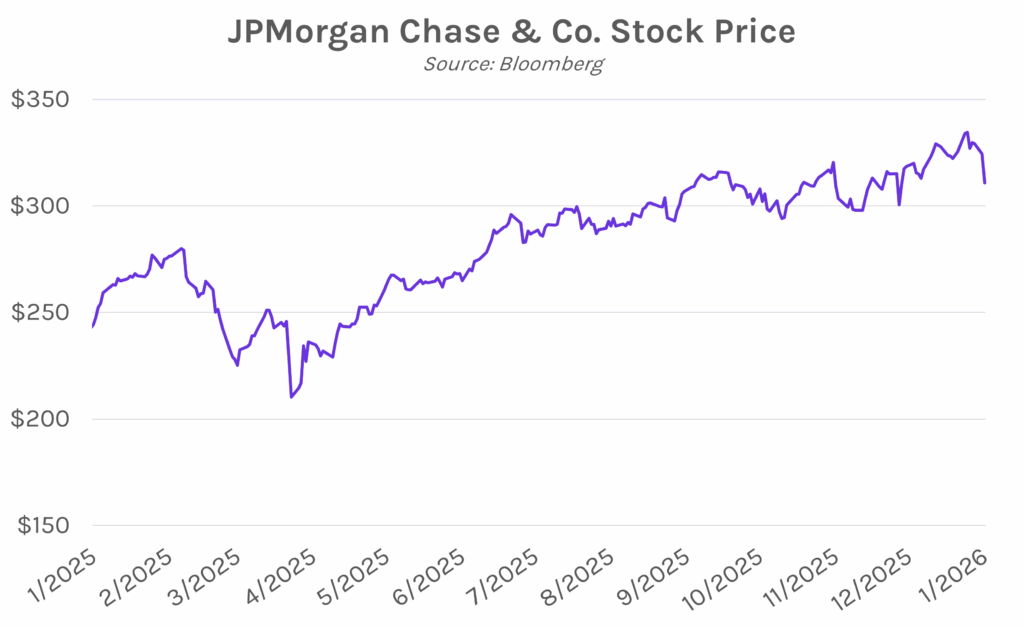

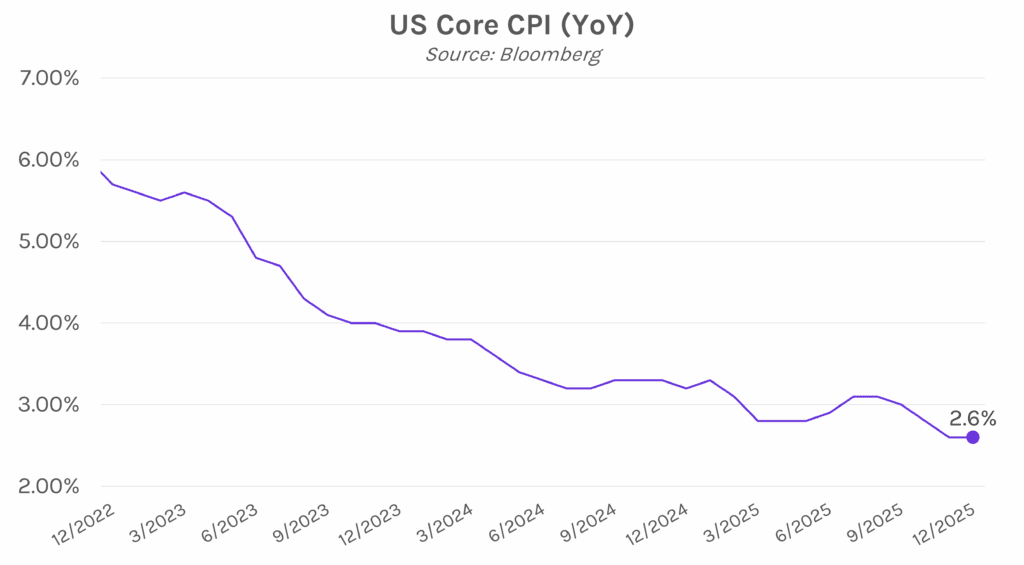

Yields nearly unchanged following CPI print. Treasury yields declined ~4 bps in the immediate aftermath of today’s core CPI print that came in below expectations, although the move quickly reversed and the data failed to alter rate cut expectations for 2026. Yields closed nearly flat across the curve, with the 2-year at 3.53% and the 10-year at 4.18%. Meanwhile, equities declined today as JPMorgan led a slide in bank names following an earnings miss in investment-banking fees, with the S&P 500 and NASDAQ down 0.19% and 0.10%, respectively. Brent crude also saw its biggest four-day gain since June as US-Iran tensions continued to escalate.

Annualized core inflation matches four-year low. The core consumer price index increased 0.2% MoM and 2.6% YoY in December, both figures landing below forecasted increases of 0.3% and 2.7%, respectively. Core CPI excludes volatile food and energy sectors, with last month’s annualized figure matching four-year lows. December headline CPI landed in line with estimates, increasing 0.3% MoM and 2.7% YoY. Price increases were mainly driven by rising shelter costs, which jumped 0.4% last month, while