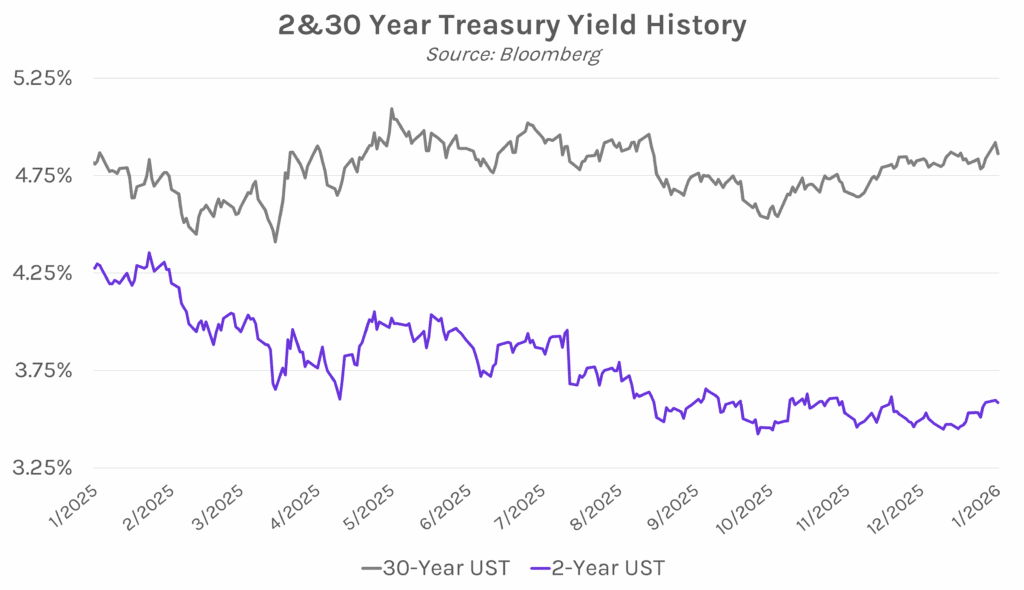

Yields decline as Trump claims progress over Greenland acquisition. In a reversal of yesterday’s move, the yield curve flattened today as US-Europe tensions calmed. Longer-dated Treasury yields edged lower as Trump announced that he would not take military action to acquire Greenland and that he had reached a “framework” of a deal, eliminating the need for him to impose retaliatory tariffs on certain European nations. The 2-year yield closed 1bp lower at 3.58%, while the 30-year yield closed 6 bps lower at 4.86%. Meanwhile, equities rallied on the deescalating tensions, with the S&P 500 and NASDAQ up 1.16% and 1.18%, respectively.

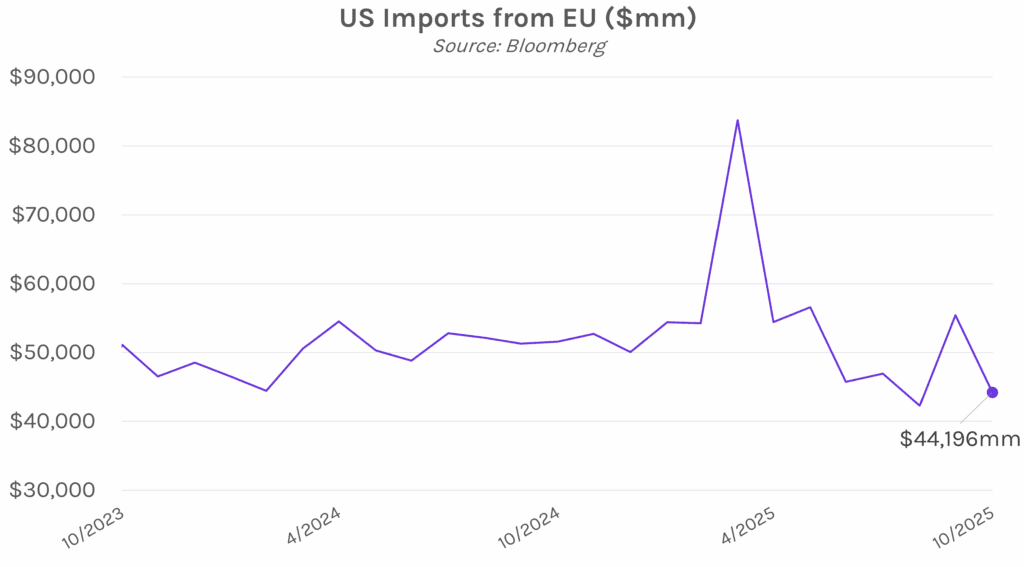

Trump reverses course on threatened European tariffs, cites “framework” deal over Greenland. After threatening a 10% tariff on eight European nations that oppose a US acquisition of Greenland, US President Donald Trump announced on social media that he would refrain from imposing tariffs. This comes as Trump met with NATO Secretary General Mark Rutte during the World Economic Forum today, and said, “We have formed the framework of a future deal with respect to Greenland and, in fact, the entire Arctic Region. Based upon this understanding, I will not be imposing the Tariffs that were scheduled to go into effect on February 1st.” The framework is unclear as Trump did not share additional details, and earlier today, Denmark stated that it would not enter any negotiations on the purchase of Greenland. Meanwhile, the European Parliament has paused the ratification of the EU–US trade agreement in response to Trump’s recent threats.

Supreme Court appears reluctant to allow Trump to fire Cook. In arguments today, justices from both sides of the ideological spectrum seemed weary of the Trump Administration’s attempt to fire Fed Governor Lisa Cook. Justice Kavanaugh, a Trump appointee, said firing Cook would “weaken if not shatter the independence of the Federal Reserve.” Justice Coney Barrett suggested that siding with the White House posed risks to financial markets that required “caution,” though she didn’t fully embrace Cook’s position either. A bipartisan group of former Treasury Secretaries, Fed Chairs, and other experts have filed a brief stating that a ruling in the White House’s favor would undermine public confidence of the Fed. They also expressed worries that firing Cook would jeopardize the ability of the Fed to effectively set monetary policy. Meanwhile, President Trump has continued to argue that Cook is the one hurting the Fed’s credibility.