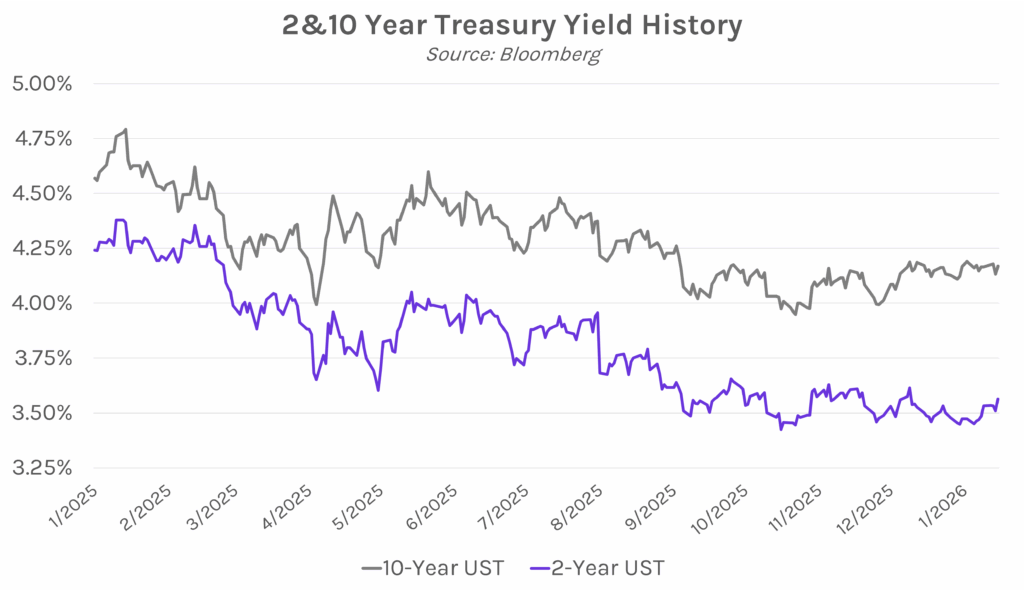

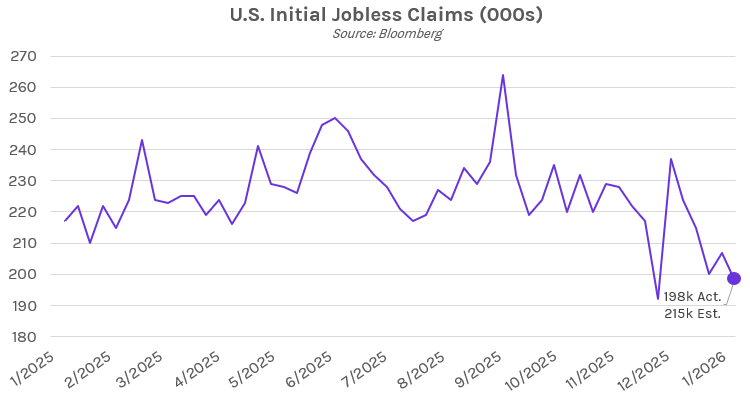

Yields rise following strong labor data. Treasury yields climbed ~3 bps in the immediate aftermath of initial jobless claims data, which hit the lowest level since November. The move sustained throughout the session as yields grinded higher into the close, with the 2-year yield up 5 bps to 3.56% while the 10-year yield closed 4 bps higher at 4.17%. Positive outlook from TSMC simultaneously revived AI hopes and fueled risk-on sentiment, contributing to the Treasury sell-off and a rally in equities. The S&P 500 and NASDAQ closed 0.26% and 0.25% higher, respectively.

Initial jobless claims see unexpected decline. Initial jobless claims for the week ending January 10 fell to 198k, below estimates of 215k and the prior week’s 208k. Marking the lowest number of applications for unemployment benefits since November, initial jobless claims have only fallen below 200k a handful of times in the past few years. Today’s release follows the holiday season, which often results in choppy data. The four-week moving average, which helps smooth out volatility, fell to 205k, the lowest level in two years. Continuing claims for unemployment benefits fell to 1.88mm for the week ending January 3, a decrease from 1.91mm in the prior week. Today’s print is a sign of a resilient labor market, even as the holidays come to an end and major corporations, such as Pepsi and Meta, announce plans to cut jobs.

Fed’s Goolsbee, Schmid remain focused on controlling inflation. Chicago Fed President Austan Goolsbee said today that, “The most important thing facing us is we’ve got to get inflation back to 2%,” and also noted that recent data shows the labor market has stabilized. Similarly, Kansas City Fed President Jeff Schmid said, “With inflation pressures still evident, my preference would be to keep monetary policy modestly restrictive.” Schmid went on to explain the importance of further labor market cooling in order to prevent the inflation outlook from worsening. Schmid dissented in favor of holding rates at the last two FOMC meetings, although recently, more Fed officials have spoken in support of holding rates steady in the near-term.