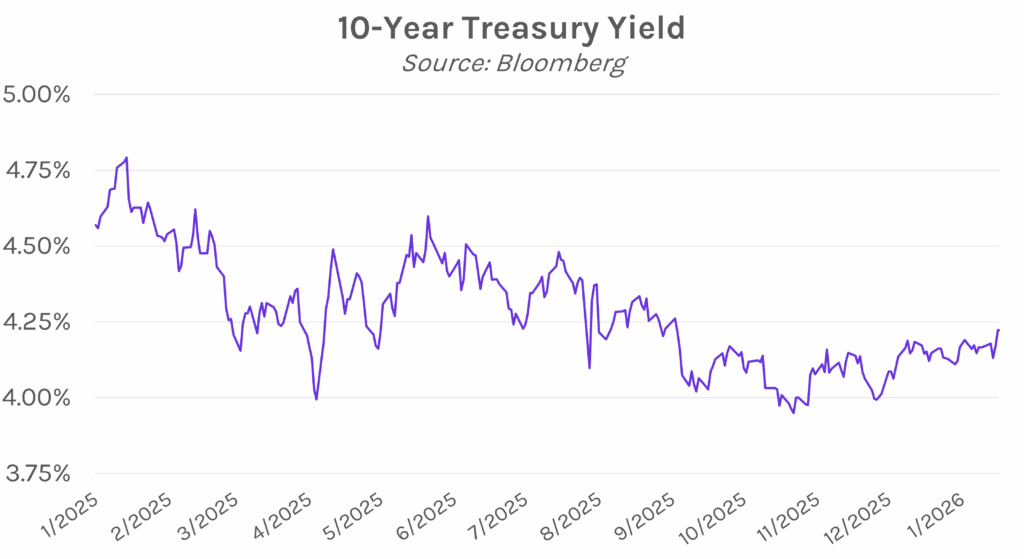

Yields rise as Fed Chair frontrunner expectations shift. Treasury yields climbed today, largely driven by Trump’s comments on his hesitation to move Kevin Hassett from the National Economic Council to be the next Fed Chair. Hassett was seen as the frontrunner for the role, and now attention has shifted to Kevin Warsh, a more hawkish candidate. The 2-year yield closed 2 bps higher at 3.59% while the 10-year yield closed 5 bps higher at 4.22%, both up 6 bps on the week. Meanwhile, equities closed little changed today, with the S&P 500 and NASDAQ both down 0.06%.

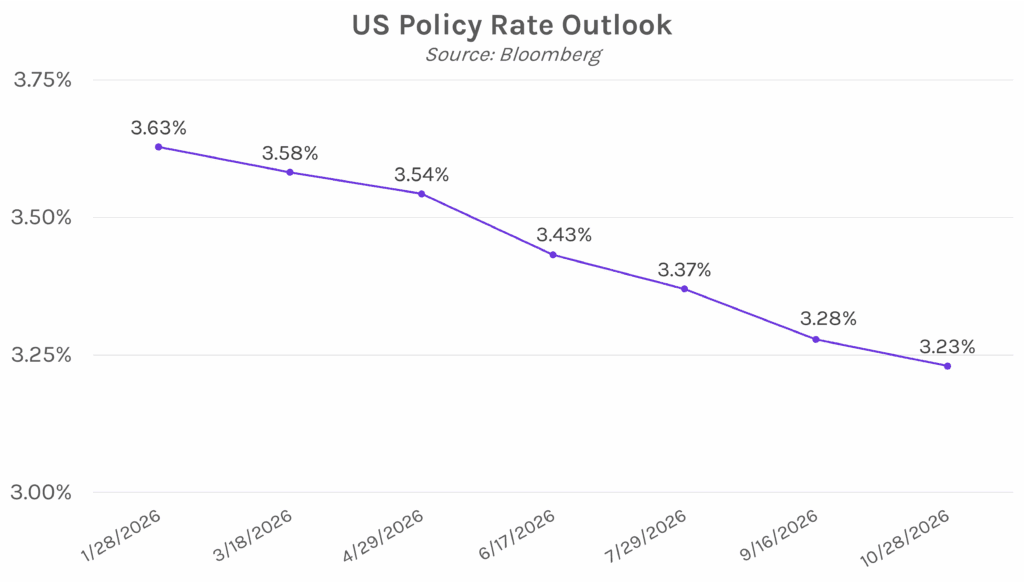

Trump waivers on Hassett for Fed chair. At a White House event today,President Trump told Kevin Hassett that “I actually want to keep you where you are, if you want to know the truth,” referring to Hassett’s current role as director of the White House National Economic Council. The remark shifted market expectations around the Fed Chair frontrunner from Hassett to former Fed governor Kevin Warsh. Efforts to replace current Chair Jerome Powell, whose term ends in May, were shaken up this week as the DOJ subpoenaed the Fed and announced a criminal investigation into Powell. The move caused significant blowback, even among Senate Republicans, whose votes President Trump will need to confirm any nominee. Senator Thom Tillis (R-NC) who sits on the Senate Banking Committee, has said he will not vote to confirm any nominee for the Fed “until this legal matter is fully resolved.” Republicans have a two-seat majority on the committee, meaning Tillis’s opposition alone would block a nominee from advancing to a full Senate vote.

US-Taiwan trade deal finalized on increased semiconductor investment to the US. On Thursday, the US and Taiwan agreed to a trade agreement that will lower tariffs on Taiwanese goods to 15% from 20% previously. Simultaneously, Taiwan semiconductor companies will increase investments into America by $500 billion. $250 billion of this entails direct investments to expand operations in the US, such as by building chipmaking plants. The remaining $250 billion consists of credit guarantees to further investment in the US semiconductor supply chain. US Secretary of Commerce Lutnick indicated that this deal was in part made because the US threatened further tariffs saying, “If they don’t build in America the tariff’s likely to be 100%.”