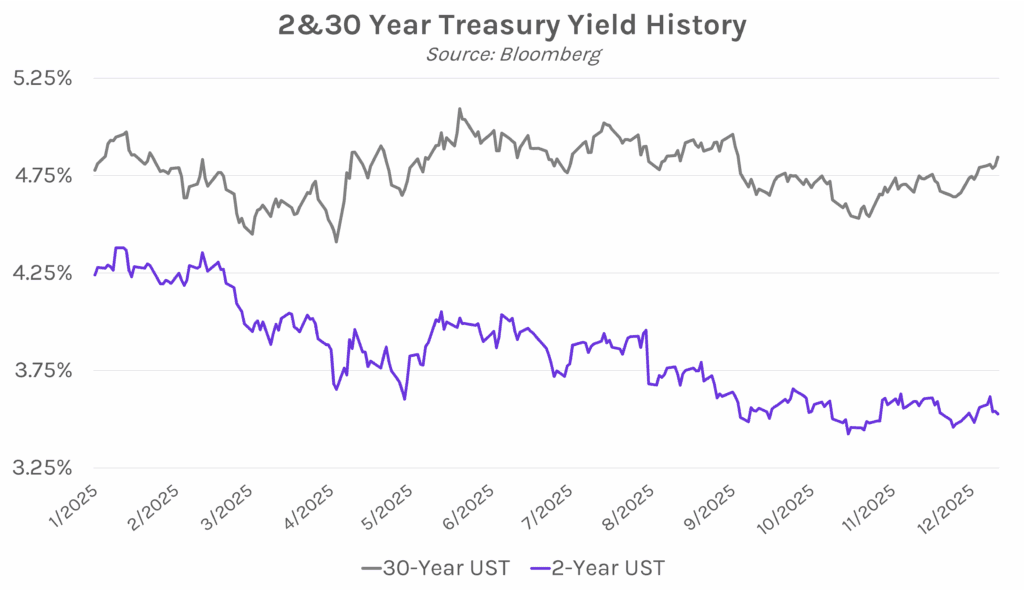

Yields steepen on hawkish Fed commentary. The front-end of the curve remained anchored while longer-dated yields climbed today, with the 30-year yield now at a three-month high after Cleveland Fed President Hammack and Kansas City Fed President Schmid argued in favor of keeping policy rates restrictive. The 2-year yield closed 2 bps lower at 3.52% (a 4 bp decline on the week), while the 30-year yield closed 5 bps higher at 4.85% (a 6 bp increase on the week). Meanwhile, equities declined today as Oracle and Broadcom led the tumble in AI names, with the S&P 500 and NASDAQ down 1.07% and 1.69%, respectively.

Fed Chair speculation continues as Hassett and Warsh seen as frontrunners. Trump, who previously signaled Kevin Hassett was the likely Fed Chair pick, met with Kevin Warsh this week and pressed him on whether he’d support rate cuts if selected. The President also said the next Chair should consult with him on interest rate decisions and argued rates should be “1% and maybe lower than that” within a year, saying the US should have “the lowest rates in the world.” Despite saying he has made up his mind, Trump’s comments suggest both candidates remain in play. Hassett, a longtime Trump economic adviser who became head of the National Economic Council in January, had been considered the frontrunner. Warsh, a former Fed governor, was previously passed over for the job in 2017 in favor of current Fed Chair Powell.

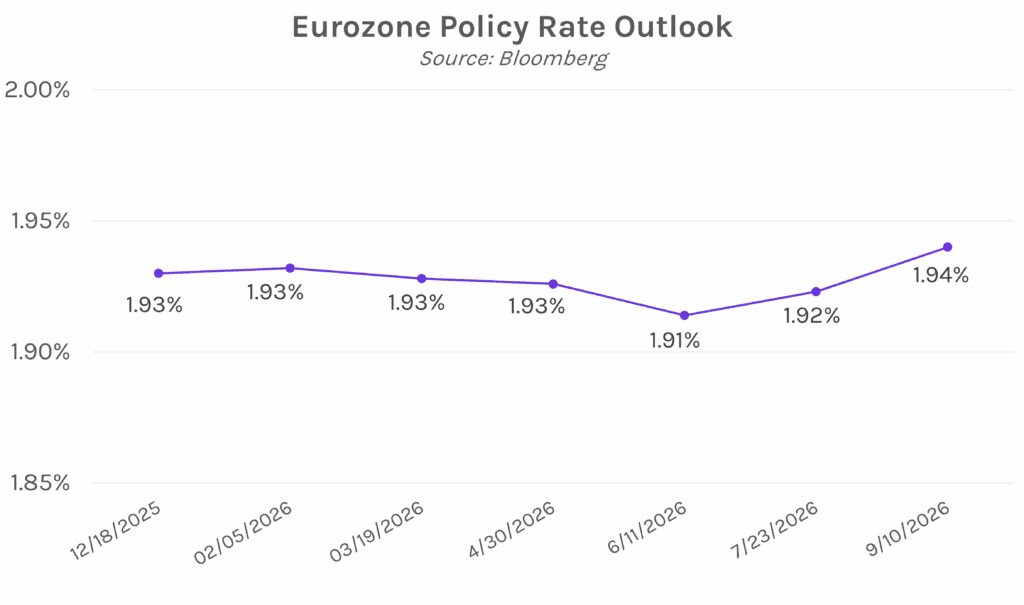

Economists predict next ECB move will be rate hike. Over 60% of economists who responded in a Bloomberg survey believe that ECB officials are more likely to hike rates than cut further, compared to only a third in October. However, a hike is not be expected soon, with futures markets currently forecasting the policy rate to remain steady at 2% for the next two years. This revised outlook comes after recent eurozone data showed inflation stabilizing and global trade and geopolitical conflicts having a limited impact. Earlier this week, hawkish ECB member Isabel Schnabel was the first policymaker to declare that rates have reached a floor. Schnabel said, “Both markets and survey participants expect that the next rate move is going to be a hike, albeit not anytime soon.”