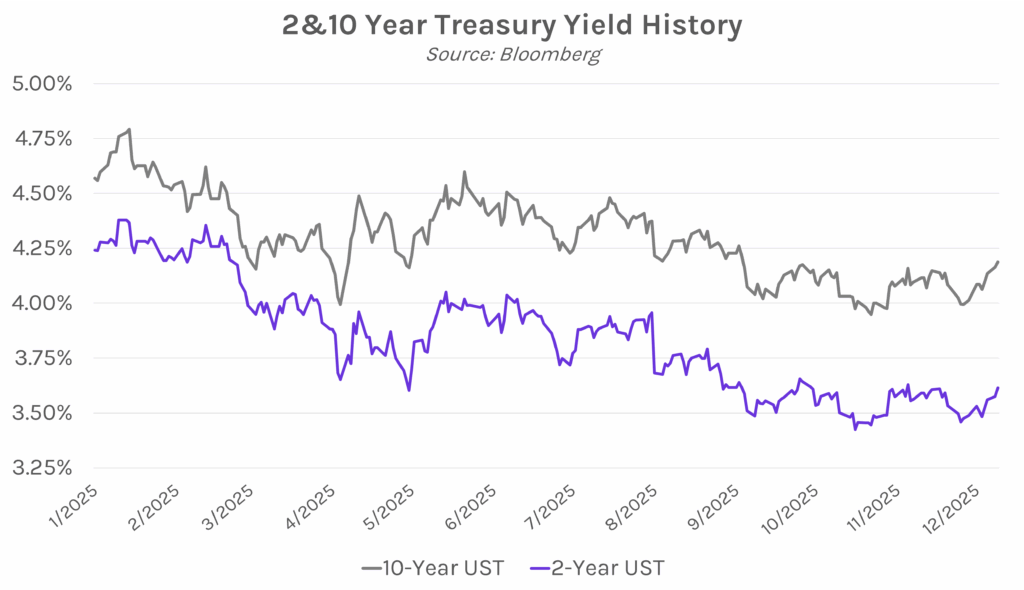

Yields climb on strong job openings. Treasury yields jumped 4 bps higher in the immediate aftermath of September and October JOLTS data that revealed a surprising increase in job openings. Yields climbed gradually throughout the remainder of the session, and market focus is now turned to tomorrow’s FOMC meeting decision and updated Dot Plot. The 2-year yield closed 4 bps higher at 3.61% and the 10-year closed 2 bps higher at 4.19%. Meanwhile, equities were mixed, with the S&P 500 down 0.9% and the NASDAQ up 0.13%.

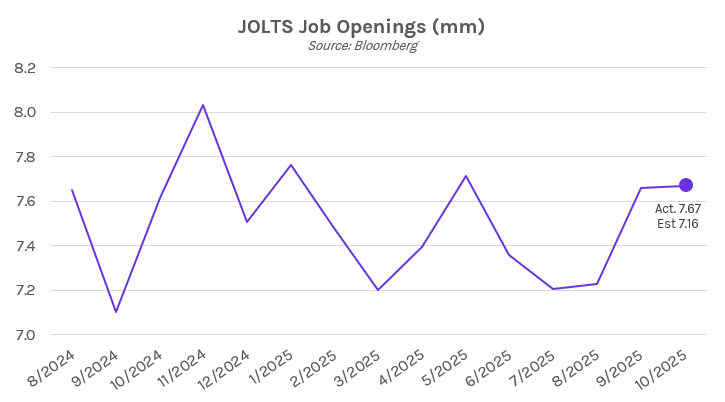

US job openings hit a five-month high in October. The BLS released JOLTS labor data for both September and October today, as the prints were delayed by the government shutdown. The number of available positions ticked up slightly to 7.67 million in October, above estimates of 7.12 million and marking a five-month high. This increase was driven by just a handful of industries, including retail and wholesale trades and healthcare, the latter which has been the top driver of US job growth this year. Despite this strength in job openings, today’s data also showed the layoff level rose, hitting 1.85 million firings in October versus 1.78 million in the prior month. The increase was mostly driven by the food service and accommodation sectors. Further, October hiring levels declined by 218k jobs after surging in September, as employers continue to weigh the impacts of trade policy and economic uncertainty. The October quits rate, which represents Americans who voluntarily leave their jobs, fell to the lowest level since May 2020.

Hassett sees room for Fed to cut more than 25 bps. Kevin Hassett, the leading contender for Fed Chair, believes there is room to substantially reduce the Fed’s benchmark rate. At the Wall Street Journal CEO Council Summit today, Hassett said, “If the data suggests that we could do it, then – like right now – I think there’s plenty of room to do it.” When asked whether that meant cuts larger than 25 bps, he responded, “correct.” His comments follow remarks yesterday, where he said it would be “irresponsible” for the Fed to try to pre-set a policy rate path for the next six months. Futures markets currently see a 25 bp rate cut as 90% likely at tomorrow’s FOMC meeting and have 2 rate cuts fully priced in for 2026.