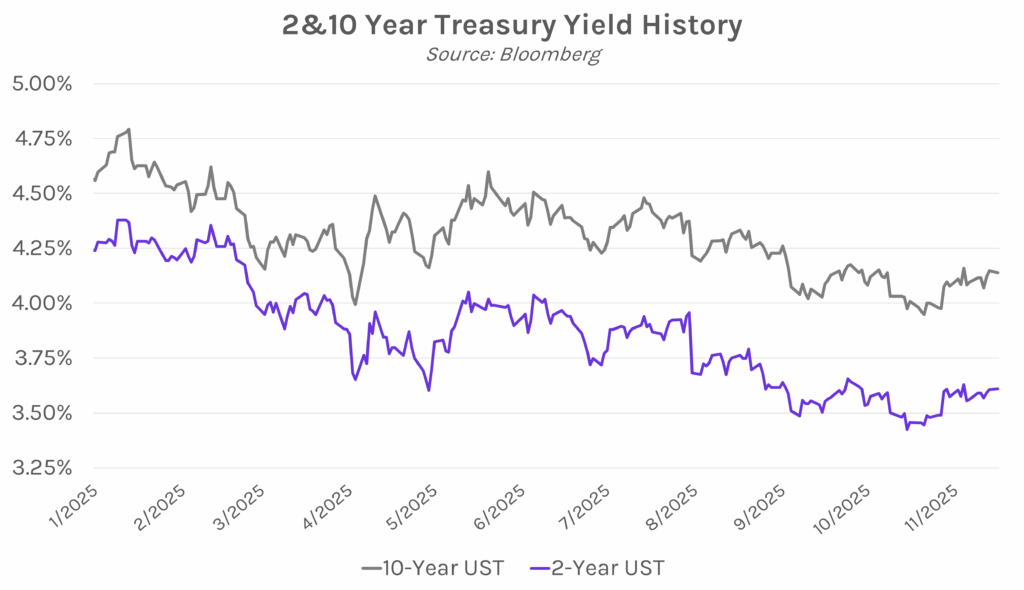

Markets risk-off ahead of Nvidia earnings, labor data. Treasury yields declined overnight before rising ~2 bps from intraday lows following Amazon’s announcement of a $15bn debt deal to fuel its AI spending. Yields then drifted lower again as markets grew cautious ahead of the upcoming Nvidia earnings report and September labor data, where the latter is expected to show 50k jobs added in September versus only 22k jobs added in August. The 2-year yield closed nearly flat at 3.61% and the 10-year yield closed 1bp lower at 4.14%. Meanwhile, riskier assets slid, with the S&P 500 down 0.92% and Bitcoin falling below $91,500.

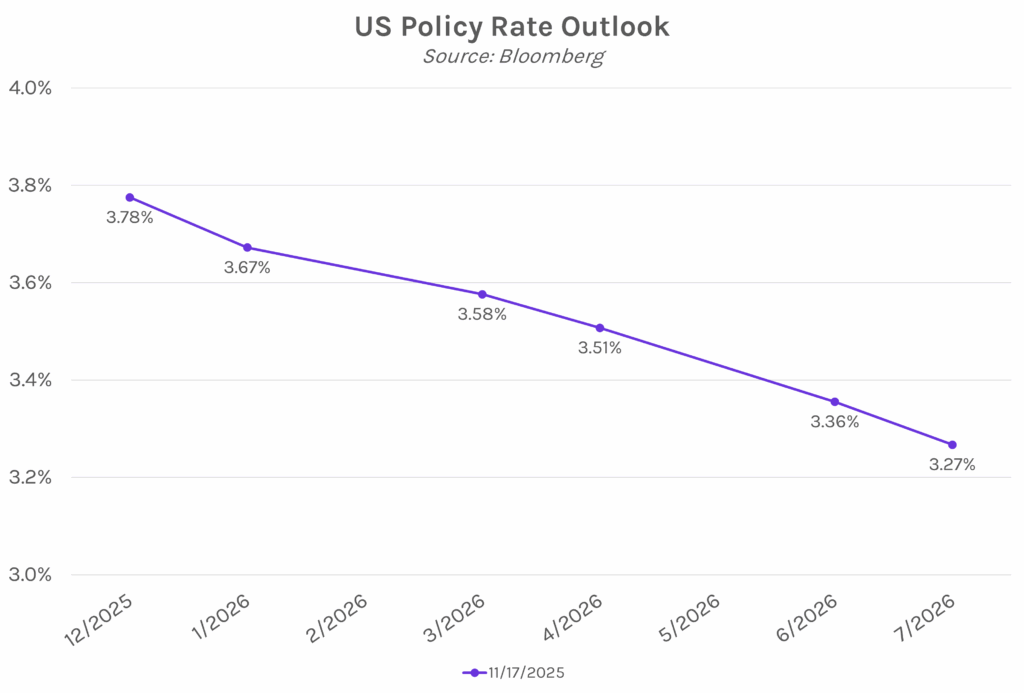

Waller confident in another cut as Jefferson hesitant. Fed Governor Christopher Waller spoke in London today, reiterating his belief that the Fed should lower rates by a quarter point in December, citing good “risk management”. Waller believes the labor market is weak and that current monetary policy is hurting low- and middle-income consumers. He also suggested that the AI boom in the stock market has not yet translated to job creation. Waller said that his “focus is on the labor market, and after months of weakening, it is unlikely that…data in the next few weeks would change my view that another rate cut is in order.” Fed Vice Chair Philip Jefferson also shared his view today that labor market risks are skewed to the downside, though he stopped short of saying he’d vote to cut rates next month. The Fed’s policy outlook remains notably uncertain, with Waller saying today that the next committee meeting might feature “the least group-think you’ve seen from the FOMC in a long time.”

Fed Governor Cook refutes mortgage fraud claims. Fed Governor Lisa Cook’s attorney, Abbe Lowell, sent a letter to Attorney General Pam Bondi and senior DOJ official Ed Martin today, disputing the mortgage fraud allegations raised by other US officials. Lowell argued that “The full record makes clear that what he claims to be contradictions in loan applications were not contradictions at all, but were cherry-picked, incomplete snippets of the full documents submitted at the time and in subsequent filings…” The Supreme Court is set to hear arguments on January 21, following their September ruling to temporarily prevent Trump from firing Cook over the allegations until the justices hear the case’s arguments. If Cook is ultimately removed from the Fed, Trump will have the chance to appoint a more dovish governor in her place.