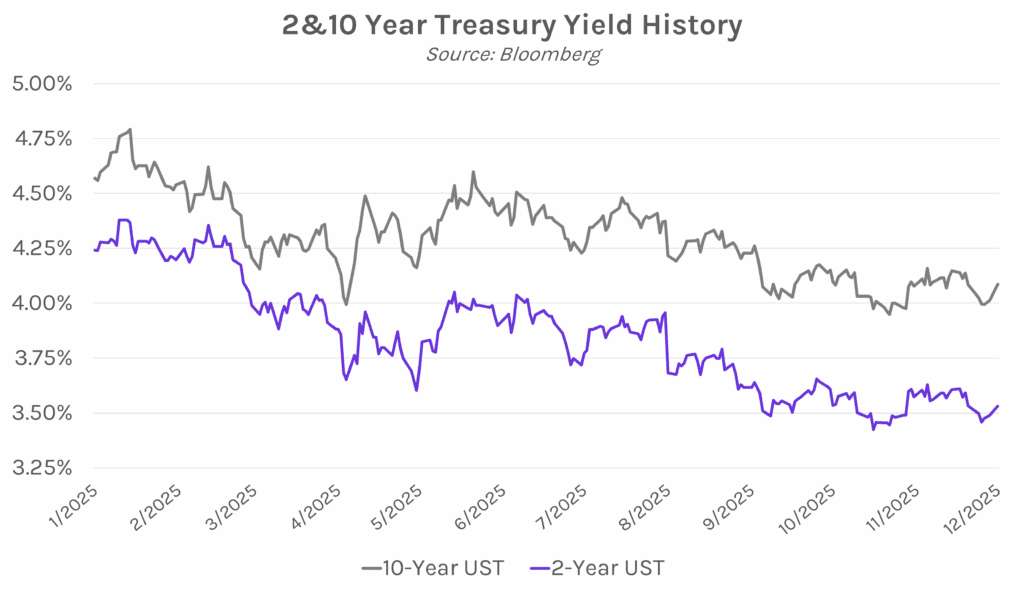

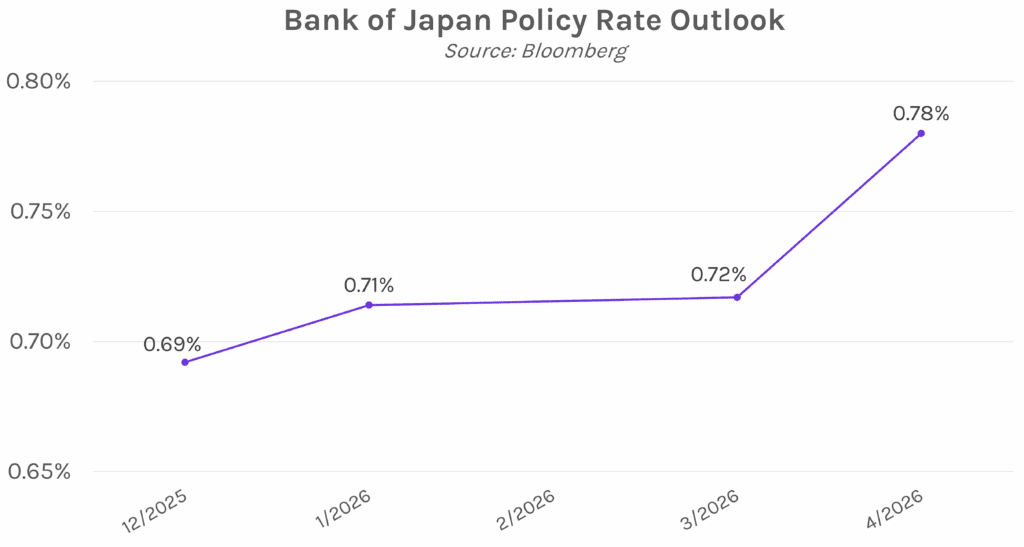

Yields climb due to Japan rate hike hint, high corporate debt issuance. Treasury yields rose 4-7 bps today as debt concerns from Japan and corporates caused a global bond selloff. The move was triggered by word of a potential rate hike by the Bank of Japan later this month, which sent Japan’s 10-year yield to its highest level since 2008. Adding further upward pressure was eight corporates issuing debt today, highlighted by an $8bn bond offering from Merck and Co. The 2-year yield closed 4 bps higher at 3.53%, while the 10-year yield closed 7 bps higher at 4.09%. Meanwhile, equities declined today, with the S&P 500 and NASDAQ 0.53% and 0.38% lower, respectively.

Bank of Japan Governor signals potential December rate hike. Bank of Japan Governor Kazuo Ueda shared that the BOJ “will consider the pros and cons of raising the policy interest rate and make decisions as appropriate” in a speech in central Japan today. Ueda also noted that he’s had smooth communications with the new government, which may show that Prime Minister Sanae Takaichi, who is typically dovish, will not be opposed to a policy rate hike. Mari Iwashita, executive rates strategist at Nomura Securities, explained that Ueda’s speech “sounds like preparation for a rate hike in December. He even mentioned the government in a sign that he has already gained its understanding of the move.” Following Ueda’s comments, futures markets are now pricing in a ~86% chance of a rate hike in December, up from ~58% on Friday.

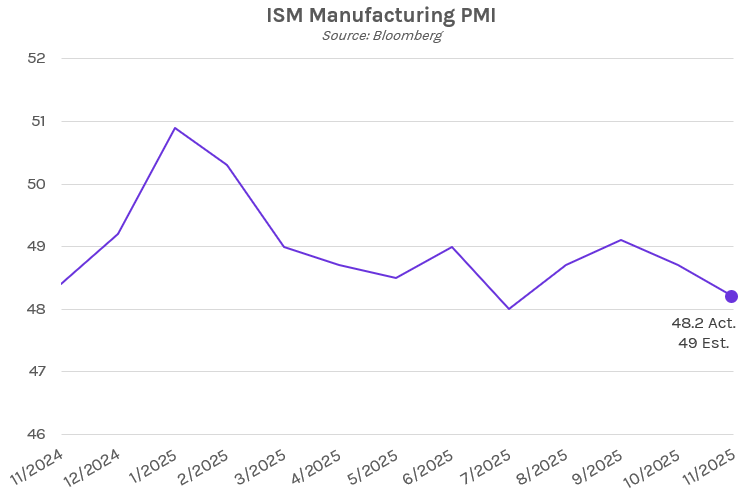

US factory activity shrinks by the most in four months. ISM manufacturing came in at 48.2 in November, a 0.5 decrease from the prior month’s level of 48.7 and below expectations of 49. With a level below 50, November marks the ninth straight month of contracting manufacturing activity. 11 industries contracted, with apparel, wood and paper products, and textiles leading the way. Just four industries—the smallest number in a year—saw growth, including computer and electronic products. Meanwhile, the prices paid for materials index came in at 58.5, increasing for the first time in five months and landing higher than estimates of 57.5. The figure is also about eight points higher than this time last year. Susan Spence, chair of the ISM Manufacturing Business Survey Committee said tariffs are driving the pullback as customers hold off on purchases until there is more clarity around the cost of goods, stating “we do not see anything on the horizon that’s going to turn the ship until there is more certainty.”