Yields rise slightly on labor market strength. Data released this morning showed that jobless claims unexpectedly fell to 199k in the week that ended December 27th, 19k below the 218k forecast. The policy-sensitive 2-year yield jumped 3bps higher in the immediate aftermath of the print and was little changed throughout the remainder of the session, now at 3.47%. Yields climbed 3-4bps at the long-end of the curve, with 10-year and 30-year yields now at 4.16% and 4.84%, respectively. Meanwhile, silver plunged over 6% today after the CME announced that it would raise margin requirements on precious-metal futures for the second time in a week. Silver is now trading at ~$71.52 per Troy ounce, well below the all-time high of $83.58 per Troy ounce, reached just two days ago.

2025 in review. Rates markets started the year with extreme volatility, largely driven by Trump’s election and speculation on tariffs and trade wars. Yields declined by ~70 bps at the short-end of the curve from mid-February to early April, the latter of which marked “Liberation Day.” Tariffs initially proved more extreme than expected, which fueled concerns about a global economic slowdown, but concerns eased throughout the year as dozens of trade deals were announced. Focus then shifted to resumed rate cuts, as the Fed trimmed policy rates by 75 bps from September to December. Volatility was muted after the Fed resumed policy easing, as short-term rates declined ~15 bps from September through year-end while the long end declined ~5bps. The yield curve is now at its steepest point since 2022, with the spread between 10-year and 2-year yields at +68bps.

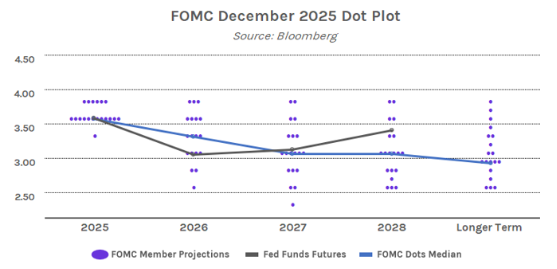

Looking ahead. The most recent Dot Plot showed a median Fed projection of one rate cut in 2026, though Fed Funds futures have two moves priced in. Markets have also shifted attention to speculation surrounding potential successors to Powell as Fed Chair. Trump has been critical of Powell for his cautious approach, and it is largely assumed that he will appoint a dovish replacement. Kevin Hassett and Kevin Warsh are viewed as the two most likely candidates, with the former seen as 39% likely and the latter as 33% likely, according to Kalshi.