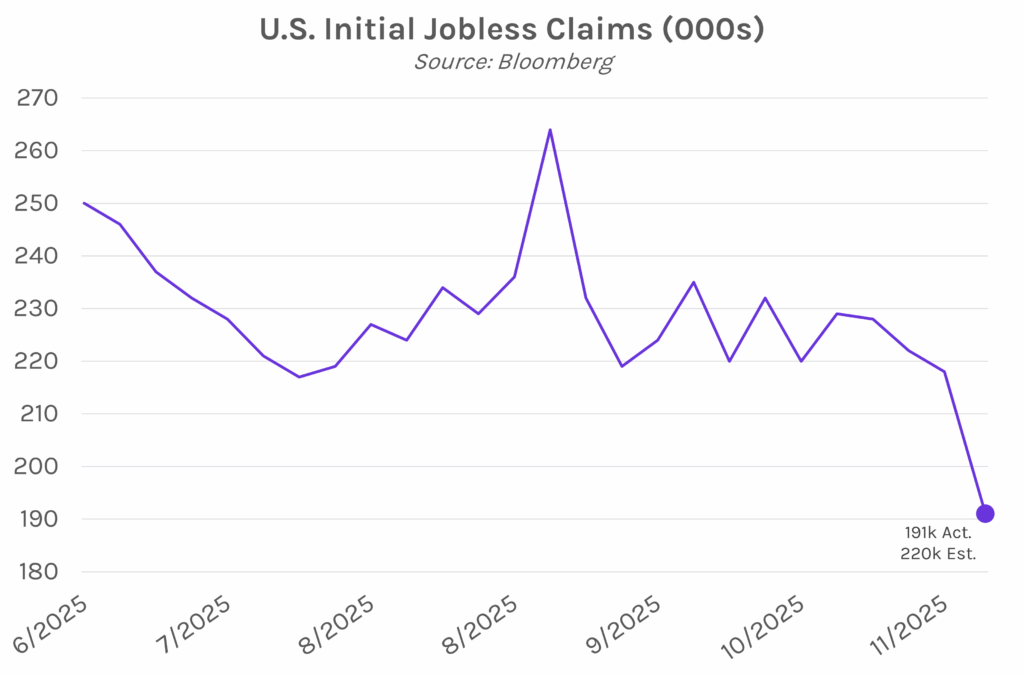

Yields rise as jobless claims slide. Treasury yields climbed gradually today after jobless claims dropped to its lowest level in three years, a positive sign of labor market strength. December rate cut bets still held steady, with futures markets still pricing in ~91% odds of a 25 bp cut. Yields closed 2-4 bps higher across the curve, with the 2-year at 3.52% and the 10-year at 4.10%. Meanwhile, equities are hovering near all-time highs, with the S&P 500 and NASDAQ inching up 0.11% and 0.22%, to 6,857 and 23,505 respectively.

Initial jobless claims fall to three-year low. The number of unemployment benefit applications for the week ending November 29 came in at 191k, a three-year low that was below estimates of 220k and the prior week’s 216k. However, initial jobless claims figures are often choppy around the holidays. As Nancy Vanden Houten, lead economist at Oxford Economics, described, the data “can be subject to big swings at this time of year, so we won’t read too much into one week’s number.” The 4-week moving average, a figure that helps smooth out volatility, fell to 214.75k which is the lowest since January yet still hovering near the highest levels since 2021. Also released today, data from outplacement firm Challenger showed layoffs cooled in November, landing at 71k after October’s 153k surge. The Fed will weigh this week’s jobs data ahead of the December FOMC meeting, which begins on Tuesday.

Key Japan officials likely to support BOJ December rate hike. According to people familiar with the matter, many key members of Prime Minister Sanae Takaichi’s government will not stop the BOJ from raising rates. These comments come following Governor Kazuo Ueda’s speech on Monday that hinted at a rate hike at the next BOJ meeting on December 19, which fueled a ~4-7 bp US Treasury sell-off. On Tuesday, Japan’s finance and economy ministers did not object to Ueda’s comments during a press conference, with Finance Minister Satsuki Katayama saying that the specific policy methods to achieve Japan’s 2% inflation goal is up to the BOJ. When Takaichi took on her leadership role in October, many speculated that she would attempt to influence the central bank to slow the pace of rate hikes, although it seems her government will not intervene.