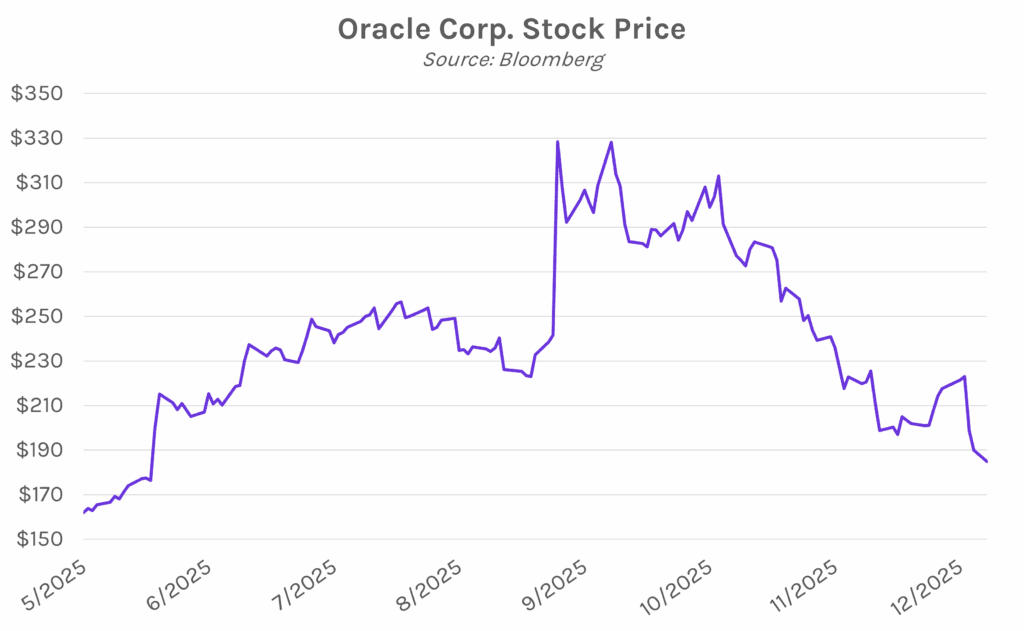

Yields decline ahead of labor data. Treasury yields declined 3 bps this morning before rising into the market close ahead of tomorrow’s nonfarm payrolls and unemployment rate prints. November nonfarm payrolls is expected to show 50k jobs added, a stark decline from September’s 119k jobs added, and the print should be under close scrutiny after October labor data was cancelled due to the government shutdown. The 2-year yield closed 2 bps lower at 3.50%, while the 10-year yield closed 1bp lower at 4.17%. Meanwhile, equities declined further today as Oracle and Broadcom continued their selloff from last week, with the S&P 500 and NASDAQ down 0.16% and 0.59%, respectively.

Hassett faces pushback on concerns about Fed independence. National Economic Council Director Hassett may no longer be the leading candidate for Fed Chair as rumors of former Fed Governor Warsh as a contender reemerged on Friday. White House officials are said to be concerned that markets will perceive Hassett as being too “in-the-pocket” of the President. Down the road, this could cause bond yields to rise on concerns about the Fed’s willingness to mitigate inflation through policy decisions. This would achieve the opposite of President Trump’s goal to get interest rates as low as possible. In a television interview this weekend, Hassett took a stronger stance on the importance of Fed Independence than he has in the past, saying that despite Trump’s “very strong and well-founded views about what we ought to do…the job of the Fed is to be independent [and] to drive a group consensus on where interest rates should be.”

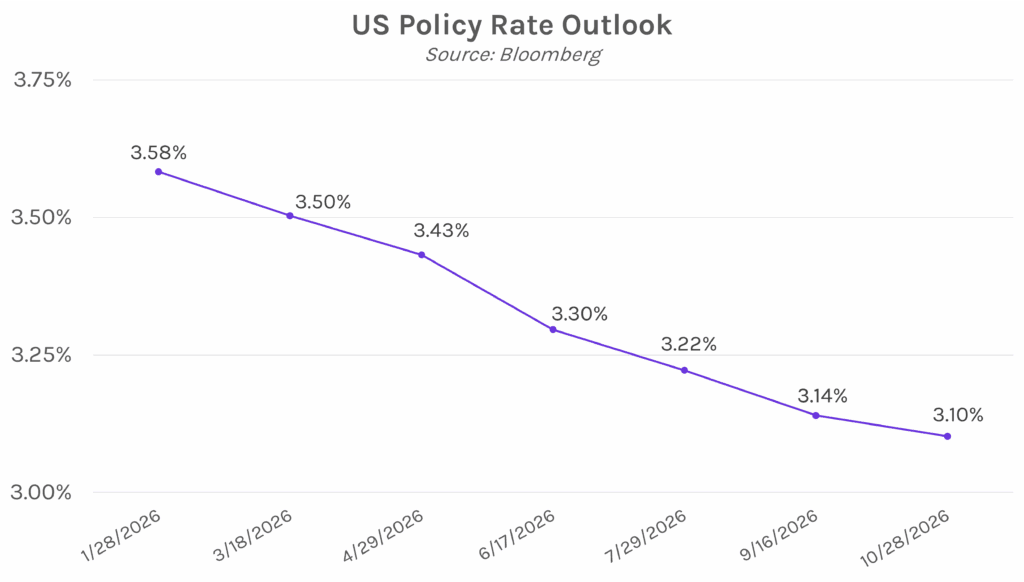

Fed officials remain divided on monetary policy. Following last week’s 25 bp rate cut, New York Fed President Williams said policy is now closer to neutral and “well positioned as we head into 2026.” Boston Fed President Collins also supported the rate cut but called it a “close call” as “available information suggested the balance of risks had shifted a bit.” She says that officials need more clarity on inflation before lowering rates further. In contrast, Fed Governor Miran continues to argue that policy rates remain overly restrictive. He stated that prices have stabilized, and warned that leaving policy rates unnecessarily high can lead to further labor market deterioration that can be difficult to reverse.