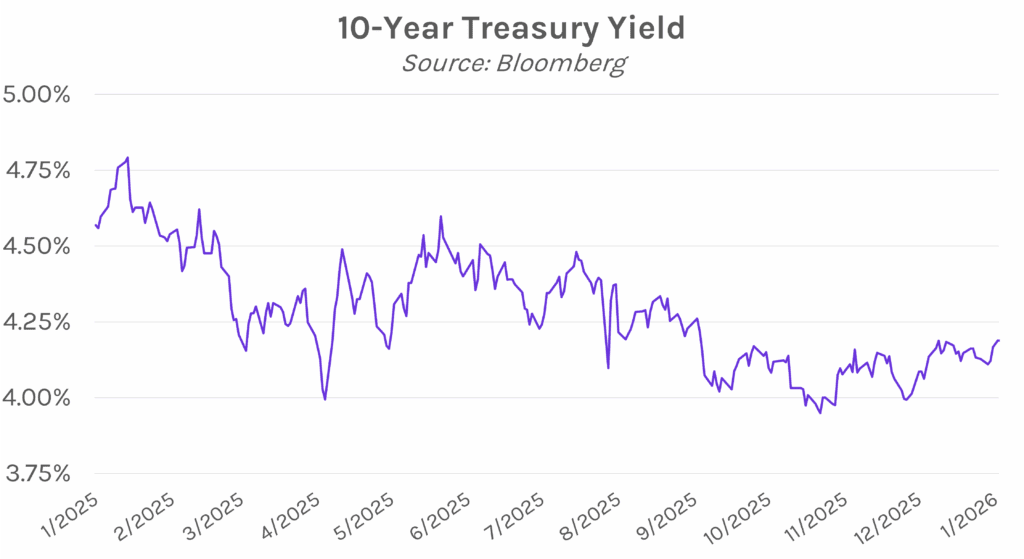

Yields edge slightly higher in 2026’s first trading session. Treasury yields traded in a 3-4 bp range today, with S&P manufacturing PMI printing in line with expectations at 51.8 and having little impact on yields. The 2-year yield closed nearly flat at 3.47% (a 1bp decrease on the week) and the 10-year yield closed 2 bps higher at 4.19% (a 6 bp increase on the week). Meanwhile, equities fluctuated between gains and losses today, with the S&P 500 ultimately closing 0.19% higher and the NASDAQ little changed despite rising over 1% earlier in the session.

Japan’s Takaichi speaks with Trump, plans spring meeting. Japanese Prime Minister Sanae Takaichi said that she had an “extremely meaningful” call today with President Donald Trump and plans to visit the United States later this spring. The conversation between the two comes amid escalating Japan-China tensions and as Japan plans to invest $550 billion into the US to secure lower tariffs as part of a broader trade agreement. Separately, Singapore Prime Minister Lawrence Wong also spoke with Trump today, thanking him for an invitation to the G20 Summit later this year.

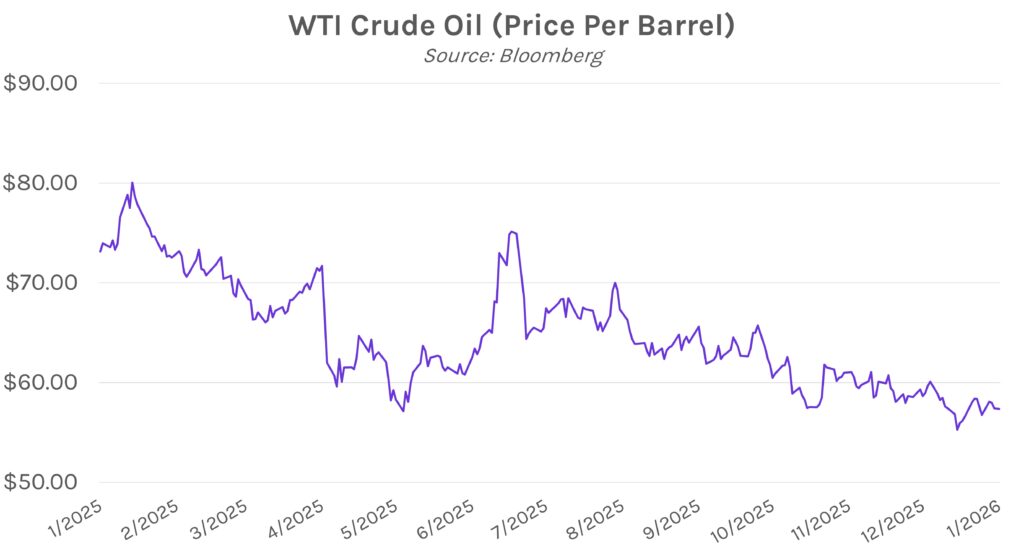

Oil continues decline as markets anticipate surplus, despite geopolitical risks. Brent crude futures declined to near $60 a barrel, and WTI crude futures to around $57 today as the International Energy Agency forecasts a surplus of ~3.8 million barrels a day for the year. The expectations for a supply surplus are helping to offset potential output disruptions from geopolitical risks in countries such as Iran, Venezuela, and Russia. Key OPEC+ members will be meeting on January 4th, where they are expected to pause supply increases during the first quarter of 2026, especially as there is currently a seasonal lull in oil consumption.