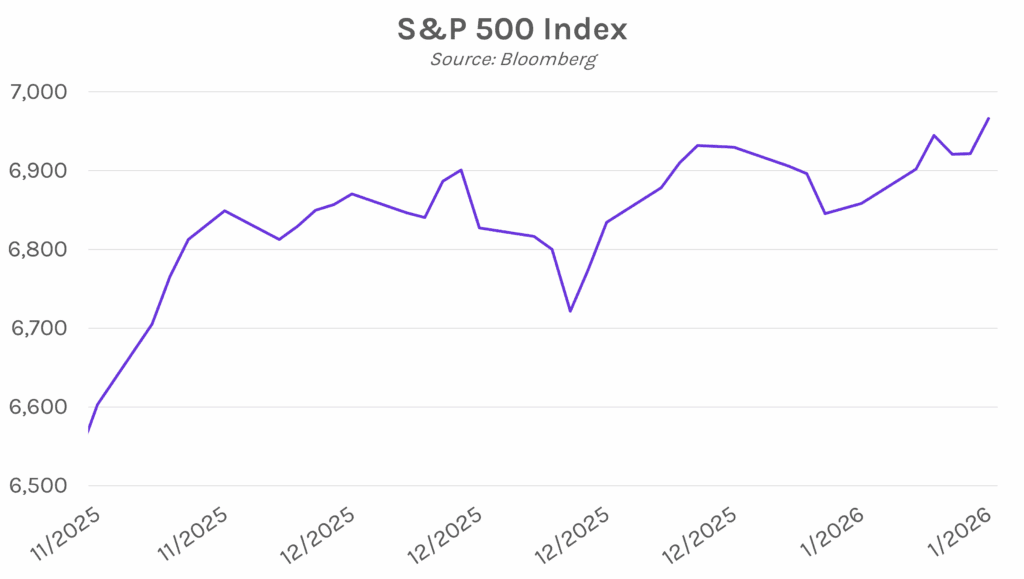

Yields rise on labor data while Supreme Court holds off on tariff ruling. The policy sensitive 2-year UST yield rose ~4 bps today after this morning’s December labor data reinforced expectations that the Fed will leave rates unchanged in the near-term. The 10-year yield was unchanged on the day, and 30-year yields fell ~2 bps. Elsewhere, equities shrugged off tariff concerns after the Supreme Court refrained from a final ruling, with the NASDAQ ending 0.81% higher on the day and the S&P 500 climbing 0.65% to set a new record high.

