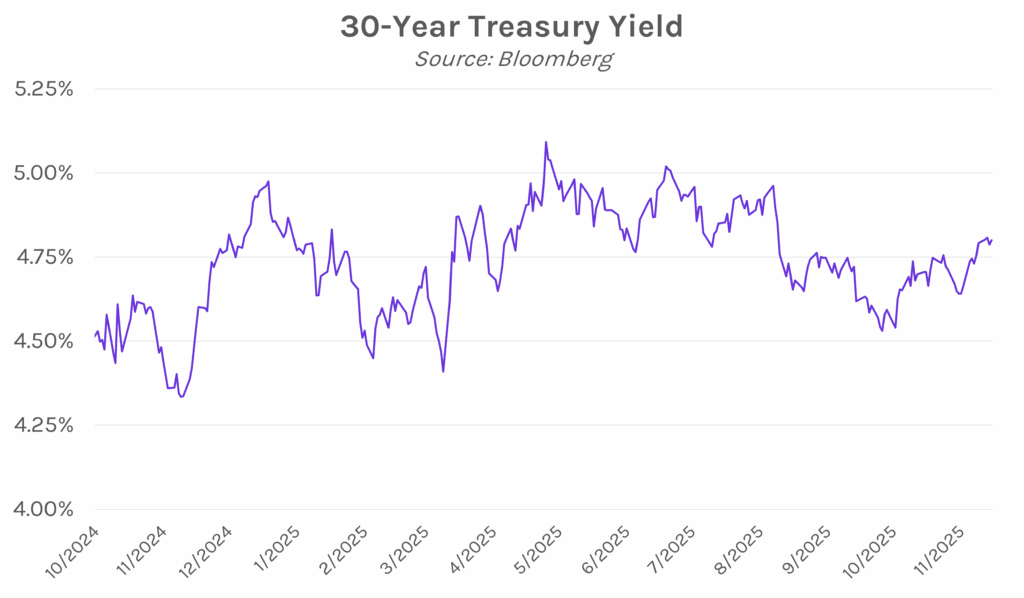

Yields close flat as markets digest rate outlook. Treasuries rallied this morning, with yields declining as many as 5 bps after initial jobless claims came in at 236k in the week that ended December 6th, a 44k increase from the week prior. Yields ultimately reversed course and closed nearly flat across the curve with the 2-year at 3.54% and the 30-year at 4.80%. Meanwhile, equities were mixed today with the S&P 500 closing 0.21% higher while the NASDAQ closed 0.25% lower, weighed down by disappointing Oracle earnings.

Fed unanimously reappoints 11 regional presidents. The Fed Board of Governors reappointed 11 of its 12 regional presidents to new five-year terms, following a comprehensive review by the regional bank boards and the Fed board in Washington. The current terms expire this upcoming February and by law are served in five-year increments. These reappointments reduce some uncertainty surrounding the composition of the FOMC as markets also await the official announcement of Fed Chair Powell’s successor, which is likely to be White House National Economic Council Director Kevin Hassett. Atlanta Fed President Raphael Bostic, who historically has been hawkish, is the only regional president that was not reappointed as he announced that he will be retiring at the end of his term.

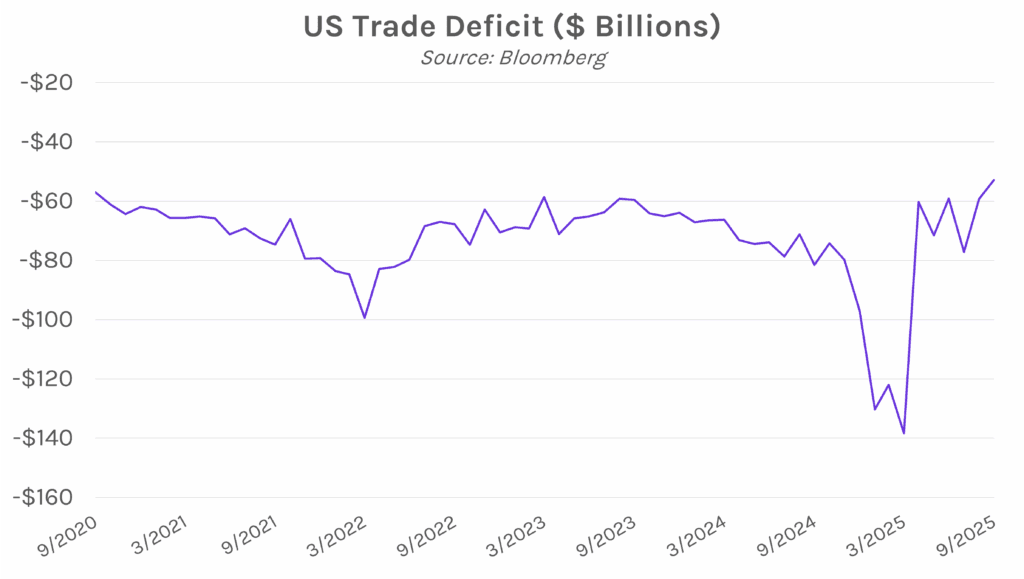

US trade deficit shrinks to smallest level since 2020. The US trade deficit in September unexpectedly narrowed to $52.8bn, well below expectations of $63.1bn and the smallest gap since mid-2020. The shrinking deficit was driven by surging exports, led by gold and pharmaceutical exports. Gold exports reached a record value, mainly as a reversal of earlier imports of gold tied to tariff concerns. Gold and pharmaceutical exports also played a key role in driving the value of US exports to the second-highest level on record. This unexpected narrowing in the September trade deficit adds to the volatility in trade balance data over the past year, largely driven by shifting tariff policy.