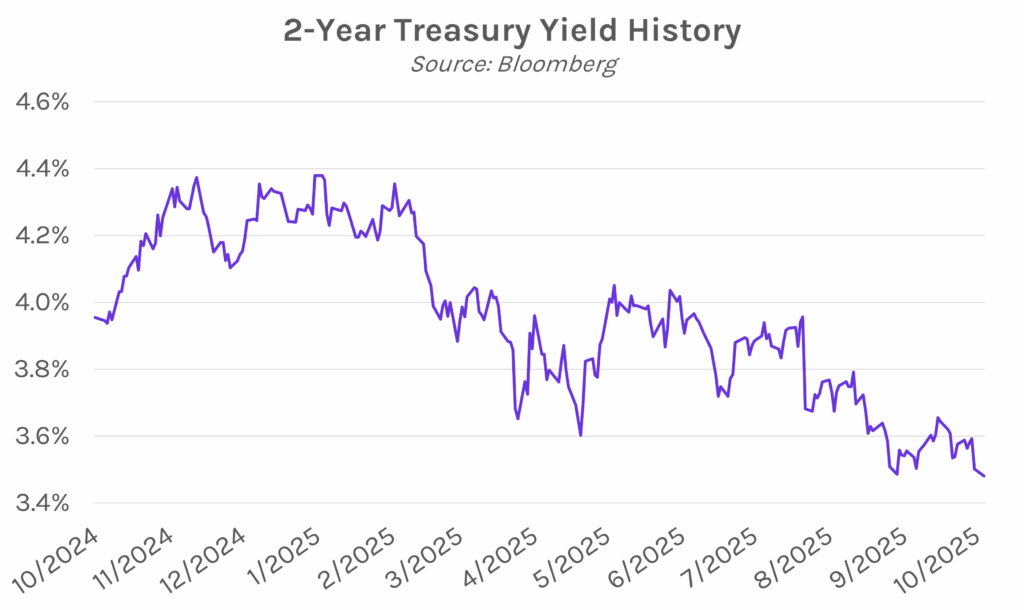

Yields decline again as US–China tensions continue. After yields plummeted 6-11 bps on Friday, volatility was relatively muted this morning after President Trump softened his tone toward China over the weekend. However, yields declined 3-4 bps in the afternoon as tensions re-kindled, with Trump calling China’s boycott of US soybeans an “economically hostile act.” The 2-year yield closed near its lowest level since 2022 at 3.48%, and the 10-year yield closed nearly flat at 4.03%. Meanwhile, equities sold-off despite a brief rebound earlier in the day, with the S&P 500 and NASDAQ closing 0.16% and 0.76% lower, respectively.

US, China remain open to trade talks amid ongoing tension. China announced additional export controls on rare earth minerals last week, which in response led President Trump to threaten a 100% tariff on Chinese goods and to potentially cancel a planned meeting with President Xi later this month. It now seems that the two still plan to meet and, separately, Vice Finance Minister Liao Min, a key Chinese trade negotiator, is reportedly speaking with his US Treasury counterpart in the coming days. The news comes as the Chinese Ministry of Commerce has stated “the door is open” for continued talks, rebuffing a claim made by US Treasury Secretary Scott Bessent that China hadn’t responded to US inquiries. Despite this, the tit-for-tat situation further escalated today as China targeted US subsidiaries of the South Korean shipbuilder Hanwha Ocean. China will now collect fees on American-built ships, a policy that went into effect on today, the same day the US imposed new charges on Chinese ships at US ports.

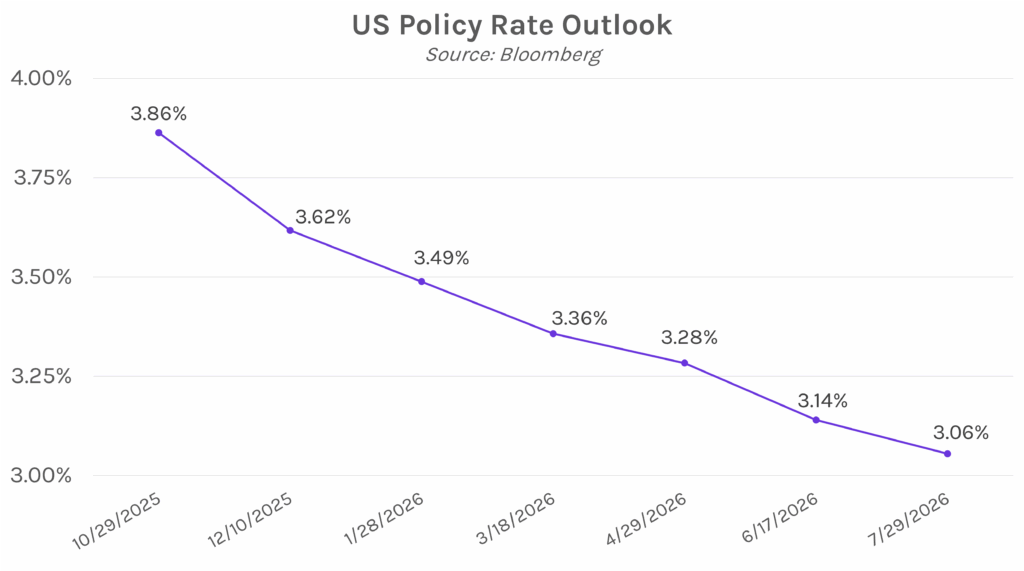

Powell, Collins acknowledge continued labor market weakness. Today, Fed Chair Jerome Powell expressed that his focus remains more on the labor market than inflation, stating, “The labor market has demonstrated pretty significant downside risks” as, “available evidence suggests that both layoffs and hiring remain low, and that both households’ perceptions of job availability and firms’ perceptions of hiring difficulty continue their downward trajectories.” Boston Fed President Susan Collins echoed Powell’s concern, saying, “With inflation risks somewhat more contained, but greater downside risks to employment, it seems prudent to normalize policy a bit further this year to support the labor market.” Collins sees two additional rate cuts this year, on par with the median expectation released in the September Dot Plot.