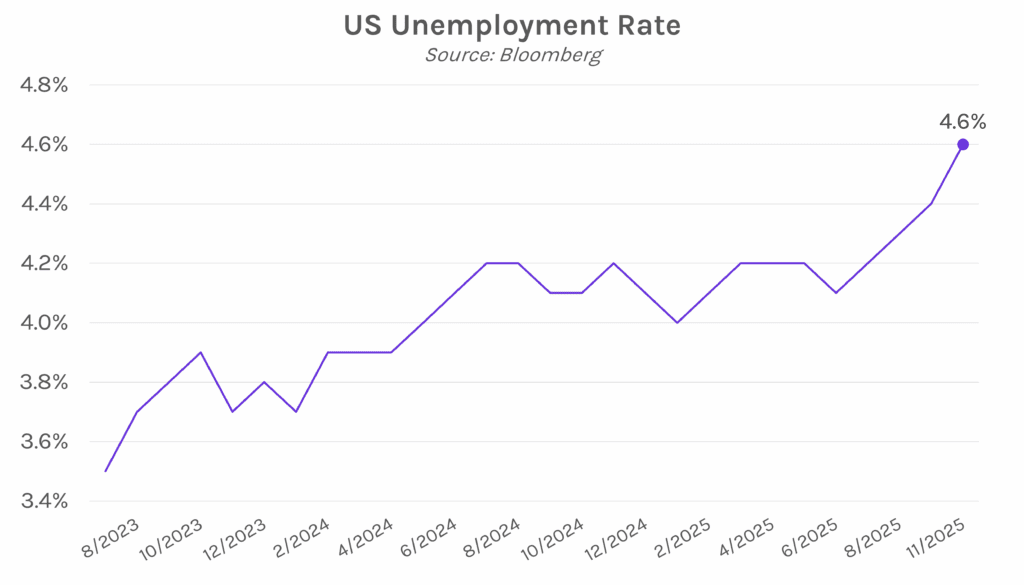

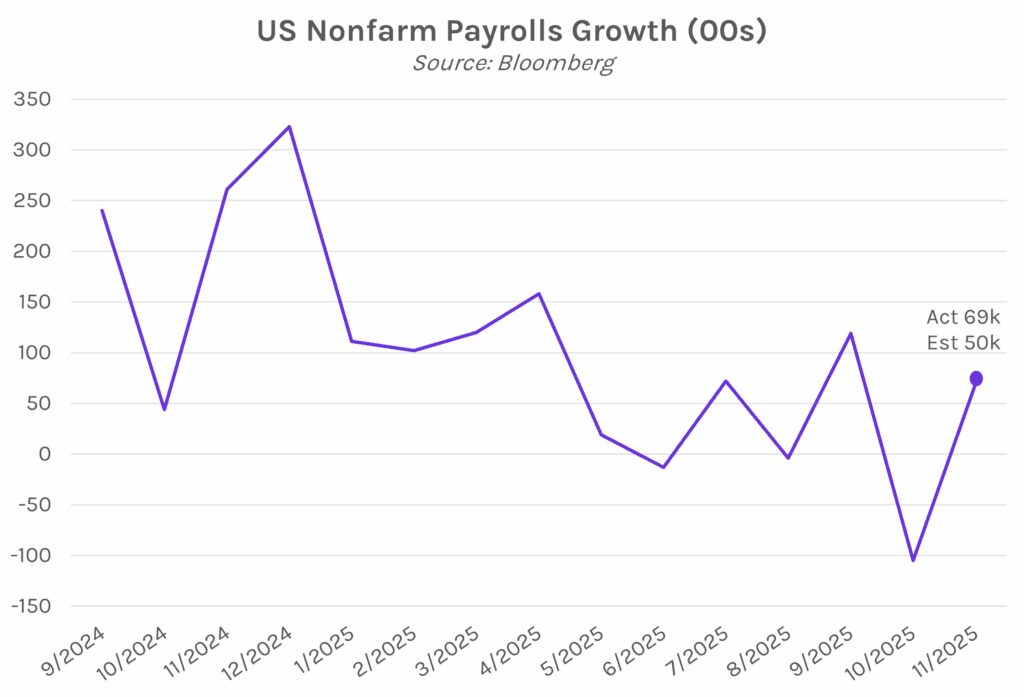

Yields decline following mixed labor data. Treasury yields whipsawed in the aftermath of data that showed a sluggish, but not rapidly worsening labor market, initially falling 2-4 bps before quickly making a reversal. November nonfarm payrolls showed a significant improvement from October, although the unemployment rate ticked up to the highest level since 2021. Yields ultimately drifted lower for the remainder of the session, with the 2-year and 10-year yields closing 1-3 bps lower at 3.49% and 4.15%, respectively. Meanwhile, equities were mixed, with the S&P 500 closing 0.24% lower and the NASDAQ 0.23% higher.

November payrolls rebound as the unemployment rate remains high. Nonfarm payrolls for November saw 64k jobs added, above estimates of 50k and significantly higher than October’s 105k job loss. The growth was driven by healthcare, social assistance, and construction sectors, while employment fell in the transportation and hospitality industries. Despite the uptick in payrolls, the labor market remains sluggish as the unemployment rate rose to 4.6% in November. This is up from 4.4% in September, the most recent prior figure as the BLS cancelled the October print