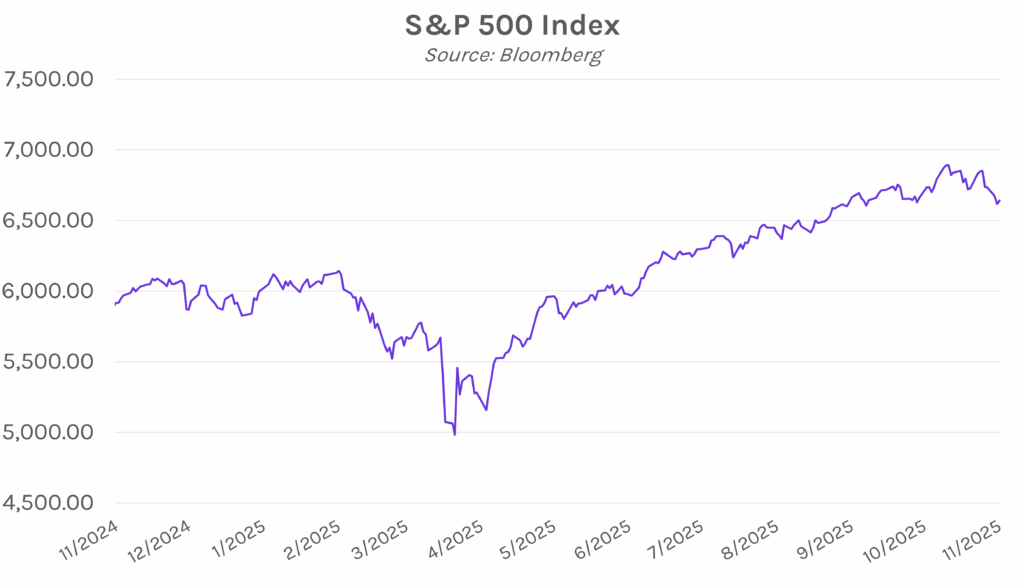

Yields rise on hawkish FOMC minutes. Treasury yields traded higher today as Fed meeting minutes revealed that many officials saw it appropriate to hold rates steady for the remainder of the year. The Bureau of Labor Statistics also announced that it will not be publishing October’s unemployment rate. Markets are now looking ahead to tomorrow’s September labor data, where nonfarm payrolls are expected to show 54k jobs added compared to 22k in August. Yields closed the day 2-3 bps higher across the curve, with the 2-year at 3.59% and the 10-year at 4.14%. Meanwhile, equities rose ahead of Nvidia’s after-market earnings today, with momentum expected to continue tomorrow after Nvidia posted strong results, with the S&P 500 and NASDAQ up 0.38% and 0.59%, respectively.

Fed minutes highlight a divided path forward. Minutes from the October FOMC meeting released today showed that while members voted in favor of a quarter-point cut, the decision was not without deliberation. The minutes state that “many participants were in favor of lowering the target range for the federal funds rate…some supported such a decision but could have also supported maintaining the level…and several were against lowering the target range.” Looking ahead to the December FOMC meeting, it is not clear whether the Fed will lower rates again, though the minutes note that most participants do foresee future cuts, just not necessarily this year. The uncertainty stems mostly from disagreement over whether current policy is necessarily ‘restrictive’ given that inflation remains elevated and the economy resilient. This mixed sentiment is in line with recent public comments from Fed officials, as some prioritize the labor market and others inflation.

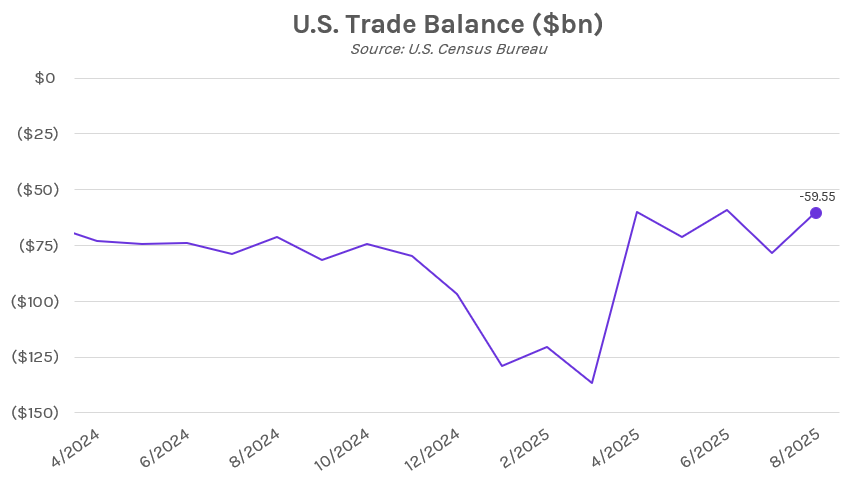

August trade deficit shrinks as tariffs take effect. The US trade deficit narrowed sharply in August, falling nearly 24% from July to $59.6 billion as many of Trump’s “reciprocal” tariffs took effect. Imports declined by 5.1%, the most in four months, while exports edged up 0.1% MoM. The pullback in imports was led by a decline in shipments of nonmonetary gold following a 39% tariff on Switzerland, one of the world’s main gold exporters. The US and Switzerland reached a preliminary agreement last week to lower the tariff rate to 15%. The data illustrated a significant contrast versus July, where the trade deficit widened to $78.2 billion from $59.1 billion in June, as companies rushed to import goods ahead of August tariffs.