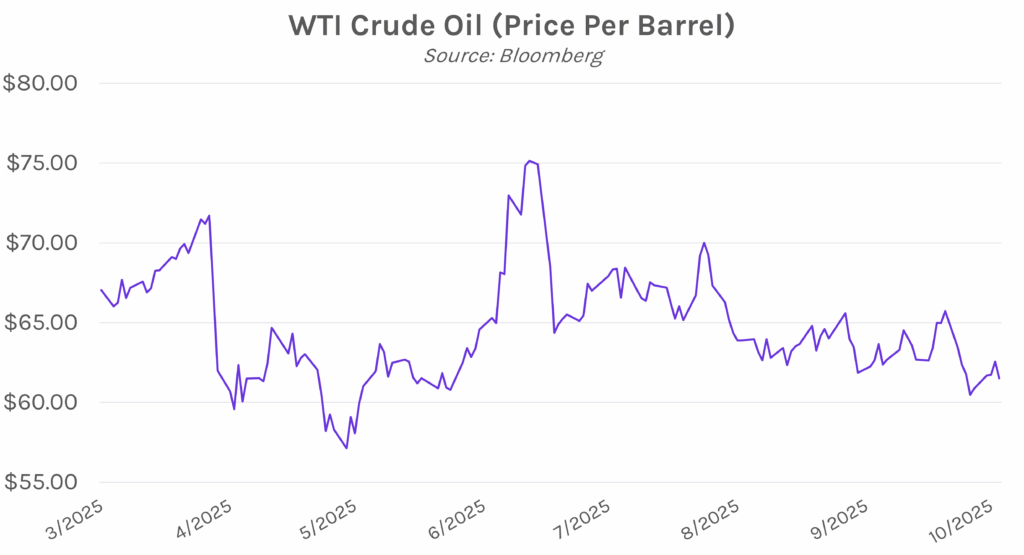

Yields inch slightly higher in the absence of data. UST yields traded in a tight 2 bp range for the majority of the session, as jobless claims and trade data were postponed today by the government shutdown. In the afternoon, the $22B 30-year auction saw weak demand, which further supported the slightly elevated levels. The 2-year yield ended 1bp higher at 3.59%, and the 10-year yield 2 bps higher at 4.14%. Meanwhile, oil fell today, with the price per barrel falling as much as 2.1% after the Hamas negotiation chief announced a peace deal with Israel.

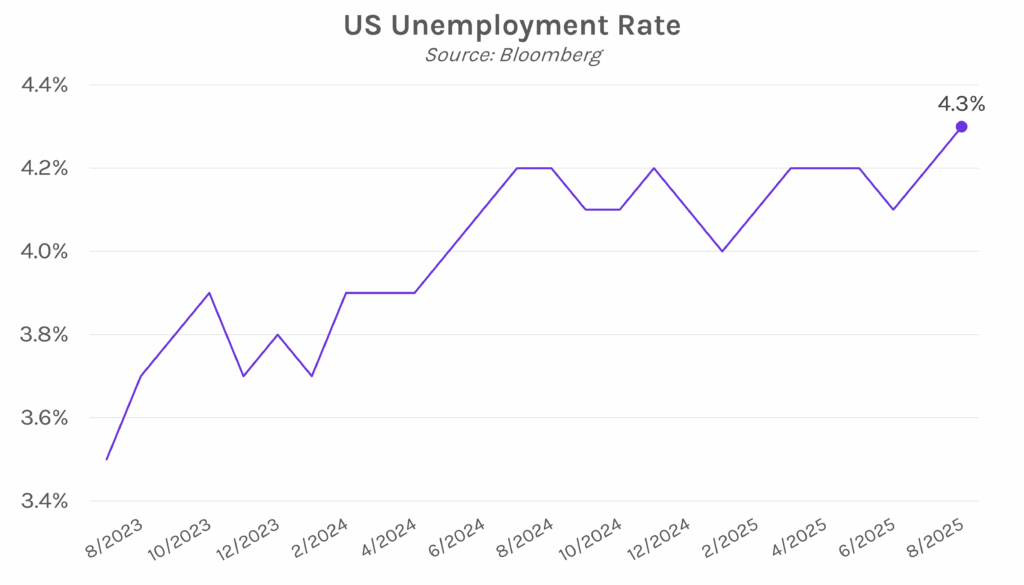

NY Fed President John Williams backs more rate cuts, while Fed Governor Barr is more cautious. FOMC voter John Williams argued that the Fed should continue with rate cuts this year if unemployment rises past its current 4.3% level, even if inflation continues to rise in the short-term. He elaborated that “there’s more downside risks to the labor market and employment, and that is something that takes some of the upside risk off of inflation.” However, Fed Governor Michael Barr has a more cautious view, with a greater focus on tariff-driven inflation, noting that “while, in principle, tariffs are a one-time increase in prices and should not sustainably raise inflation, that may not be the case if prices keep rising month after month and affect expectations.” Both FOMC voters emphasized that they will be taking a data-driven approach as they head into the policy meeting at the end of this month, on par with Chair Powell’s tone following the September FOMC meeting.

China announces new controls on rare earth exports. Today, China announced they will be imposing export controls on an additional five rare earth exports, as well as on certain related equipment and technologies used for mineral processing. China accounts for 70% of the global rare earth supply, and specific lithium-ion batteries, as well as synthetic diamonds, are among the goods impacted by the changes going into effect November 8th. Also today, China declared ‘case-by-case’ reviews on some minerals used in AI chips, a targeted retaliation to the US curbing exports of high-tech chips, despite the US having already reversed the policy. The move comes after the nation also stopped purchasing US soybeans. Today’s rare earths announcement was seen as provocative, especially towards the United States, and is a sign China is gathering as much negotiating power as possible ahead of the Trump-Xi meeting in South Korea at the end of the month, where the two leaders are set to continue trade talks.