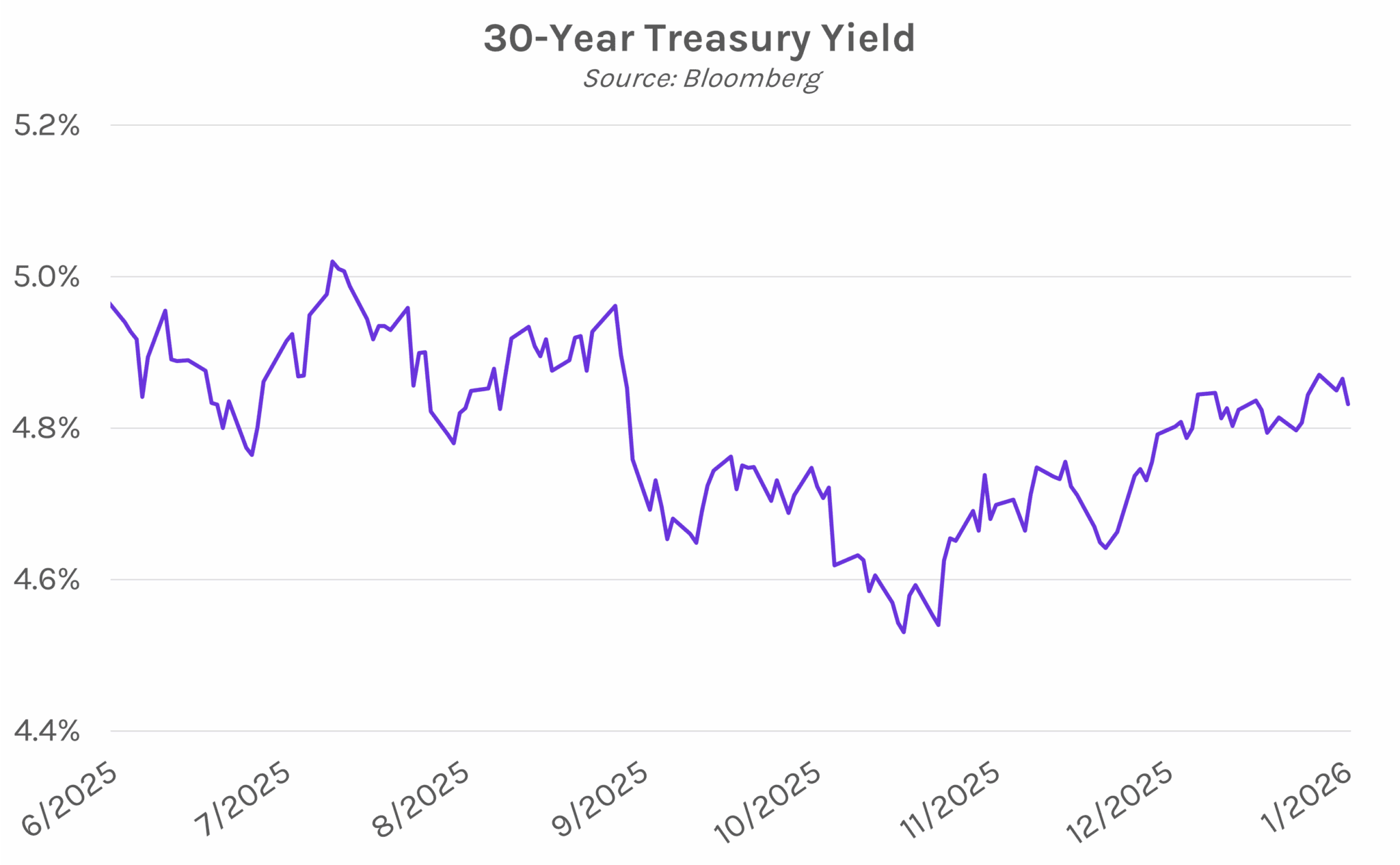

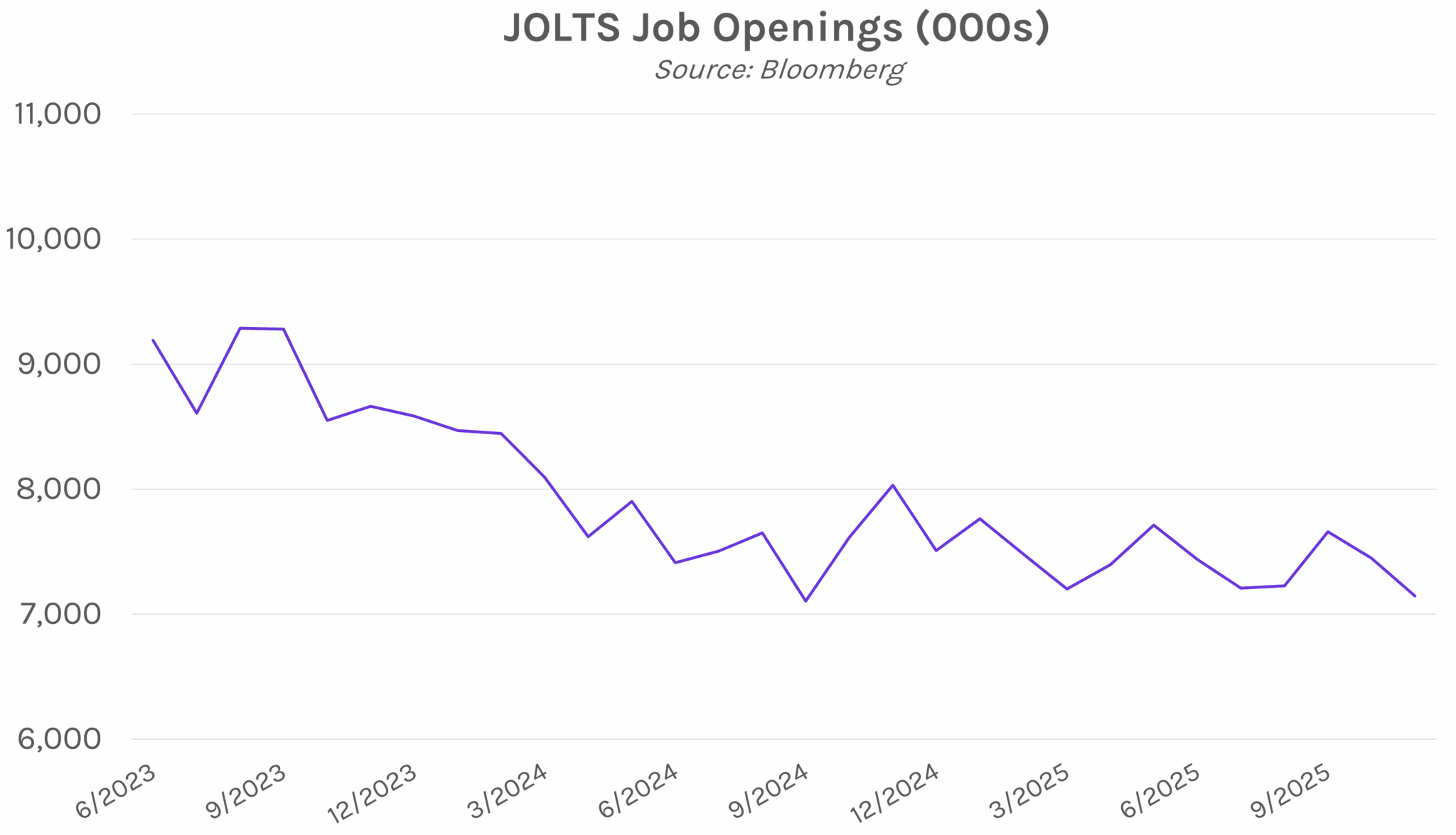

Yields decline on mixed data. Treasury yields declined overnight before jumping 3-4 bps in the immediate aftermath of ISM services data that showed the fastest pace of growth in over a year. The sudden move higher did not hold as markets digested JOLTS data that showed job openings and new hires declining to the lowest levels in over a year. The 2-year yield closed up 1bp at 3.47%, while the 30-year yield closed 4 bps lower at 4.83%. Meanwhile, equities were mixed today, with the S&P 500 closing 0.34% lower and the NASDAQ closing up 0.16%.

