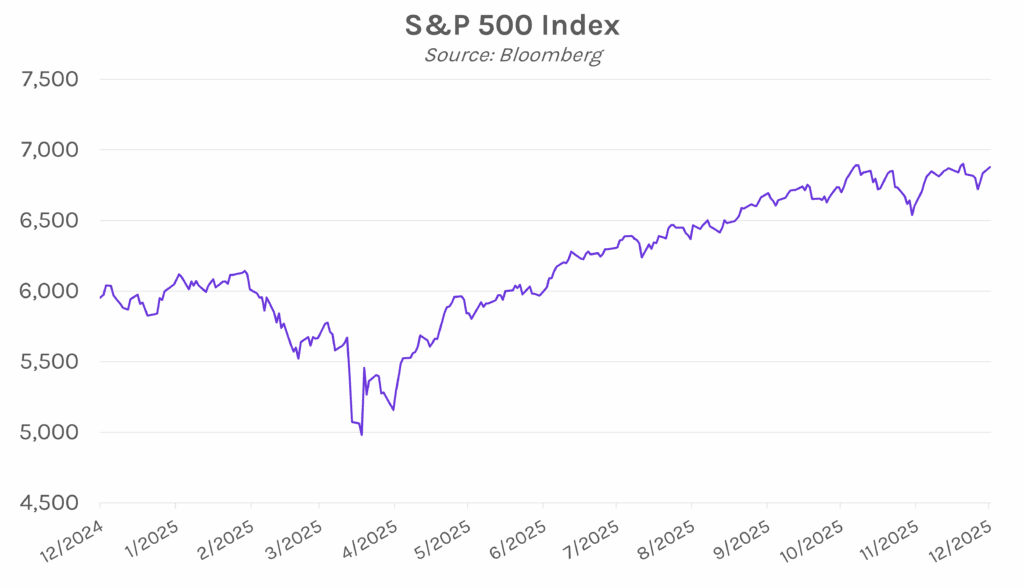

Yields rise as shortened holiday trading week kicks off. Treasury yields edged higher throughout most of the session, with the 2-year yield hitting intraday highs after facing soft demand in today’s $69B auction. Yields ultimately closed 1-3 bps higher across the curve, with the 2-year yield at 3.51% and the 10-year yield at 4.16%. Meanwhile, equities climbed with the S&P 500 up 0.63%, positioning the index for its eighth consecutive monthly gain and the longest winning run since 2018.

Miran sees need for further rate cuts, while Hammack believes it is time to pause. Fed Governor Stephen Miran advocated for continuing rate cuts next year, citing recession risks in the long term if the Fed pauses its easing cycle. He said, “The unemployment rate has poked up potentially above where people thought it was going to go. And so we’ve had data that should push people into a dovish direction.” Meanwhile, Cleveland Fed President Beth Hammack argued that monetary policy is well positioned for a pause to focus on bringing inflation down to target levels. She explained, “Where we are today is my base case that we can stay here for some period of time until we get clearer evidence that either inflation is coming back down to target or the employment side is weakening more materially.”

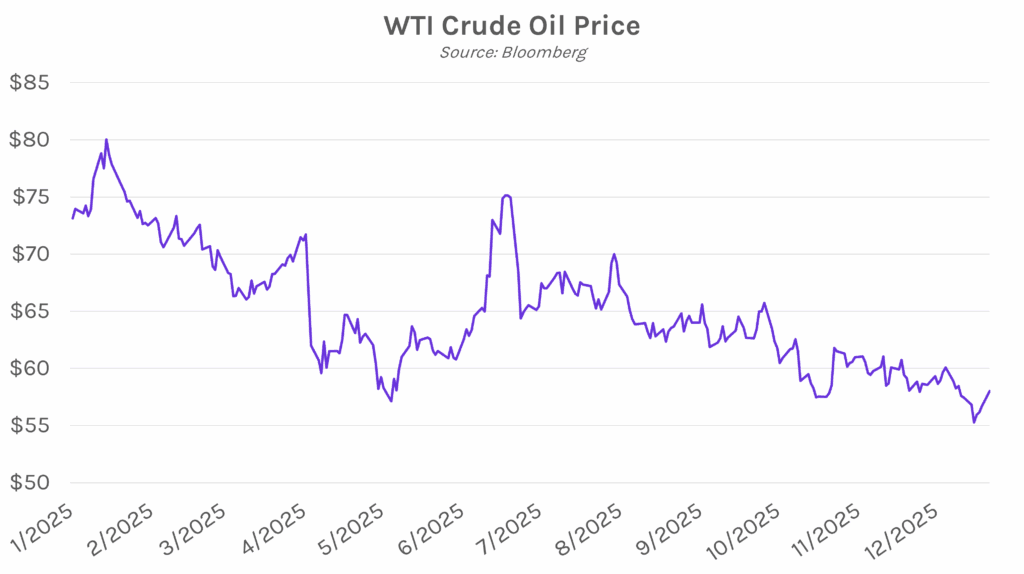

Oil prices climb as the US intensifies its blockade on Venezuela. After two straight weeks of declines, WTI crude rose 2.4% to settle above $58 a barrel. The increase follows reports that US forces boarded one oil tanker—said to be carrying up to two million barrels of oil—and are pursuing another. Recent geopolitical developments have helped put a floor under oil prices, which had fallen nearly 20% this year amid oversupply and slowing demand growth. US action in Venezuela comes after the Trump administration designated Venezuelan President Nicolás Maduro’s regime a foreign terrorist organization, citing alleged involvement in drug trafficking. While Venezuela holds the world’s largest crude oil reserves, most of its exports go to China, and they account for less than 1% of global oil demand.