grocery costs increased by the most since August 2022. Olu Sonola, head of US research at Fitch Ratings said, “The key positive in this report is flat core goods prices, reinforcing the view that tariff pass-through to consumers has been much milder than anticipated.” Furthermore, the data follows concerns that November’s CPI figures, which were impacted by the government shutdown, underrepresented inflation levels. Today’s release offered a clearer sign that price pressures are, in fact, easing.

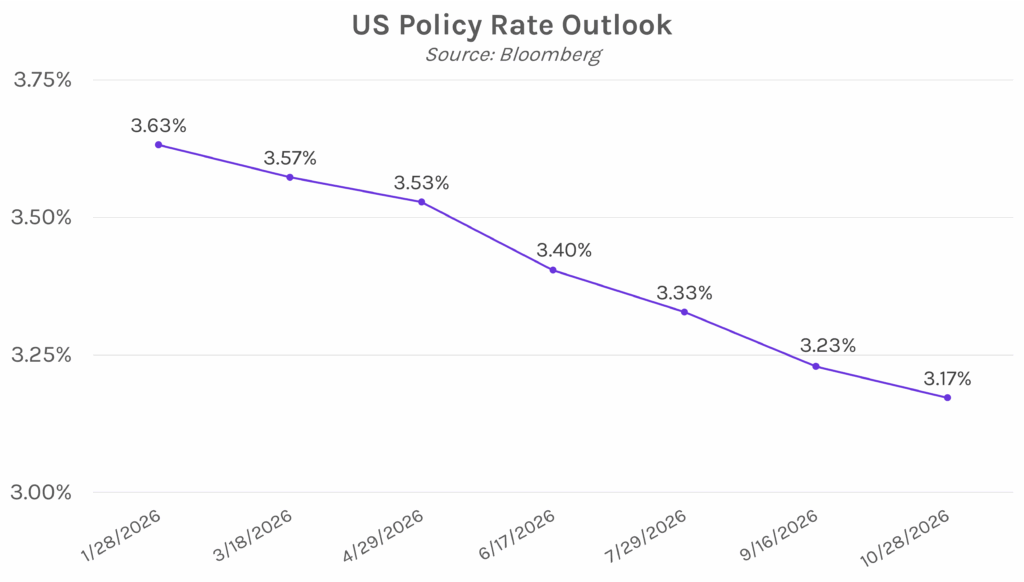

Fed’s Musalem and Williams see policy rates as well positioned. Following today’s CPI report, St. Louis Fed President Alberto Musalem said, “I expect inflation to resume its convergence toward our 2% target over the course of this year… I think policy is really well positioned right now, balancing both the expected path of the economy and the risks on both sides.” His view aligns with New York Fed President John Williams, who noted yesterday that risks of the Fed’s dual mandate are in “better balance” following rate cuts over the last year. Both Musalem and Williams see little reason to cut rates in the near term, and futures markets are not fully pricing in a rate cut until July.