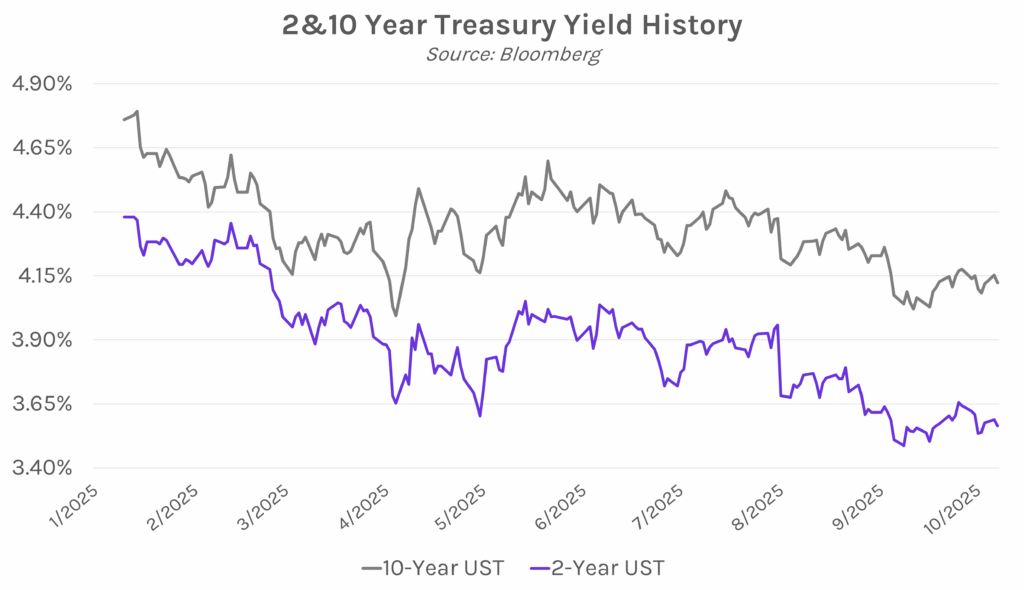

Yields fall slightly despite ongoing government shutdown, increased inflation expectations. UST yields edged lower throughout the session despite higher than expected NY Fed 1-year inflation expectations data, which rose to 3.38%, the highest in five months. Strong demand at a $58B 3-year treasury auction largely overshadowed the inflation data and fueled a 1-4 bp decline across the yield curve. The 3-year yield closed at 3.58% after a 3 bp decline while the 30-year yield dropped 2 bps to 4.72%. Meanwhile, equities fell today on concerns over AI valuations, with the S&P 500 and NASDAQ closing 0.38% and 0.67% lower, respectively.

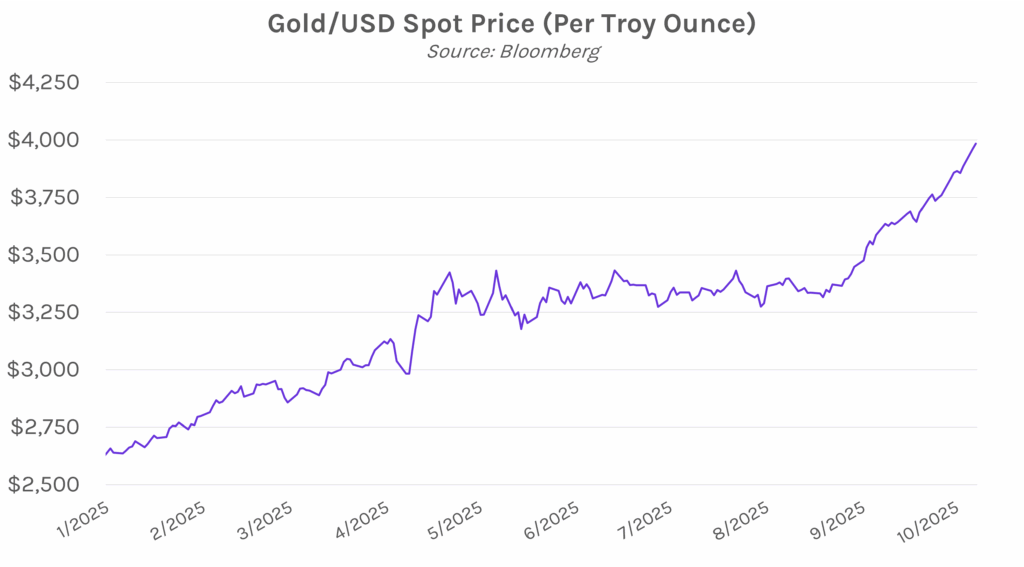

Gold hits record levels, hinting at underlying market anxiety about US sovereign risk. Spot gold hit a record high of ~$3,991 per ounce while December gold futures passed $4,000 for the first time ever, reflecting increased market demand for safe haven assets. Ken Griffin, the founder of Citadel, said this rush to gold is “really concerning,” as “people are looking for ways to effectively de-dollarize.” Ray Dalio, the founder of Bridgewater Associates, echoed Griffin’s view, saying that gold is “certainly” safer than the dollar, especially at times of rising government budget concerns and geopolitical tensions. US outstanding debt is now ~$37T, and the staggering debt load fueled a sell-off at the long-end of the curve earlier this year. Gold isn’t the only non-dollar asset individuals are turning to, as Bitcoin hit an all-time high price of $126,210.50 yesterday.

Miran still sees overly restrictive policy as Kashkari worries about stagflation. Fed Governor Stephen Miran spoke today, reiterating his belief that current Fed policy is too restrictive. Speaking about the Fed and his colleagues, Miran said that he “view[s] the mandates as less in tension than some others do,” and cited muted tariff-driven inflation and slower population growth as reasons to cut rates. Minnesota Fed President Neel Kashkari also spoke today, though largely in opposition to his colleague, he believes that “some of the data that we’re looking at is sending some stagflationary signals.” Others aligned with Kashkari point to inflation remaining stubbornly above the Fed’s 2% goal and expect that the full impact of the Trump Administration’s tariffs is yet to come. As such, many want to guard against potential future inflation risk, a sentiment Kashkari shared today expressing worry that severe rate cuts will only further stoke inflation.