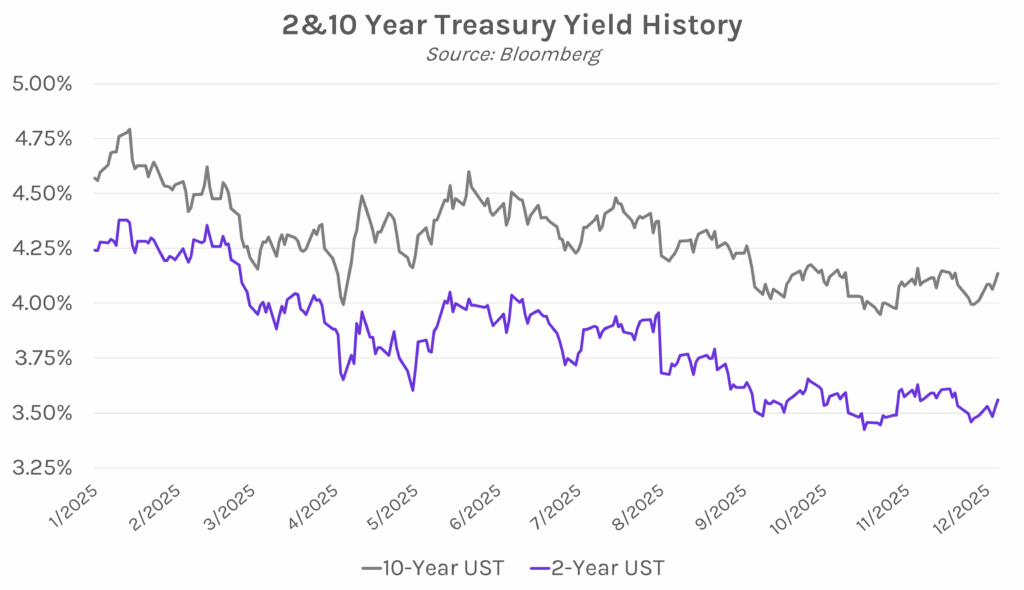

Yields climb as inflation data avoids blowout. September personal consumption expenditures data came in largely as expected, pushing yields steadily higher throughout the session but doing little to alter rate-cut expectations. Treasury yields ultimately closed 3-4 bps higher across the curve, with the 2-year yield closing at 3.56% (up 7 bps on the week) and the 10-year closing at 4.14% (up 13 bps on the week). Meanwhile, equities rose today but stopped just shy of record levels, with the S&P and NASDAQ up 0.19% and 0.31%, respectively.

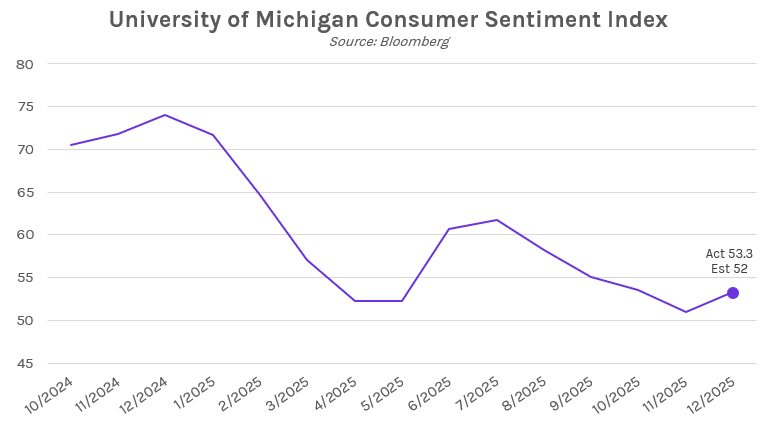

Consumer sentiment rises for the first time in five months. Preliminary University of Michigan consumer sentiment data for December came in at 53.3, above estimates of 52 and rising for the first time in five months. The unexpected increase follows November’s final level of 51, which was near record lows. Today’s data surveyed the period from November 18 to December 1, following the end of the record long government shutdown, and credits younger consumers for the uptick in sentiment. Also notable, the print showed a decline in inflation expectations, with consumers forecasting a 4.1% increase in prices over the next year, down from 4.5% last month and at the lowest level since January. Long term inflation expectations also fell, coming in at 3.2% over a 5-10 year outlook, down from 3.4% in the prior month. Joanne Hsu, the Michigan survey director, said “Consumers have noted that the soaring inflation they feared in April…at the height of the tariff developments has not come to fruition.”

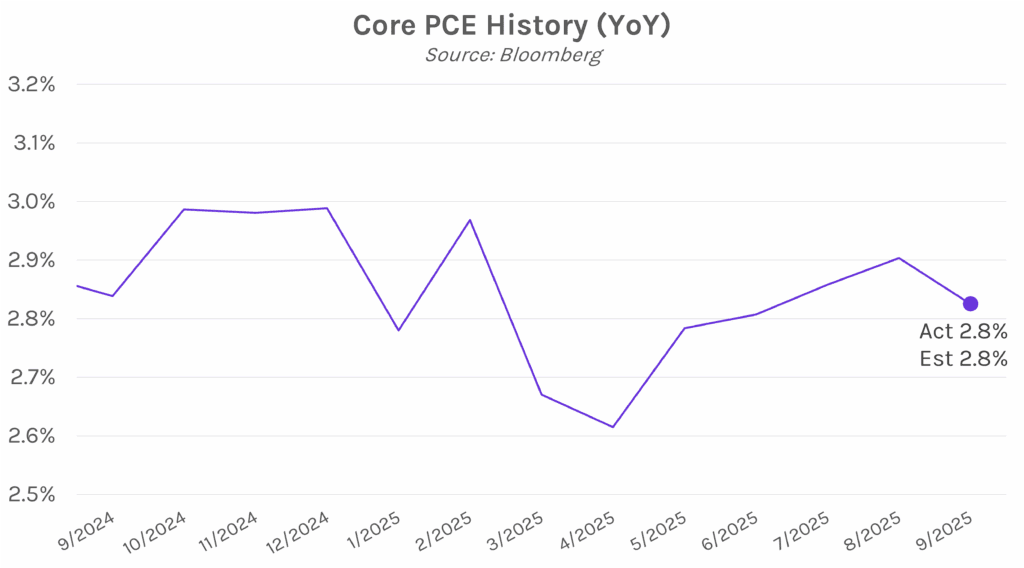

Consumer spending, inflation data in line with expectations. The core personal consumption expenditures price index was little changed in September, rising 0.2% from August and 2.8% from the prior year, largely in line with expectations. The data highlights a pullback in consumer spending ahead of the government shutdown, which began on October 1st. This pullback could potentially provide a glimpse into the US economy this quarter as consumer spending is one of the key drivers of growth, with recent data displaying weak consumer confidence as concerns over rising costs and job security take focus.