US job openings fall to lowest in over a year. JOLTS data released today showed that November job openings declined to 7.15 million, below expectations of 7.65 million and the lowest level in over one year. Meanwhile, October job openings were revised downward from 7.67 million to 7.45 million. The decline in openings was largely driven by leisure and hospitality, health care and social assistance, and transportation and warehousing sectors. This report highlights a softening job market, on par with recent data that showed the unemployment rate hit 4.6% in November, its highest level since 2021. Friday’s government jobs report is expected to show moderate payroll growth and a slightly lower unemployment rate in December.

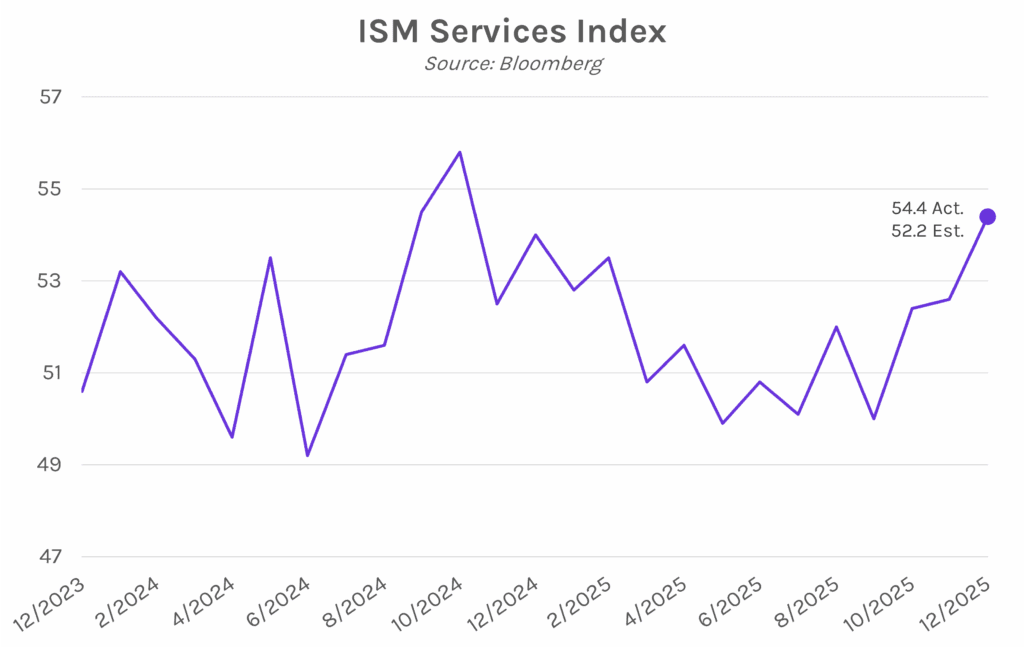

Services activity posts highest growth in 12-months. The ISM services index for December came in at 54.4, above estimates of 52.2 and the prior month’s 52.6. The growth was fueled by an uptick in demand and an increase in hiring. Readings above 50 indicate expansion, and today’s figure marks the highest level of services activity since October 2024. 11 industries recorded growth, led by retail trade, finance and insurance, and accommodation and food service. Five industries contracted, including company management and support services. ISM new orders came in at 57.9, above estimates and November’s level, marking the largest expansion since September 2024. Business activity also hit a one-year high, helping to spark the most services job growth since February.