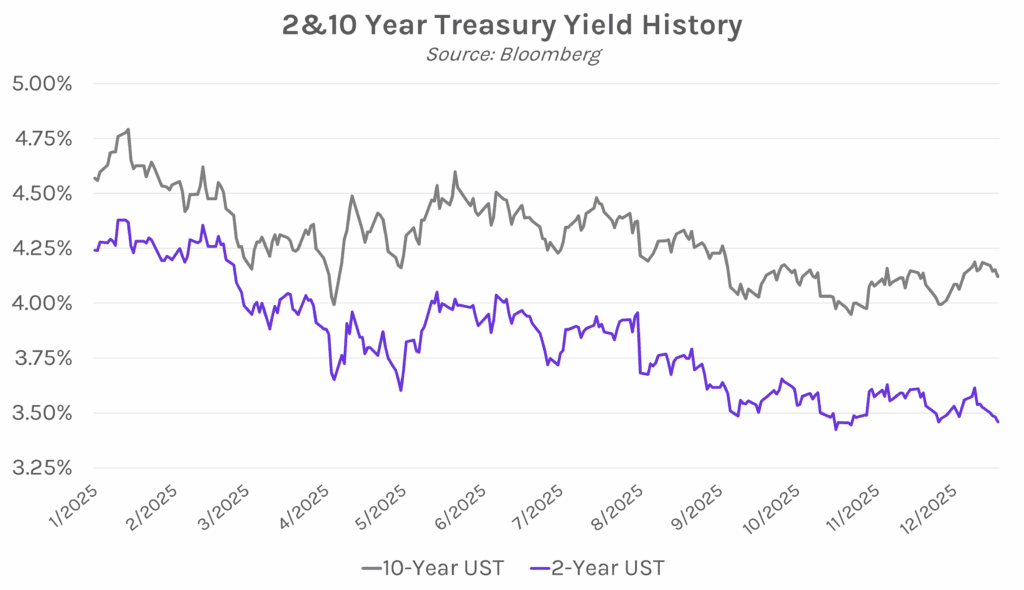

Yields decline on soft CPI data. Treasury yields fell to intraday lows this morning following cooler than expected CPI data despite some skepticism surrounding the print as the Bureau of Labor Statistics began sampling later than usual due to the government shutdown. The 2-year yield closed 2 bps lower at 3.46% and the 10-year yield closed 3 bps lower at 4.12%. Meanwhile, equities rallied on the inflation data and a strong outlook from Micron Technology, Inc., with the S&P 500 and NASDAQ up 0.79% and 1.38%, respectively.

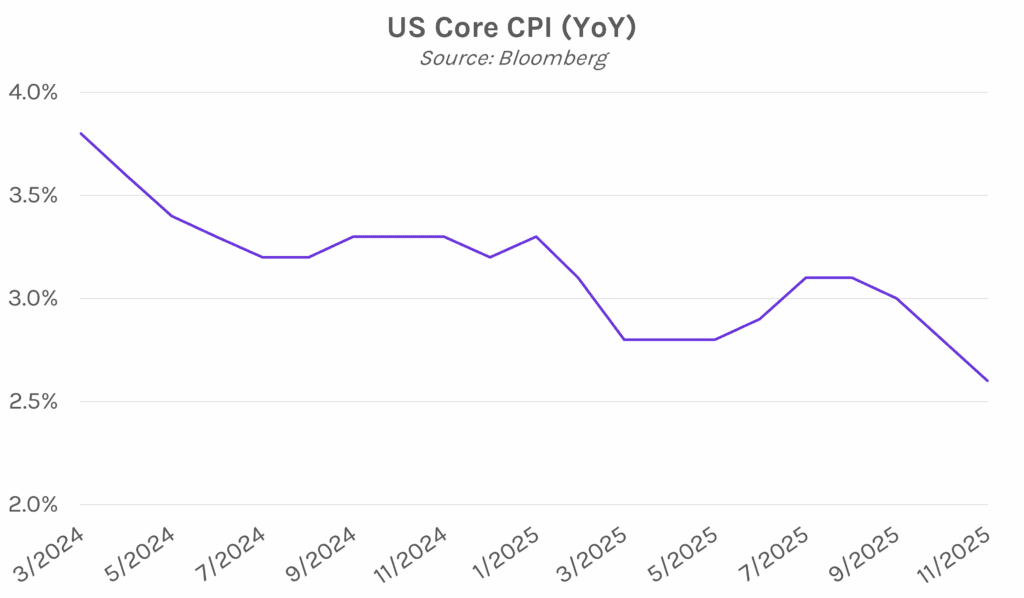

Core CPI falls to lowest level since 2021. Today’s inflation data showed headline CPI came in at 2.7% YoY in November, below estimates of 3.1%. Core CPI, which excludes volatile food and energy sectors, landed up 2.6% YoY, below estimates of 3.0% and the lowest level in four years. The surprisingly low figures have caused some experts to question the possible impact of the government shutdown on the BLS’s collection of November inflation data. The October CPI print was cancelled entirely and the shutdown may have had lingering impacts on November’s data. The BLS did release Core CPI for the two-month period ending in November, which came in at 0.2% YoY. The surprisingly small increase was driven by declines in lodging, recreation, and apparel prices, while household furnishings and personal care product prices rose. Paul Ashworth, chief North American economist at Capital Economist said, “we all have to wait until the December data is published next month to verify whether this is a statistical blip or a genuine disinflation.”

Fed’s Goolsbee optimistic about inflation but wants more data before cutting rates further. Following today’s cooler than expected inflation print, Chicago Fed President Austan Goolsbee said, “I realize it’s just one month, and you never want to hinge too much on a single month, but that was a good month.” Goolsbee dissented in favor of holding rates steady at least week’s FOMC meeting, explaining that he wanted to see more data before concluding that inflation has cooled enough to warrant more rate cuts. Today, Goolsbee added that if employment remains stable and inflation continues to come down, he would be comfortable lowering rates “a fair bit.”