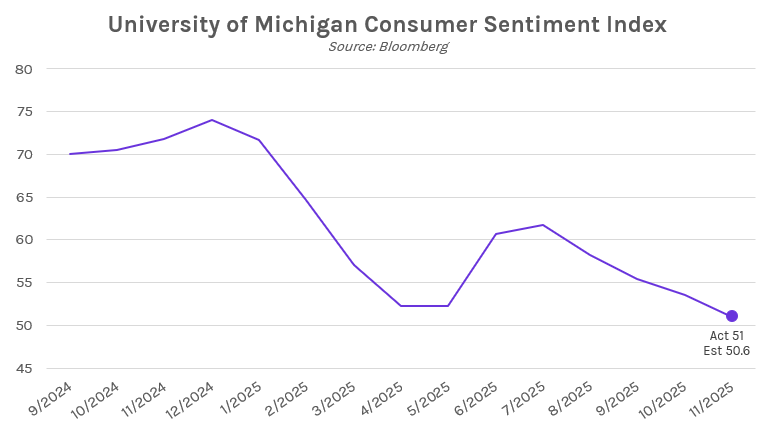

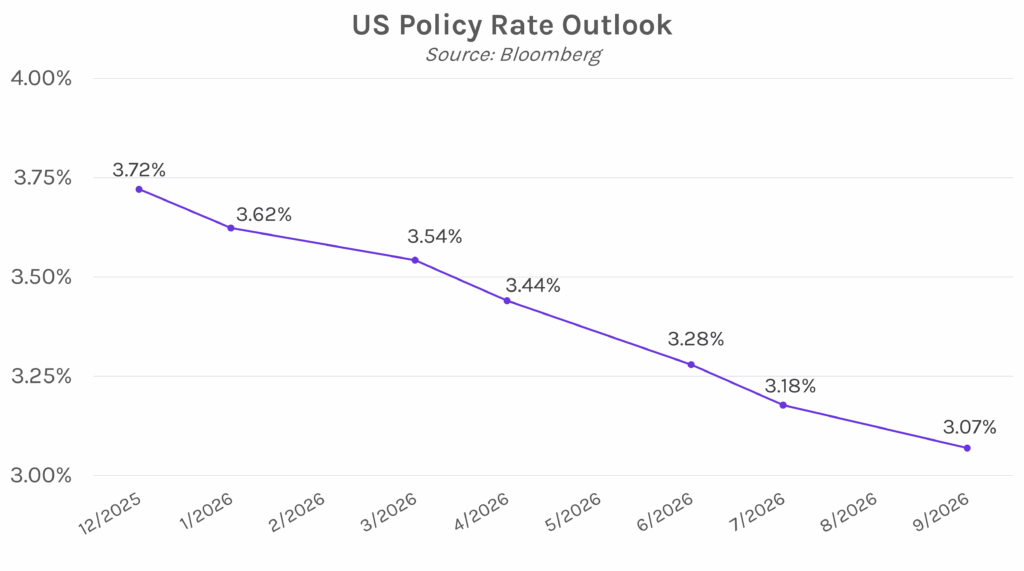

Yields fall on dovish Fedspeak. Treasury yields declined today as New York Fed President Williams expressed that he sees more room for easing, which pushed the implied probability of a 25 bp cut in December up to ~65% from 35% yesterday. PMI data came in near expectations, failing to stir market movement, though new orders rose to the highest level this year and business activity expanded by the most in four months. Meanwhile, University of Michigan consumer sentiment data ticked down near all-time lows. Yields closed 2-3 bps lower today, with the 2-year at 3.51% (a 10 bp decline on the week) and the 10-year at 4.06% (a 9 bp decline on the week). After a volatile week stirred by Nvidia earnings, equities rallied with the S&P 500 and NASDAQ closing 0.98% and 0.88% higher, respectively.

Fed Williams sees “near-term” rate cut. In a speech in Santiago, Chile today, New York Fed President John Williams shared that he sees further room to lower rates in the near term as the labor market continues to weaken. He believes current policy rates are modestly restrictive and inflation risks are easing, allowing “room for a further adjustment in the near term to…move the stance of policy closer to the range of neutral, thereby maintaining the balance between the achievement of our two goals.” Williams has historically been aligned with Fed Chair Powell, who will not be speaking publicly prior to the December FOMC meeting. Evercore ISI economists say, “At a minimum William’s intervention signals that the Fed leadership has not given up on a cut.”

Michigan consumer sentiment near record lows. The final figure for November’s University of Michigan consumer sentiment data came in at 51, up slightly from preliminary figures of 50.3 but down from 53.6 in October and near record lows. The measure of current conditions fell 7.5 points from last month, down to 51.1, which reflects the sourest view of personal finances since 2009. The survey director, Joanne Hsu said, “Consumers remain frustrated about the persistence of high prices and weakening incomes,” as concern about the probability of personal job loss came in at its highest level since 2009. One bright spot in the data, however, was inflation expectations. Consumers expect prices to rise 4.5% over the next year, marking the third straight month of easing. On the 5-10-year horizon, consumers expect prices to rise 3.4%, down from 3.9% last month.