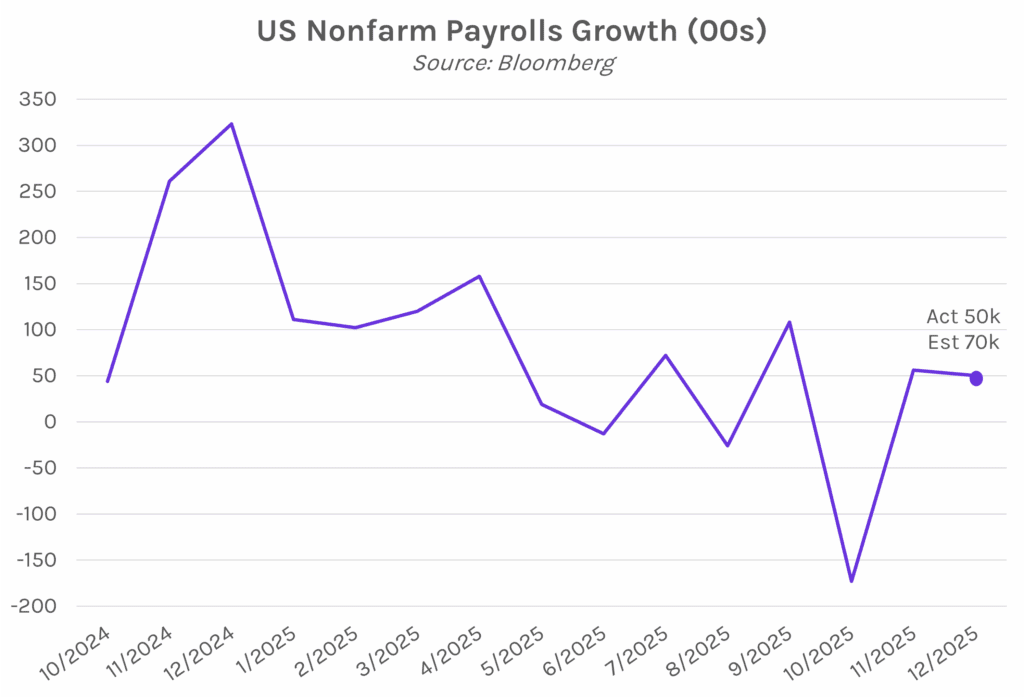

Unemployment rate falls slightly in December. Nonfarm payrolls rose by just 50k in December, falling short of expectations of 70k and below November’s revised gain of 56k. Job creation was driven mainly by the leisure and hospitality and the healthcare sectors, both of which also led gains in 2025. The retail trade and the construction and manufacturing industries saw the largest headcount declines. On the other hand, the unemployment rate fell slightly last month, down to 4.4% from 4.5% in November. This was due in part to less people returning to the workforce, as the participation rate slipped to 62.4%. Overall, the mixed results were viewed somewhat positively by markets, fueling expectations the Fed will hold rates in January. Markets are pricing in just a 5% chance of a rate cut at the FOMC meeting later this month, down from nearly 15% yesterday.

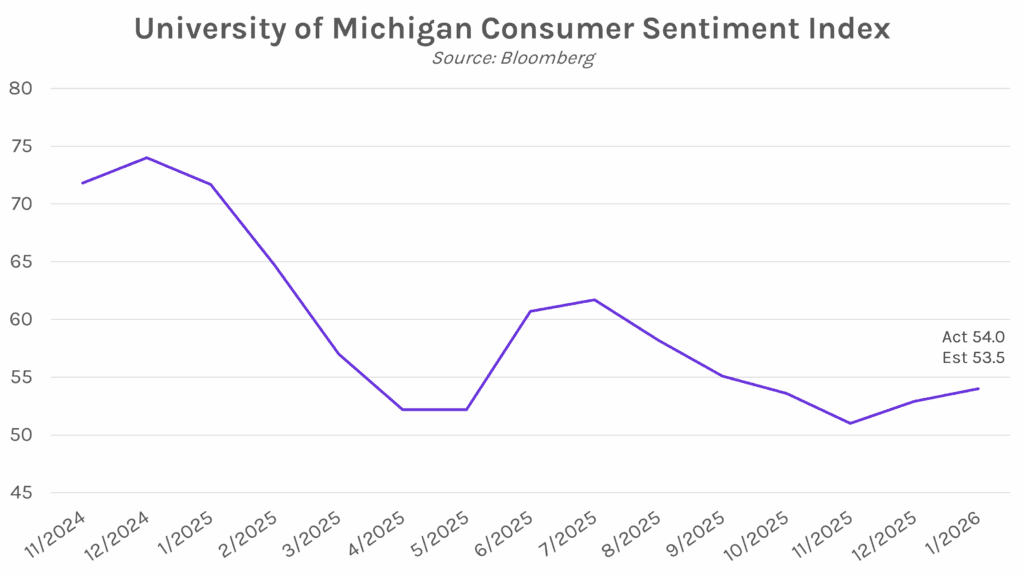

Michigan consumer sentiment lands mostly in line with expectations. The University of Michigan’s headline consumer sentiment index came in at 54.0 today, just above forecasts of 53.5 and December’s final reading of 52.9. The measure of current conditions also edged above estimates, at 52.4 versus expectations of 52.0. The reading follows a slight uptick in consumer sentiment in December after falling to near-record lows in November. Both short- and long-term inflation expectations rose by 0.1% from the prior month, with the 1-year outlook rising to 4.2% and the 5-10-year outlook increasing to 3.4%. Notably, the partisan gap in inflation expectations seems to be easing. Independents now hold the highest 5-year projection at 3.8%, while Democrats foresee 3.6%. Both figures are well below their 2025 highs, while Republicans expect 5-year inflation of 2.6%, above their post-election lows.