due to the government shutdown. Today’s payroll advance adds to recent choppiness in labor data, though the unemployment rate continues a steady upward trend. Notably, long term unemployment, or those without a job for 27 weeks or more, rose to one of the highest levels since the end of 2021. Samuel Tombs, chief US economist at Pantheon Macroeconomics said, “The labor market remains weak, but the pace of deterioration probably is too slow to spur the FOMC to ease again in January.”

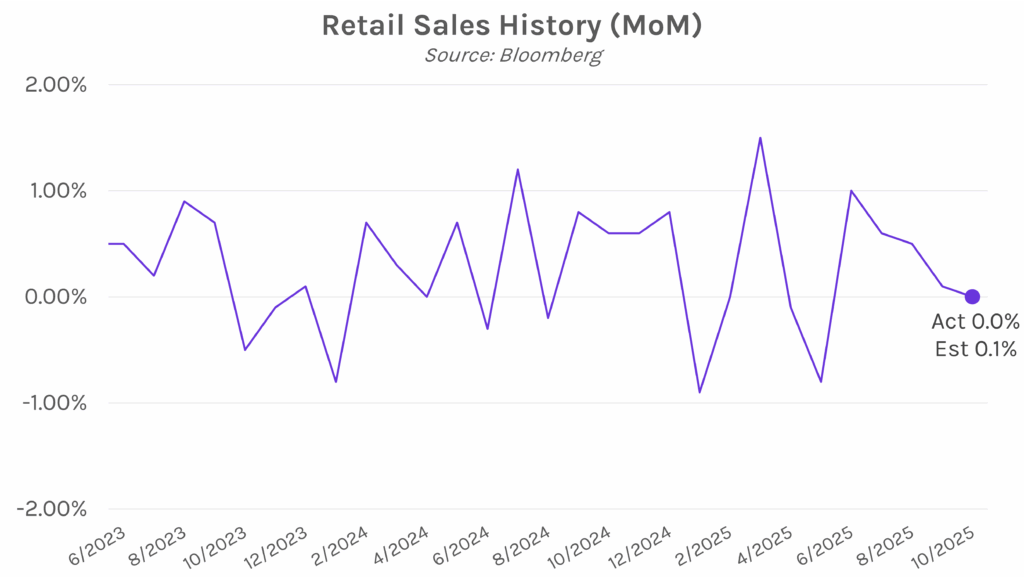

Retail sales see resilient consumer spending outside autos. Headline retail sales came in at 0% in October compared to September’s 0.1% downward revision. Excluding automobile dealers and gas stations, sales increased 0.5% on a monthly basis, and 8 out of 13 categories posted increases. Department stores and online merchants led the MoM climb, while electronics and appliance stores, furniture outlets, and sporting goods retailers also recorded stronger sales. Stronger October spending may also have been a result of seasonality; Michael Pearce, chief US economist at Oxford Economics said, “It’s possible some of the strength in October reflected consumers shifting forward holiday spending, with non-store sales surging in October.”