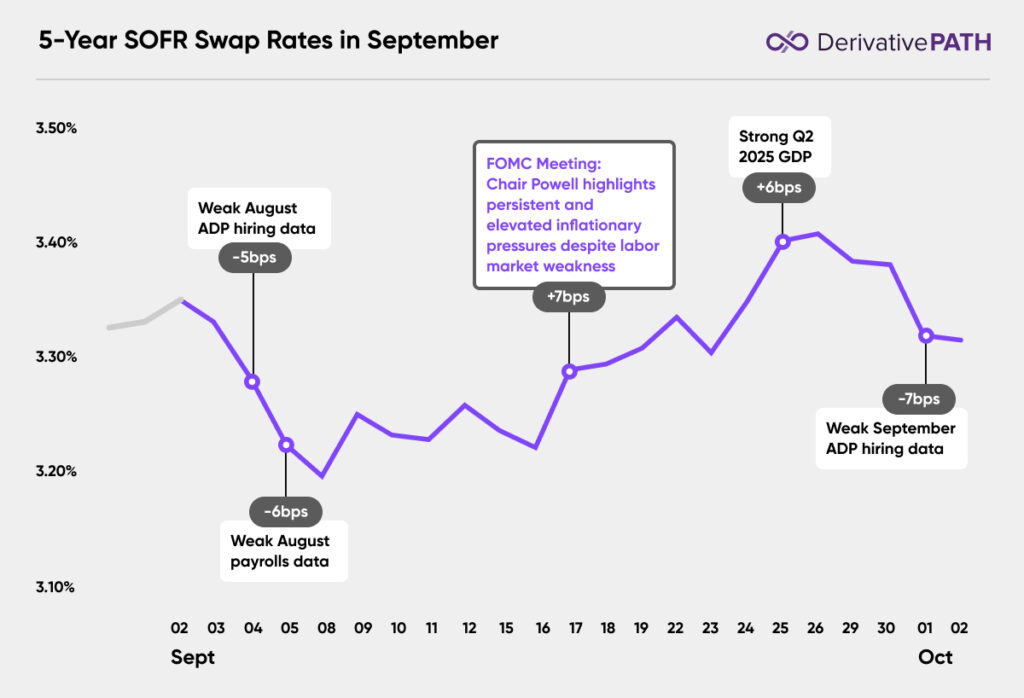

- Weak labor data sends rates to new lows. Rates fell ~15 basis points to set new year-to-date lows during the first week of September after weak labor data. Government labor data wasn’t released in October due to the ongoing shutdown, but rates fell ~7 basis points to start the month after disappointing private-sector labor releases.

- Powell concerned about inflation. As expected, the Fed delivered a 25 basis point rate cut in September. Longer-term rates rose, however, after Chair Powell struck an unexpectedly hawkish tone due to persistent and elevated inflationary pressures.

- U.S. economy grows.Gross Domestic Product grew by 3.8% in the second quarter of 2025, the fastest in 2-years, powered by higher consumer spending and business investment. The strong results drove rates ~6 basis points higher the day of the release despite a weakening labor market.

Explore More:

- August ADP Data (-5 bps)

- August Payrolls Data (-6 bps)

- September FOMC Meeting (+7 bps)

- Second Quarter 2025 GDP (+6 bps)

- September ADP Data (-7 bps)

Contact us:

415-992-8200

[email protected]