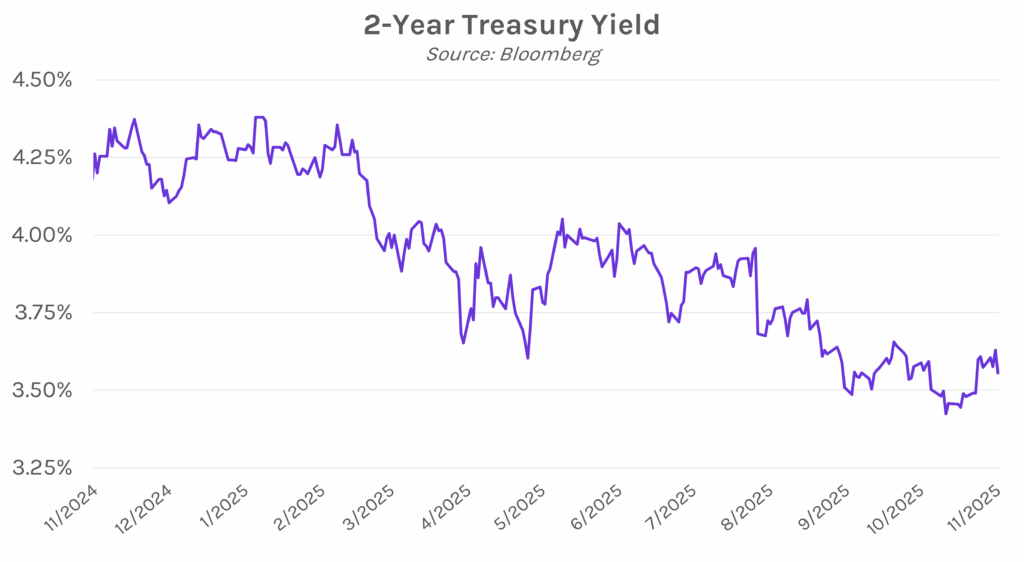

Yields plummet on weak labor market data. Treasury yields declined ~7 bps in the aftermath of today’s labor print, which showed the highest October job cuts since 2003. Yields traded in a tight 2 bp range for the remainder of the session and closed 6-8 bps lower, with the 2-year yield at 3.56% and the 10-year yield at 4.08%. The move offset yesterday’s 5-7 bp climb, which was fueled by strong services sector activity. Meanwhile, equities sold off as the cool labor market data fueled a flight to quality, with the S&P 500 and NASDAQ ending 1.12% and 1.90% lower, respectively.

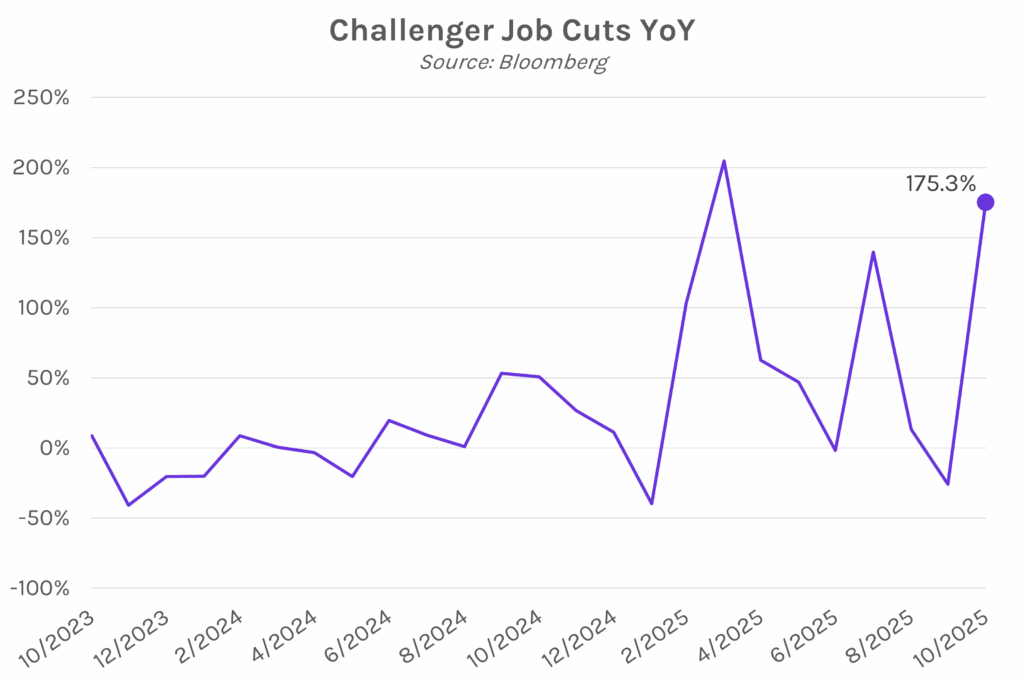

Challenger job cuts data shows 153k layoffs in October. Outplacement firm Challenger released data today reporting 153,074 layoffs in October. This marks an 175.3% increase in job cuts on an annual basis, well above the 25.8% annualized decline in layoffs seen in September. Technology and warehousing industries led the firings, and Challenger cited declining consumer and corporate spending, rising costs, and AI adoption as leading causes of hiring freezes and firings. This level of layoffs is the most since 2003, when a surge in cell phone adoption contributed to elevated layoffs. Year to date, Challenger data has reported over 1 million job cuts, which they attribute to firms looking to protect their margins from tariff costs and correcting lingering Covid-era hiring bloat. Today’s print is at odds with Fed Chair Jerome Powell’s recent characterization of the labor market, which he described as experiencing “very gradual cooling.” Further, the employment outlook remains uncertain because, though year-end typically sees hiring growth, Challenger says they “do not expect a strong season hiring environment in 2025.”

Fed’s Goolsbee & Hammack hesitant to cut rates further while Williams is more open. Chicago Fed President Austan Goolsbee said today that he is uneasy about further interest rate cuts amid a lack of inflation data due to the current government shutdown. He explained, “If there are problems developing on the inflation side, it’s going to be a fair amount of time before we see that.” Cleveland Fed President Beth Hammack echoed Goolsbee’s worries, saying “I remain concerned about high inflation and believe policy should be leaning against it.” Meanwhile, New York Fed President John Williams argued that market estimates of the neutral rate are too high, and that the Fed may still have room to lower rates while keeping policy restrictive.