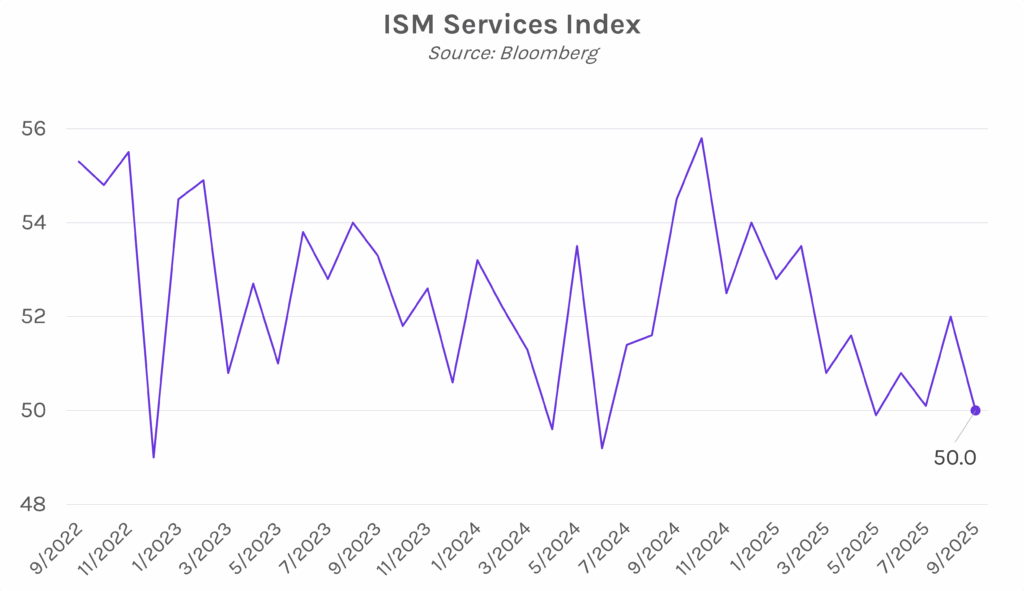

Yields climb higher as US government shutdown continues. Rate market volatility remained muted today as the government shutdown forced payrolls data to be postponed. However, ISM services data came in below estimates, highlighting a slowdown in the services industries, while prices remained elevated. Higher prices likely contributed to today’s climb in yields, where the 2-year yield and 10-year yield closed 4 bps higher, at 3.58% (down 6 bps on the week) and 4.12% (down 5 bps this week), respectively. Meanwhile, equities were somewhat mixed today, with the S&P 500 barely closing higher, up 0.01%, and the NASDAQ down 0.28%, as concerns over a prolonged government shutdown overshadowed the AI optimism from yesterday.

Disappointing ISM services data signals a stagnating economy in September. The ISM services index for September registered at precisely 50, indicating neither growth nor contraction, but falling below expectations of 51.7 and last month’s 52. Simultaneously, the business activity index fell five points to 49.9, its first contractionary reading since May 2020, while new orders fell slightly more than five points to 50.4. According to Steve Miller, chair of the ISM Services Business Survey Committee, “commentary in general indicated moderate or weak growth,” in economic activity. Ten services industries reported growth, with accommodation and food services and healthcare leading the way, while seven sectors contracted. Meanwhile, services employment data declined for the fourth consecutive month, and prices paid surged to one of the highest levels in the last three years.

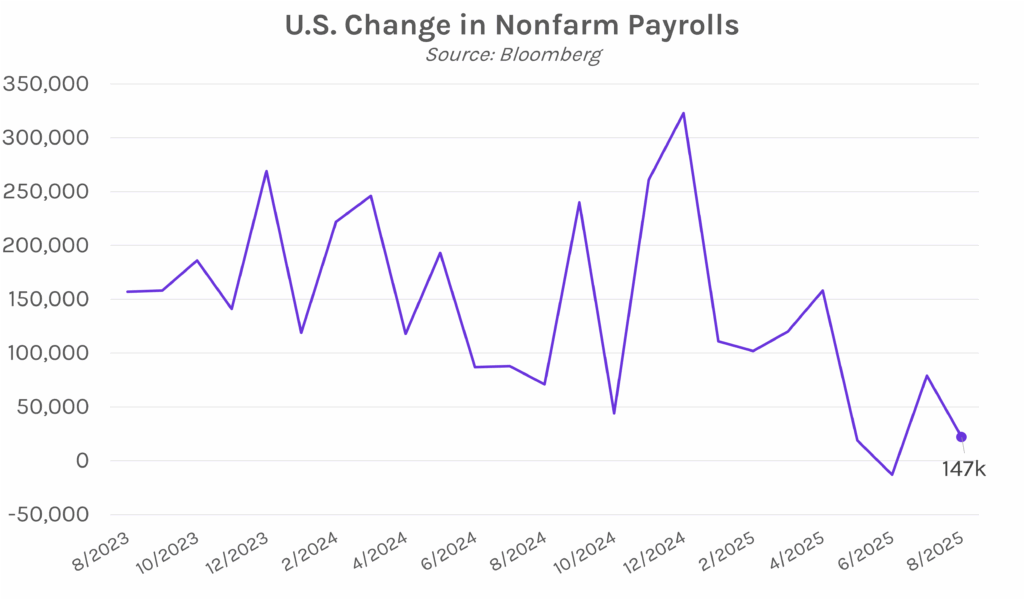

Potential costs of government shutdown come into focus. As the ongoing government shutdown nears the end of its third day, top of mind is the potential economic impact. In the short term, the Congressional Budget Office estimates it will cost the federal government $400 million a day in pay to furloughed employees. That amount could be reduced if the White House follows through on their threat to fire federal employees, though by comparison, the 2013 shutdown saw government employees receive ~$2.5 billion for the 16-day closure. However, in the long run, experts believe the overall economic impact will be temporary and minimal. Also uncertain is what effect the shutdown will have on Fed policy, with Richmond Fed President Barkin saying, “With all this change, a dense fog has fallen…a ‘zero visibility, pull over and turn no your hazards’ type of fog.” Most do not expect any impact on interest rate decisions at the end of the month.